The True Strength Index (TSI) indicator for MT4 is a momentum indicator developed by Williams Blau to determine the most likely trend exhaustion zones of instruments in the financial market. Simply put, it spots probable overbought and oversold zones for potential trend reversal trading opportunities.

Furthermore, the indicator is also an incredible tool for identifying bullish and bearish divergences of the price, which suggests a possible exhaustion of the trend. Therefore, it helps traders identify zones of potential trend reversal.

Features of the True Strength Index Indicator for MT4

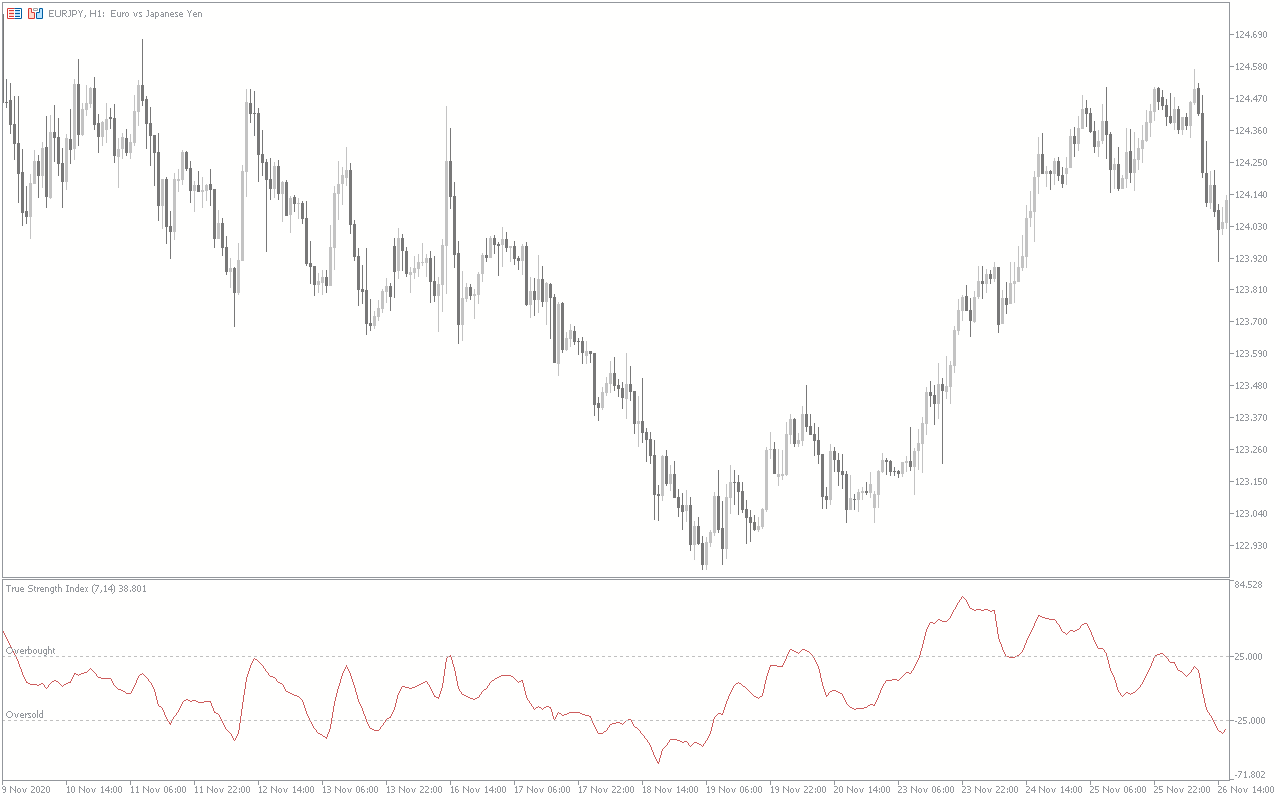

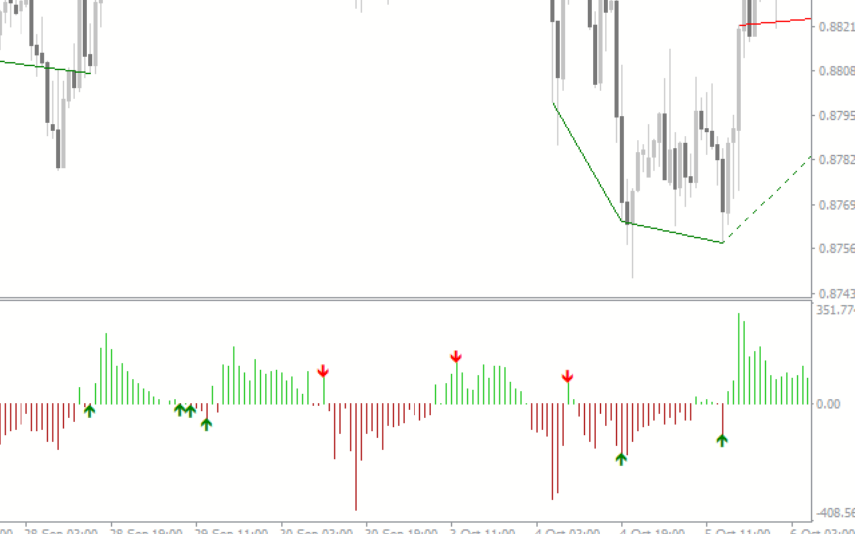

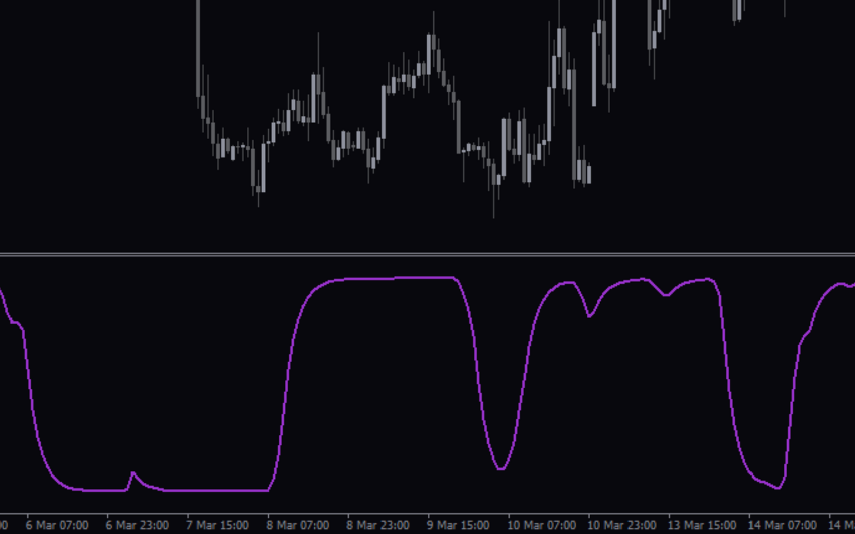

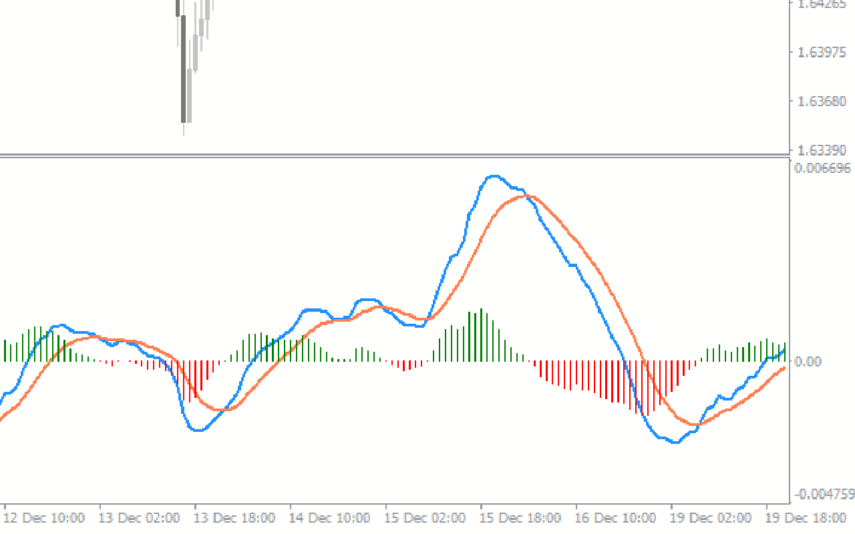

The indicator is an oscillating tool with a single line that moves on a separate window below the main chart. It is calculated using a doubled-smoothed Exponential Moving Average (EMA), which smooths the momentum of price changes.

