In the dynamic world of forex trading, staying ahead of the curve requires a keen understanding of market dynamics and the tools to interpret them effectively. One such essential tool in a forex trader’s arsenal is the volume indicator. As the lifeblood of the financial markets, volume reveals critical insights into price movements and the overall strength of trends. But with a plethora of volume indicators available, how do you determine the best one for your forex trading strategy?

In this article, we embark on a journey to uncover the best volume indicator for forex trading. We’ll explore the importance of volume analysis in the currency markets, delve into the characteristics that define an exceptional volume indicator, and finally, introduce you to some of the top contenders that have earned their place in the world of forex trading. Whether you’re a seasoned trader seeking to refine your strategy or a newcomer looking to harness the power of volume, read on to discover the key to more informed and profitable forex trading decisions.

Top 10 Volume indicators for forex trading

- Volume Profile Indicator

- Volume Weighted MA Indicator

- Volume Candlesticks Indicator

- VWAP Plus Indicator

- Better Volume 1.5 Indicator

- FXSSI.OrderBook Indicator

- Market Profile Indicator

- Better Volume New Alerts Indicator

- VWAP Bands Indicator

- WeisWave Indicator

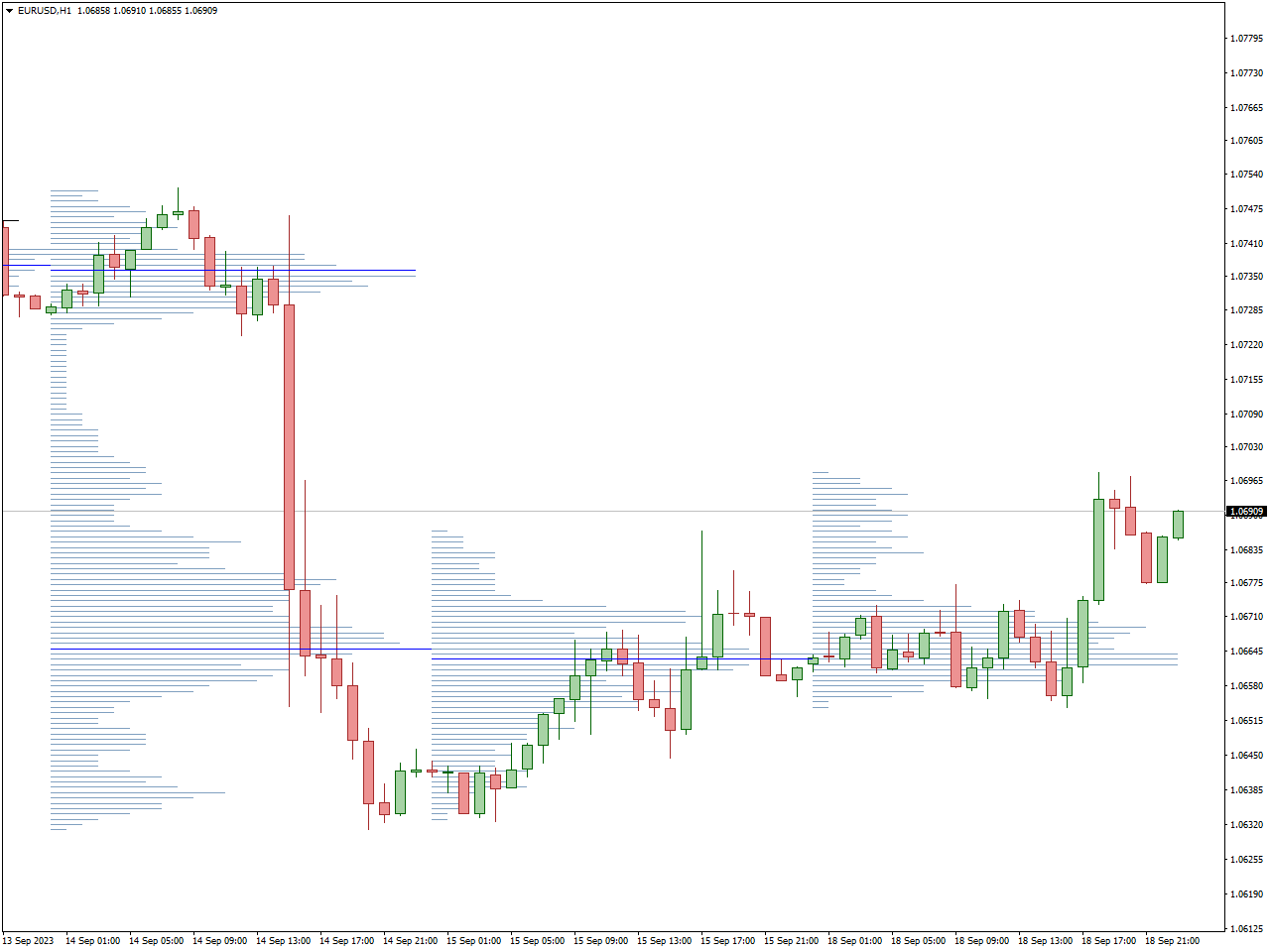

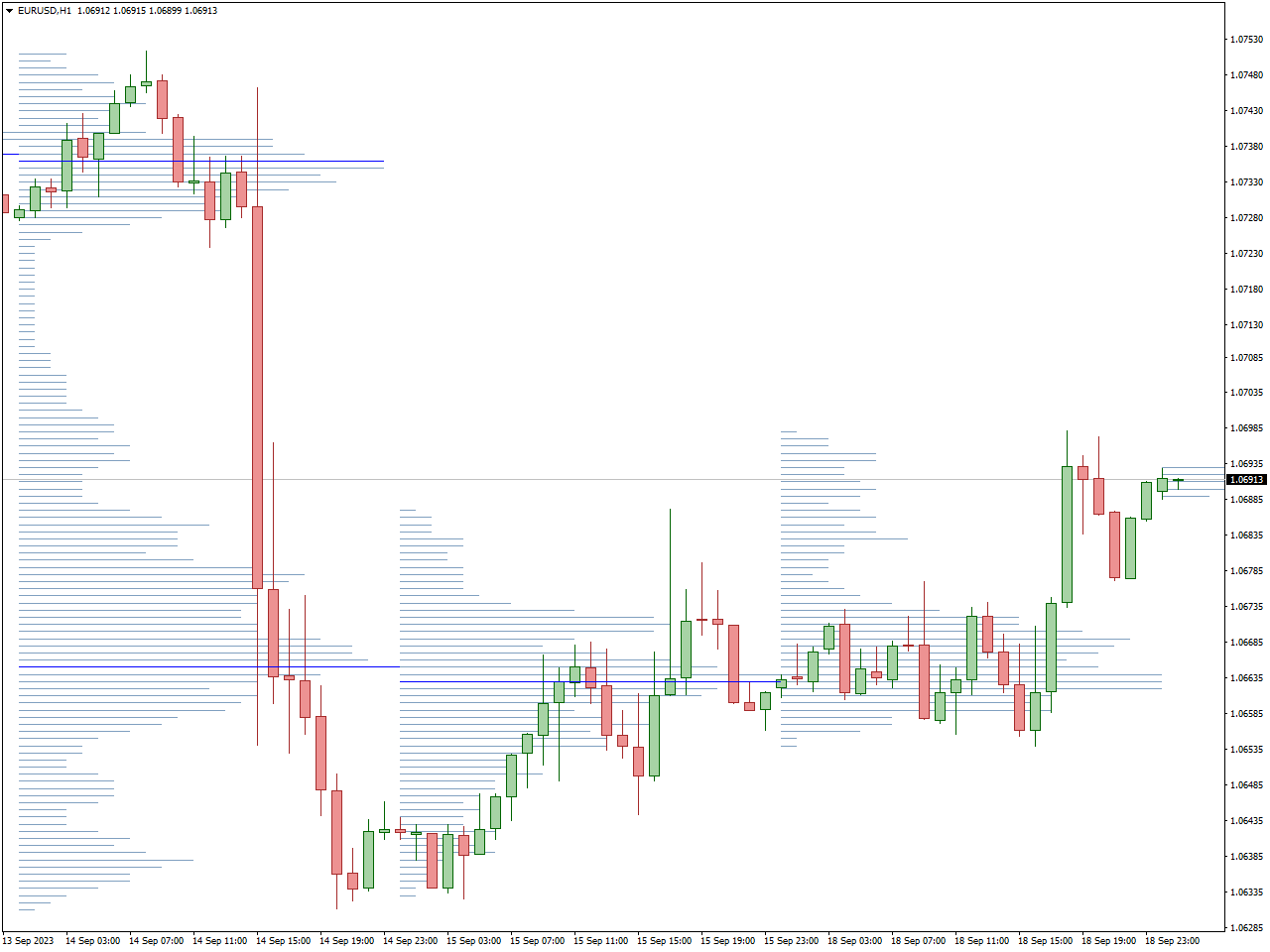

Volume Profile Indicator

The Volume Profile Indicator stands as a potent instrument in technical analysis, serving the purpose of dissecting and presenting trading volume at distinct price levels during a designated timeframe. Its popularity is notably high among traders across diverse financial markets, including the ever-active forex market, primarily for its ability to furnish invaluable perspectives on market dynamics and pinpoint the price thresholds witnessing noteworthy trading engagements.

The indicator divides the price chart into horizontal bars or profiles, each representing a specific price range or level. It then plots the volume traded at each of these price levels over the selected time frame.

Traders use the Volume Profile Indicator to identify important price levels, support and resistance zones, and potential breakout or reversal points. It can be used in conjunction with other technical analysis tools to make more informed trading decisions.

Volume Weighted MA Indicator

The Volume Weighted Moving Average (VWMA) Indicator is a frequently utilized tool in the realm of technical analysis across financial markets, including the forex market. What sets it apart from conventional moving averages is its incorporation of not just price data but also trading volume in the calculation of the average price. This attribute renders it an invaluable tool for traders aiming to scrutinize the interplay between price fluctuations and trading volume.

