Features of the Elliott Wave Oscillator

Ralph Nelson Elliot’s Elliott wave theory serves as the foundation for the Elliott wave oscillator. The theory states that the market moves in waves. There are two corrective moves and three impulsive moves in each wave. In other words, there are fluctuations in the trend’s direction. The Elliot Wave Oscillator helps identify and incorporate these waves into your trading plan. Although you can use it for short-term trading, it performs better in medium- to long-term trading.

How the Indicator Can Benefit You

The Eliot Wave Oscillator is useful in that it gives trade entry signals. Here is how:

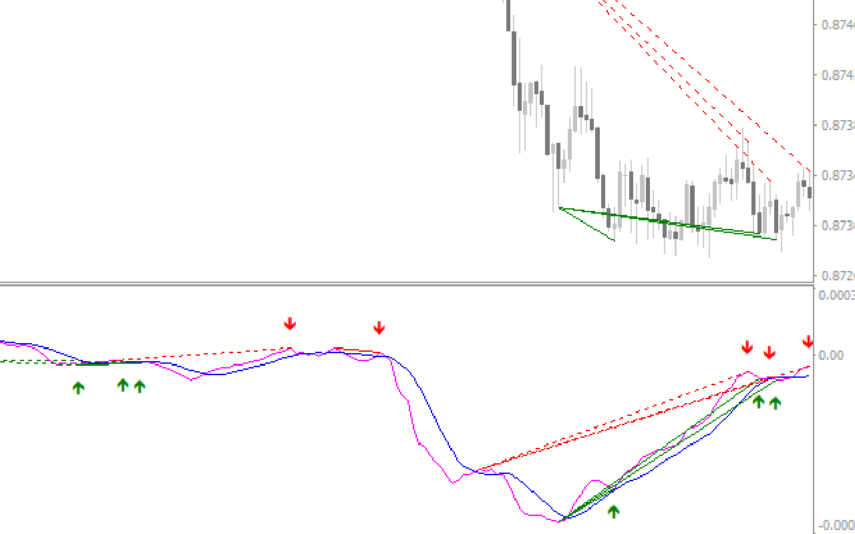

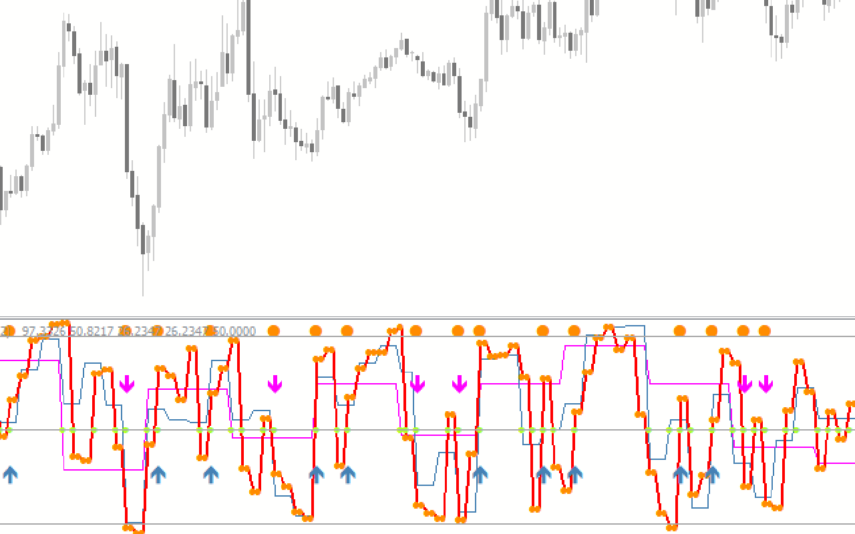

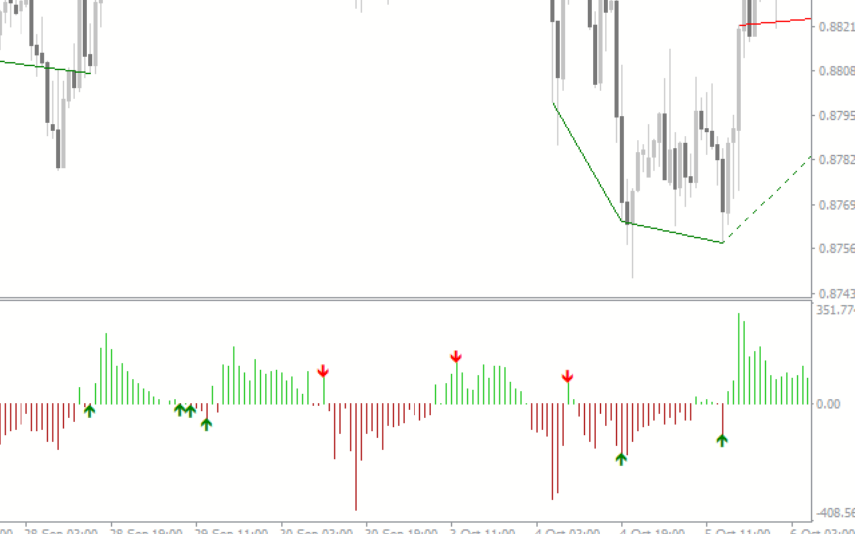

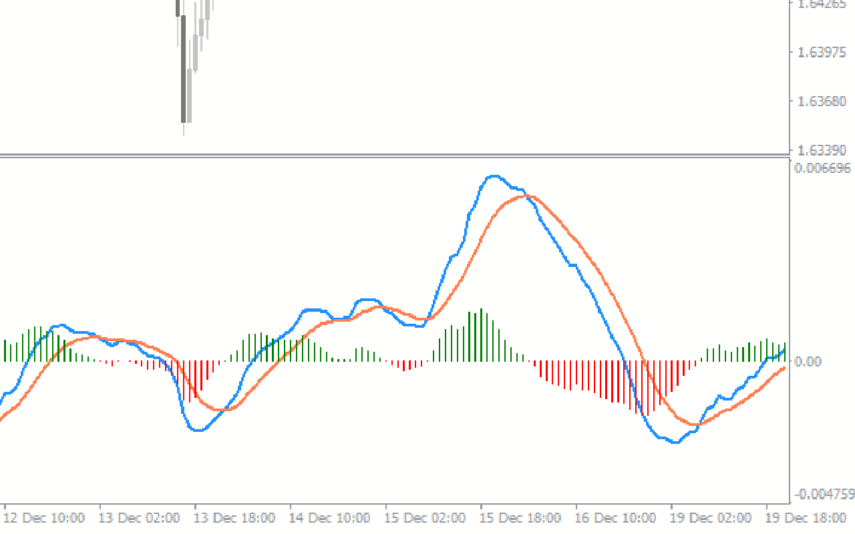

- The market price forms five waves. The first, third, and fifth waves follow the trend. Corrections occur in the second and fourth waves. When the third wave starts, and the price reaches new highs, the indicator displays its strongest reading. The price then reaches new highs in the fifth wave, but the oscillator diverges. Put another way, the oscillator makes a lower high while the price soars to new highs. This signifies the end of the pattern and the reversal of the trend.

- The case for a downtrend is the same. The third wave occurs alongside price drops in the direction of the trend. The signal comes when the price drops to lower lows in the fifth wave, but the Eliot Wave oscillator diverges.

- Trading with Elliott waves is made simple by the Elliot wave oscillator. It indicates the wave formation, pointing to the approaching price reversal and the end of the Elliott wave patterns.