The indicator’s line above the +25 level suggests overbought conditions, while the line below the -25 level depicts oversold conditions. Thus, the line above the +25/-25 levels indicates a decline or weakness in the strength of a bullish/bearish trend, signaling a likely trend exhaustion and a potential change in market direction.

However, the indicator is recommended to be used with price action/other technical indicators to enhance better market analysis and trading decisions.

Benefits of Using the Indicator

- Overbought/Oversold Condition: The TSI indicator helps traders identify optimal overbought and oversold conditions for potential trend reversal opportunities.

- Early Trend Reversal Signal: Traders can use the indicator to identify the possible beginning of a trend. For instance, when the TSI line crosses above the -25 from below to the upside, it can suggest the start of a bullish trend.

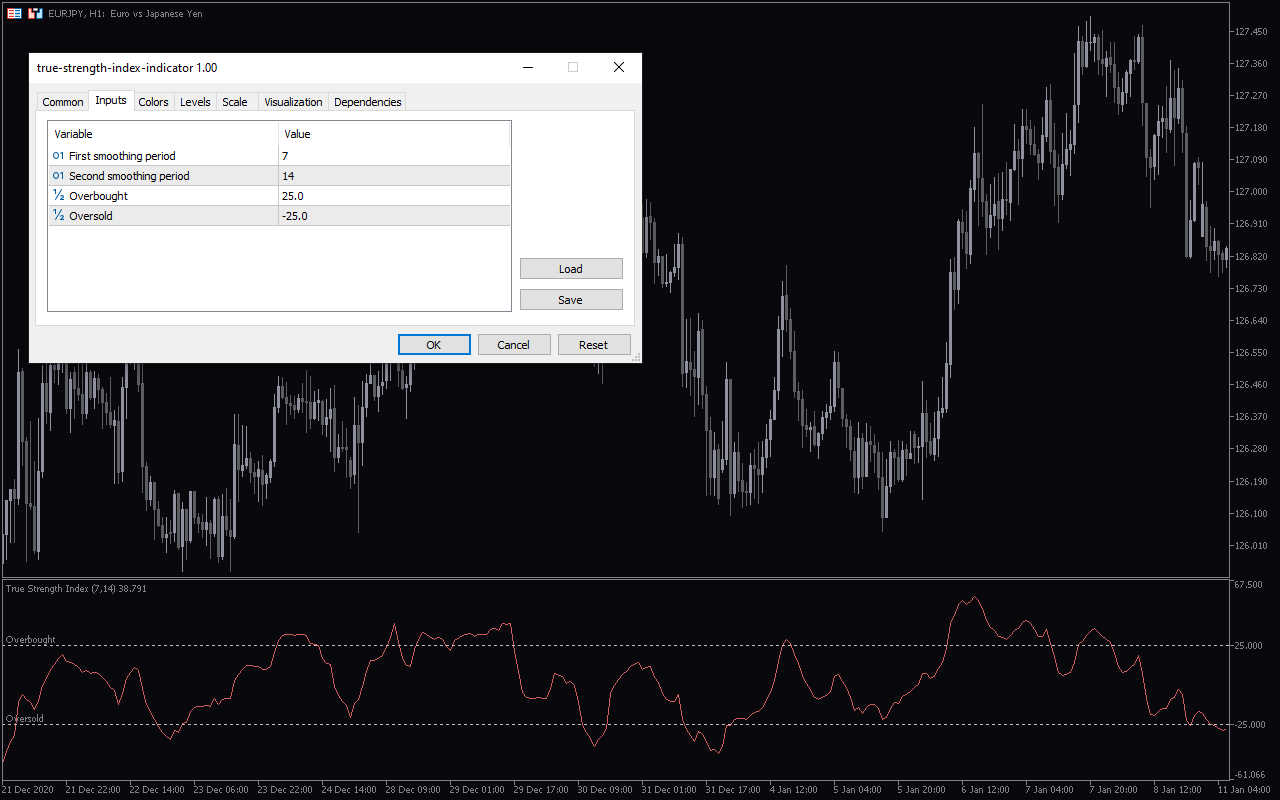

Indicator Settings Description

The indicator comes with the following customizable settings:

First smoothing period: Determines the initial EMA period for smoothing price changes.

Second smoothing period: Determines the secondary EMA period to further smooth price changes.

Overbought: Determines the indicator’s overbought level.

Oversold: Determines the indicator’s oversold level.

Reviews

There are no reviews yet.