The VWMA calculates the average price for a specific period, giving more weight to periods with higher trading volume. It effectively combines price and volume data to provide a more accurate representation of market activity.Since the VWMA considers trading volume, it reflects the significance of price moves that occur with higher trading activity. In other words, it highlights price levels where substantial trading interest is concentrated.

Crossovers between the VWMA and the price can generate trading signals. For example, when the price crosses above the VWMA, it may signal a potential buy, while a crossover below the VWMA could indicate a potential sell.

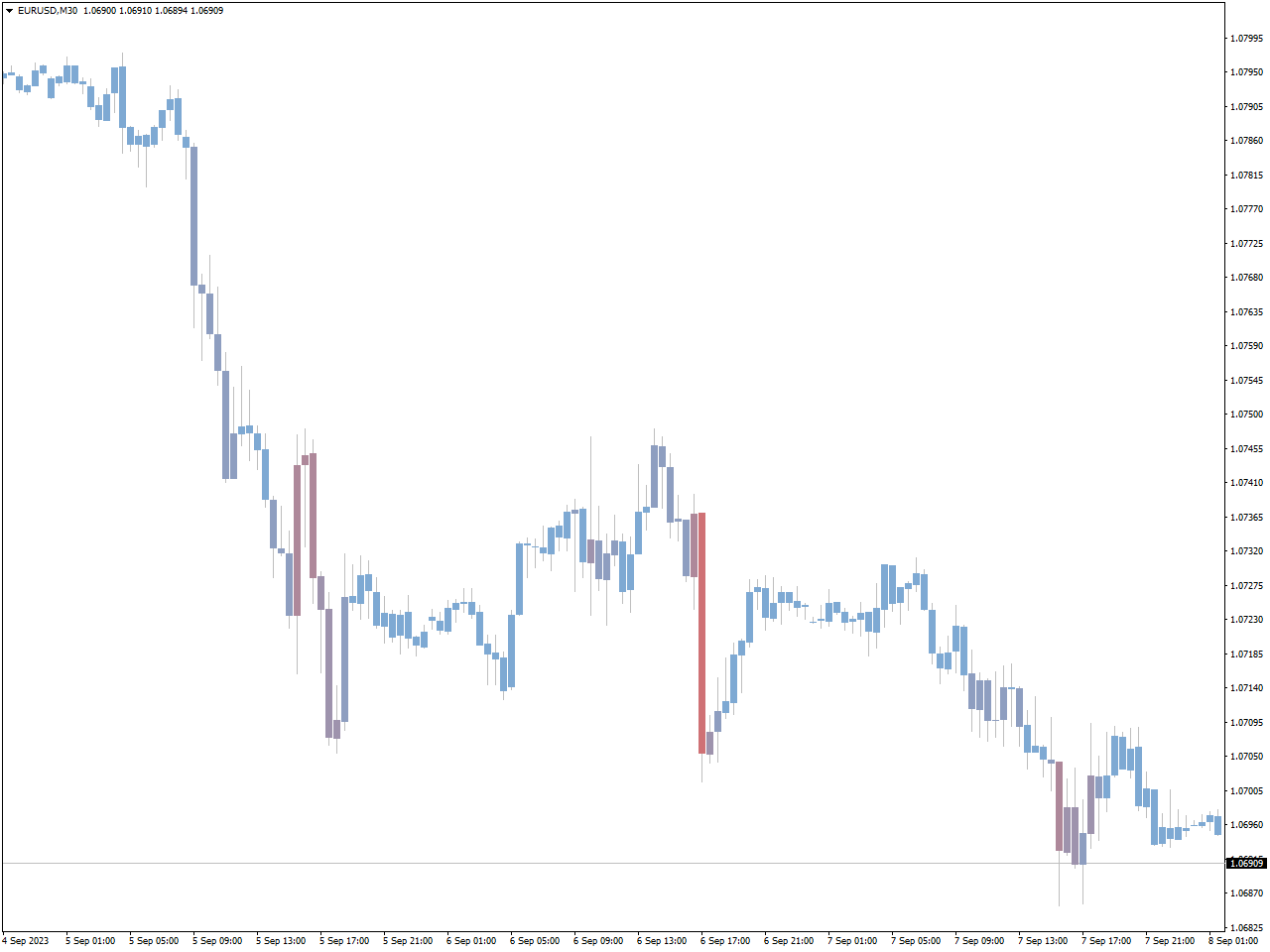

Volume Candlesticks Indicator

This indicator facilitates the representation of volume data on the chart without the need for a traditional volume histogram. In simpler terms, it achieves a 3D-like visualization using a heatmap overlaid on regular candlesticks.

By using this indicator, you’ll be able to identify areas of high volatility accompanied by heightened volume, phases of directional price movement with relatively low trading activity, and instances of candles displaying “stopping volume” on the chart.

It’s important to note that while this indicator doesn’t entirely replace the conventional volume histogram, it significantly streamlines the way information is visually presented, enhancing the speed and efficiency of trading decisions.