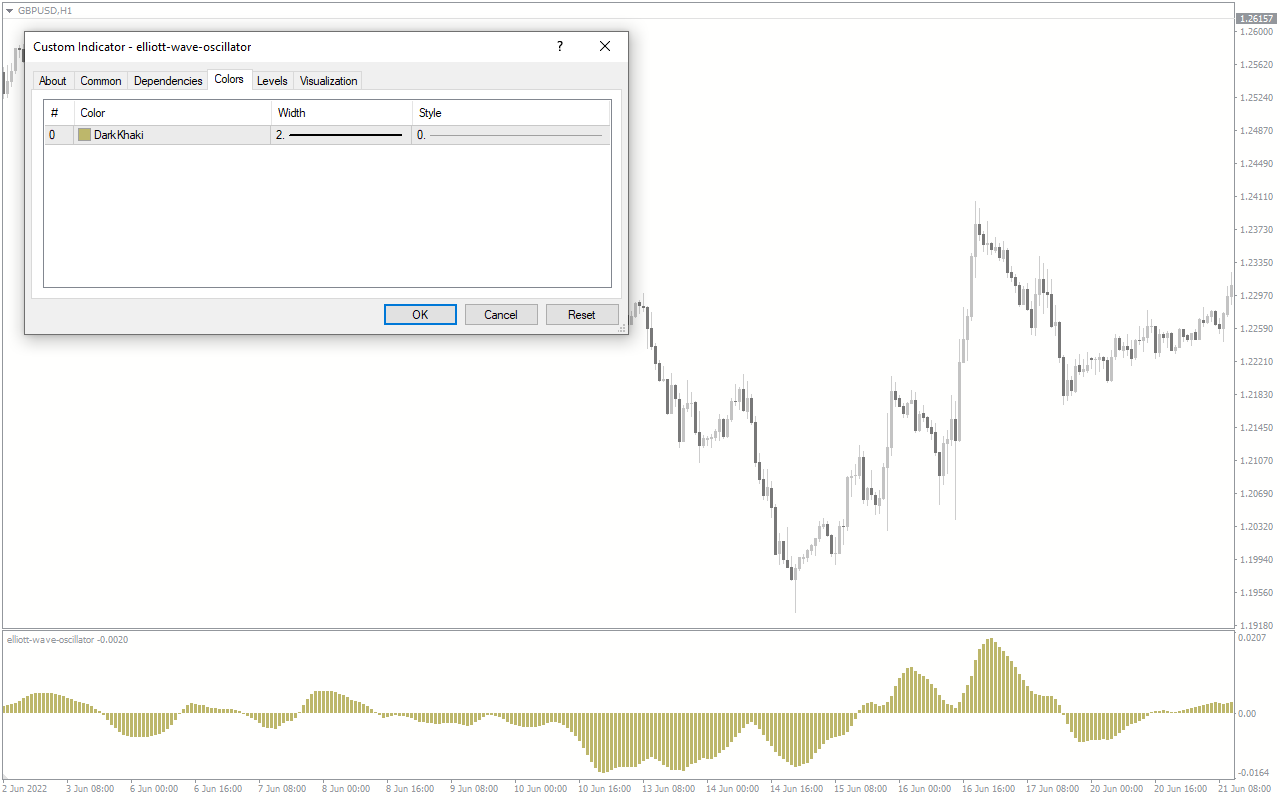

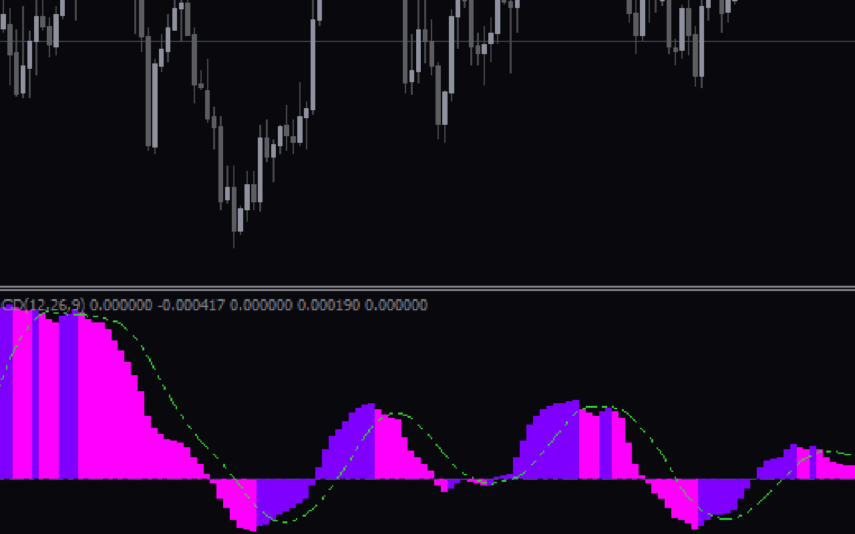

Indicator Setting Description

The indicator lets you change the color, width, and line style.

Reviews

There are no reviews yet.