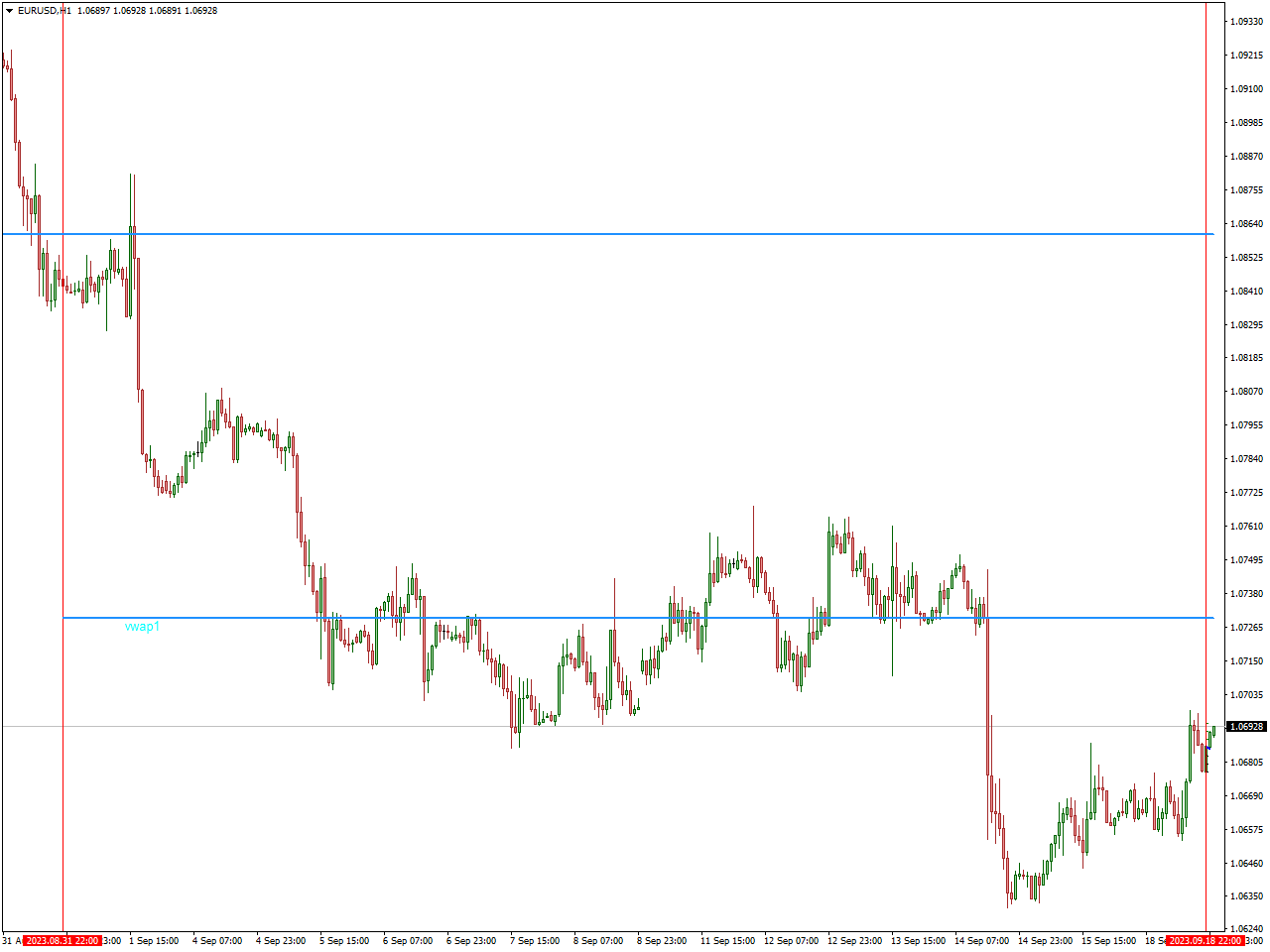

VWAP Plus Indicator

The VWAP Plus Indicator represents a modified version of the Volume Weighted Average Price (VWAP) indicator. In this context, “Plus” refers to the inclusion of supplementary lines serving as dynamic Support and Resistance levels, which can also serve as potential Take Profit targets. However, the fundamental concept remains unchanged: Long trades are typically executed above the primary VWAP line, while short trades are initiated below it.

Incorporating the VWAP Plus indicator into your trading toolbox can prove to be a valuable addition. It’s important to recognize that a proficient forex indicator can likely improve your chances of success. However, it’s equally crucial to maintain realistic expectations. Like any other technical analysis tool, it cannot guarantee 100% precise signals. Therefore, occasional false signals may occur. The indicator’s performance is subject to notable variations depending on prevailing market conditions. You are encouraged to explore and build your unique trading system around it.

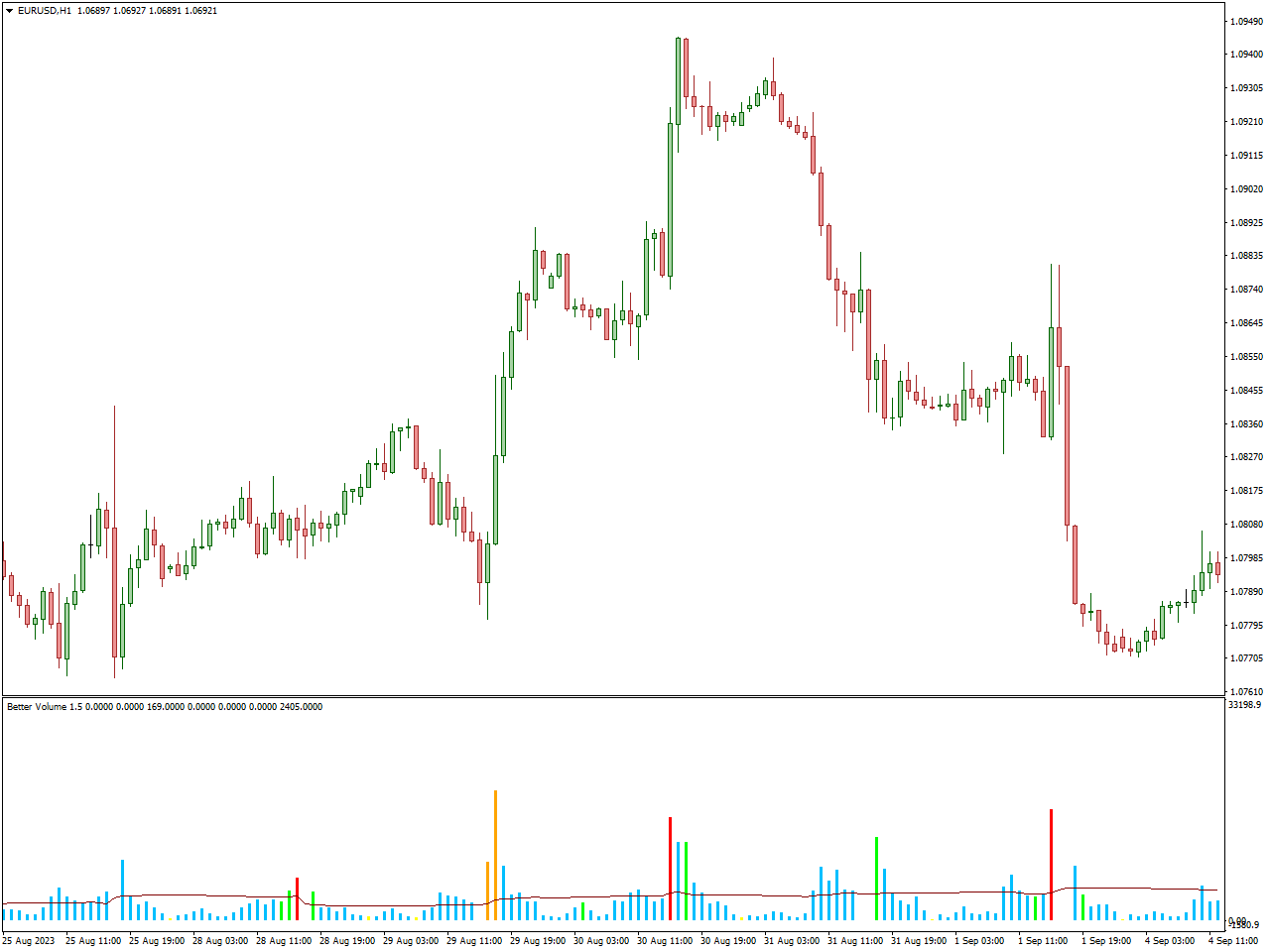

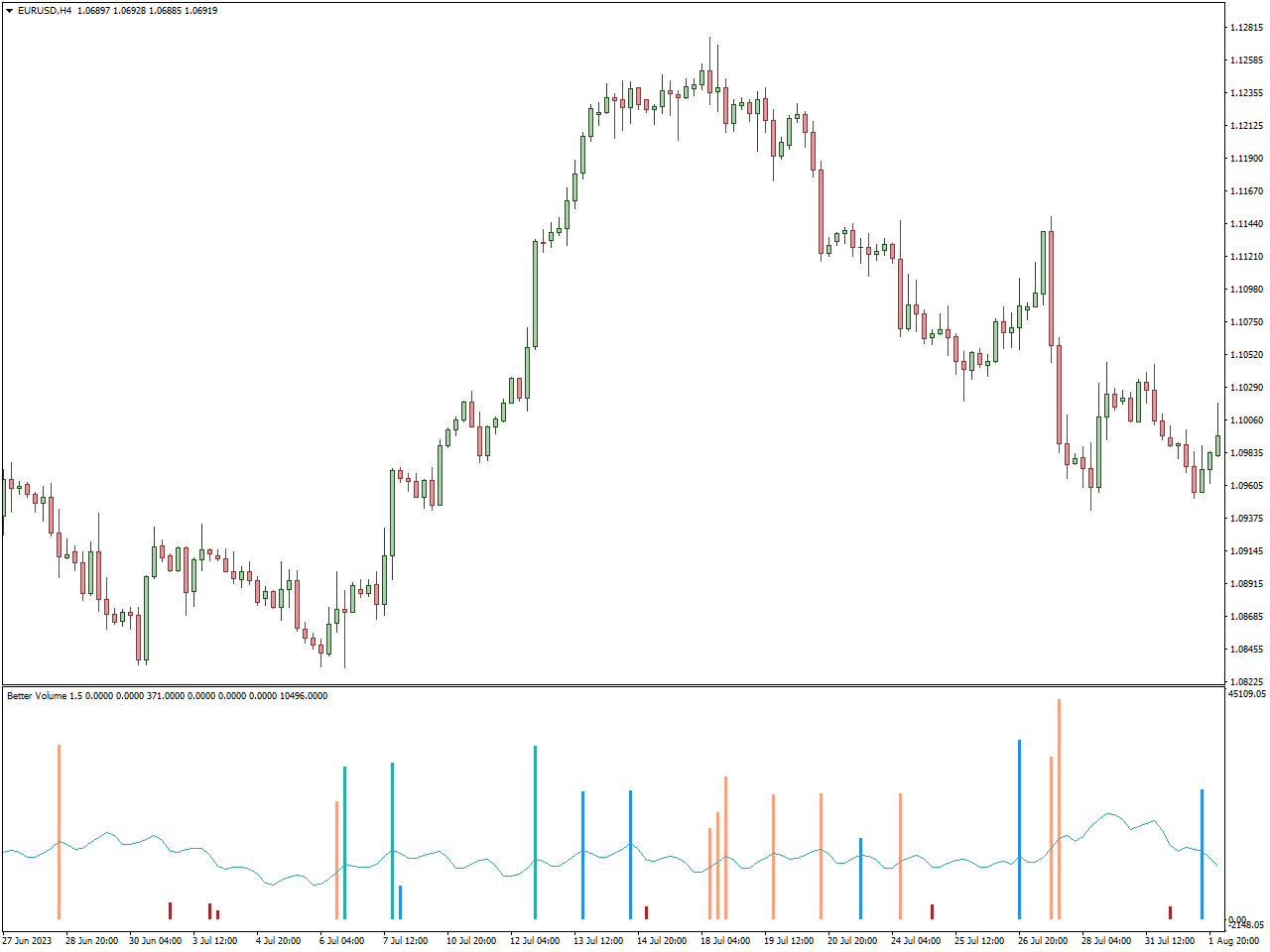

Better Volume 1.5 Indicator

The “Better Volume 1.5 Indicator” is a technical analysis tool employed by traders in various financial markets, including forex. It represents an enhanced version of the conventional volume indicator, offering traders more sophisticated insights into market activity and the strength behind price movements.

This indicator delivers a more comprehensive and nuanced examination of trading volume compared to standard volume indicators. It aids traders in evaluating the importance of volume changes in relation to price actions.

This indicator is particularly useful for intraday traders who need to analyze volume dynamics within shorter timeframes.

FXSSI.OrderBook Indicator

FXSSI.OrderBook is a trading service and tool offered by FXSSI (Forex Sentiment & Volume Analysis), a platform dedicated to providing an array of resources and data to assist traders within the foreign exchange (forex) market. Specifically, FXSSI.OrderBook concentrates on delivering order book data and conducting sentiment analysis for major currency pairs.

The Order Book displays the volume and orders at various price levels, allowing users to review and analyze market dynamics historically. The Order Book also shows the quantity of assets available at each price level. Traders look for areas where there is a significant amount of buying or selling interest. Some traders use Order Book data to develop trading strategies, such as scalping or momentum trading, based on short-term order flow.

FXSSI.OrderBook has been meticulously crafted to empower forex traders in making more enlightened trading decisions. It achieves this by granting access to both real-time and historical order book data, coupled with in-depth sentiment analysis, facilitating a deeper understanding of market dynamics and trends.

Market Profile Indicator

The Market Profile Indicator is a valuable tool in technical analysis used by traders across various financial markets, including stocks, futures, and the forex market. It aids traders in visualizing and understanding price movements and trading activity within specific time periods.

The Market Profile Indicator divides the price chart into horizontal bars or profiles, each representing a particular time frame, often referred to as a “market profile.” These profiles display the distribution of trading activity (volume or time) at different price levels. Within the market profile, traders identify a value area, which typically comprises the price range where the majority of trading volume or time was concentrated during the specified time frame. This zone can be crucial in identifying potential support and resistance levels.

Traders can often customize the Market Profile Indicator by adjusting parameters to align with their specific trading strategies and preferences.

Better Volume New Alerts Indicator

The “Better Volume New Alerts Indicator” is an advanced technical analysis tool used by traders in various financial markets, including forex. This indicator is an enhancement of the traditional volume analysis, designed to provide real-time alerts and notifications related to changes in trading volume and price movements.

This indicator primarily focuses on analyzing trading volume. It tracks and measures the volume of trades occurring at various price levels within a specified time frame.

Traders use this indicator to assess the strength of price trends by analyzing volume patterns. Increasing volume during an uptrend suggests strong buying interest, while high volume during a downtrend indicates robust selling pressure.

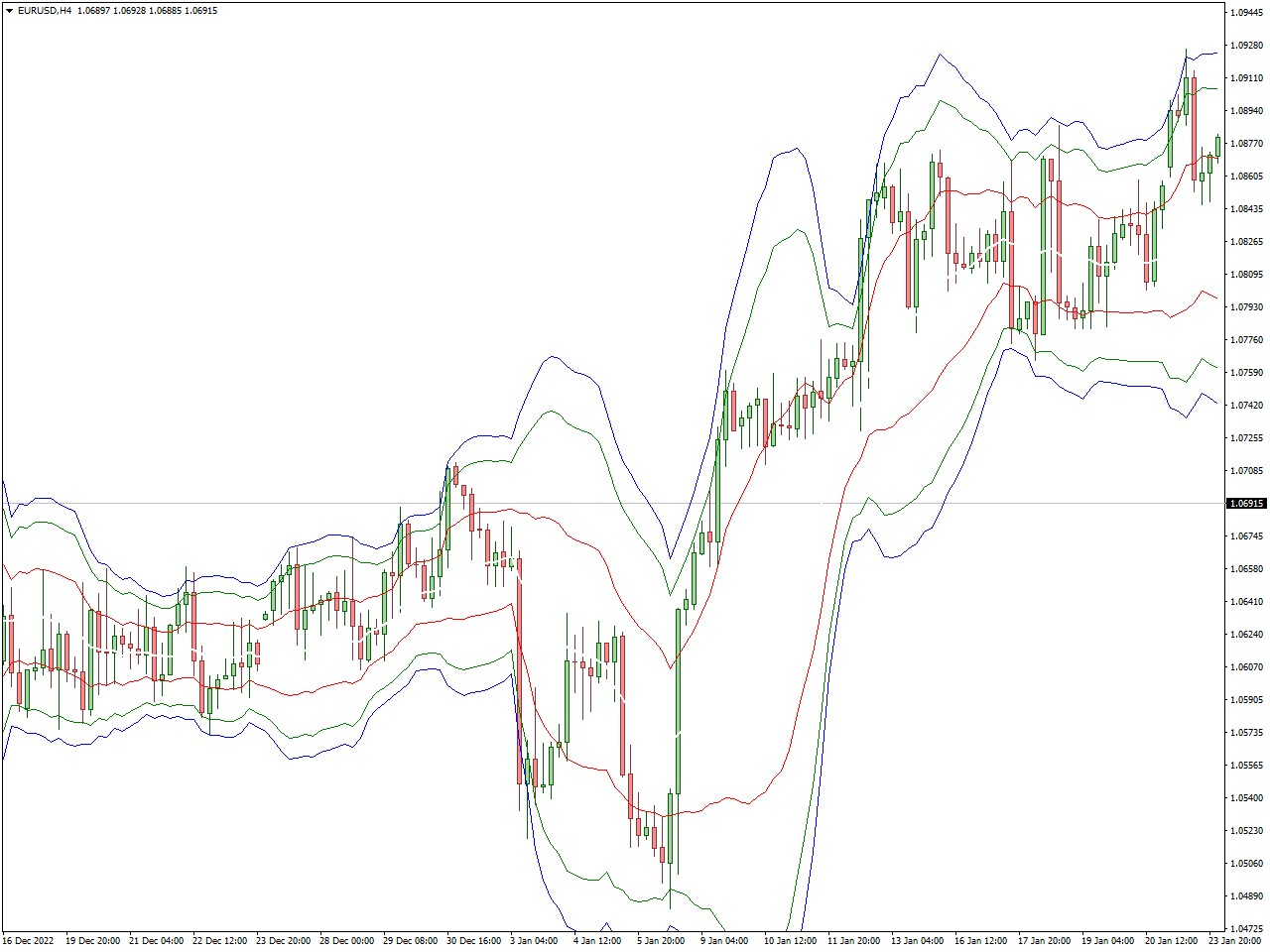

VWAP Bands Indicator

The VWAP Bands Indicator is a technical analysis instrument applied across diverse financial markets, encompassing stocks, futures, and the forex arena. Its foundation lies in the concept of the Volume Weighted Average Price (VWAP), with its primary aim being the identification of likely support and resistance levels depicted on the price chart.

The VWAP is a widely used trading indicator that calculates the average price at which an asset has traded throughout a specific time period, weighted by the trading volume at each price level. It is often used by traders to assess the fair value of an asset and potential intraday support and resistance levels.

Some traders use the VWAP Bands to confirm trends. When the price remains consistently above the VWAP and the upper band, it may signal a strong bullish trend, and when it remains below the VWAP and the lower band, it may indicate a strong bearish trend.

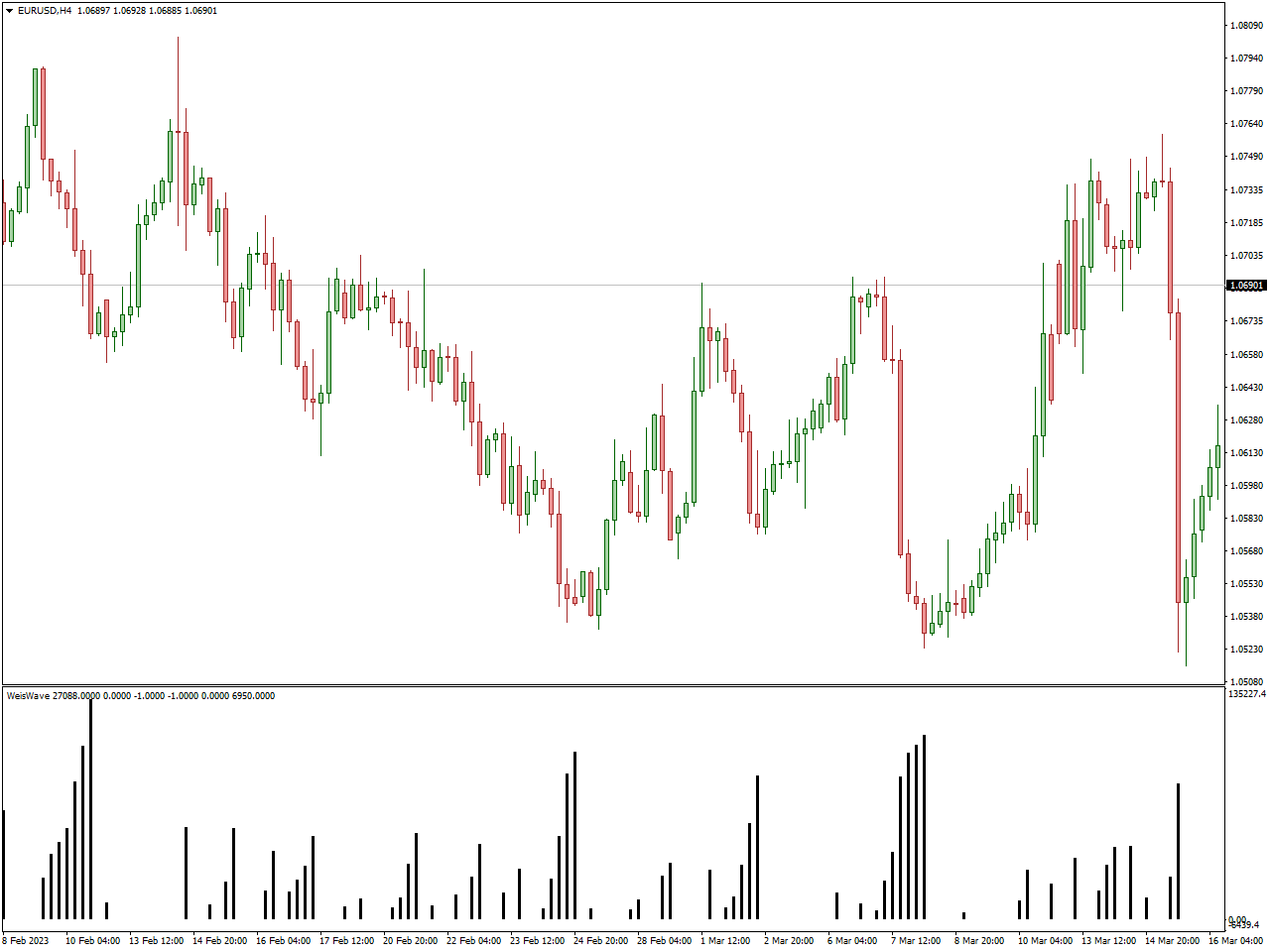

WeisWave Indicator

The WeisWave Indicator is a technical analysis instrument utilized across financial markets, encompassing stocks, futures, and the forex arena. Rooted in the principles of Wyckoff analysis, this indicator delves into price and volume dynamics to fathom market intricacies and pinpoint prospective trading prospects.

This indicator pays homage to Richard D. Wyckoff, a distinguished trader and educator, revered for devising the Wyckoff method of technical analysis. This methodology underscores the pivotal interplay between price movements and trading volume in the evaluation of market vigor and fragility.

Traders harness the WeisWave Indicator to derive confirmation signals that aid in potential trade entries or exits. These signals are crafted through a meticulous assessment of price and volume patterns, bearing in mind that their interpretation may vary among traders.

Conlusion

In summary, volume indicators are pivotal in forex trading, offering traders invaluable insights into market dynamics, shifts in sentiment, and potential price fluctuations.

When integrating volume indicators into your forex trading strategy, keep in mind the importance of sound risk management, conducting comprehensive analysis, and continually improving your approach. By amalgamating these volume indicators with a comprehensive trading plan, you can augment your capacity to make well-informed decisions and confidently navigate the ever-changing landscape of forex trading.