Venturing into the world of forex trading demands more than just a grasp of market trends; it necessitates the strategic utilization of effective trading techniques. Within the myriad of available approaches, the Inside Bar Strategy emerges as a potent tool for traders aiming to navigate the ever-shifting currency markets. This article delves into the nuances of the Inside Bar Strategy, dissecting its fundamentals, application, and the prospective impact it can have on improving trading results. Regardless of whether you’re a newcomer or a seasoned trader, uncovering the intricacies of this strategy may serve as the catalyst for advancing your success in the challenging domain of forex trading.

What is Inside Bar?

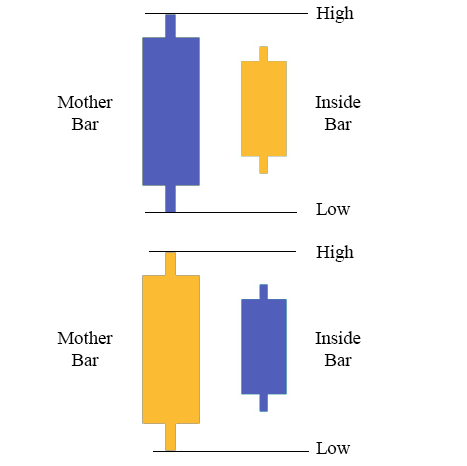

An Inside Bar is a dual-candlestick pattern that indicates a phase of consolidation or uncertainty within the market. This pattern is characterized by two consecutive candlesticks, where the high and low range of the second candle, known as the inside candle, is entirely encompassed within the high and low range of the preceding candle, referred to as the mother candle. Put simply, the entire price movement of the inside bar is confined within the limits set by the prior candlestick.

Crucially, the Inside Bar pattern does not inherently suggest a bullish or bearish bias. Instead, it signals a momentary balance between buyers and sellers, resulting in decreased market volatility. Inside Bars can manifest in both upward and downward trends, and they do not definitively indicate whether a trend reversal or continuation is imminent.

For traders, the Inside Bar pattern holds significance as it visually represents a period of consolidation or indecision in the market. Although it doesn’t forecast the specific direction of the ensuing price movement, it highlights the potential for a breakout or reversal. This prompts traders to maintain a vigilant watch on the market, anticipating the next significant move.

Identifying the Inside Bar on Trading Charts

To spot this pattern on trading charts, traders can adhere to the following steps:

- Observe two candlesticks: Begin by recognizing a candlestick with a distinct high and low range and then examine the following candlestick.

- Analyze the high and low range: Verify whether the high and low range of the subsequent candle is completely encompassed within the high and low range of the preceding candlestick. The entire price movement of the subsequent candles should stay within the limits set by the last candlestick.

- Confirmation: Upon confirming that the subsequent candle aligns with the specified criteria, traders can affirm it as an inside bar.

How to Trade Inside Bar Pattern

Utilizing the Inside Bar pattern as a trading signal involves identifying potential breakouts or the continuation of the prevailing market trend. Traders recognize the Inside Bar by observing two candles, where the entire price action of the second candle is enclosed within the high and low range of the preceding candle.

Initiating the trading strategy starts with evaluating the direction of the preceding trend through an examination of the overall candle pattern. In an uptrend, prior candles should predominantly be bullish, while in a downtrend, preceding candles should primarily be bearish. The Inside Bar signifies consolidation and potential compression in prices, prompting traders to await a breakout from the range of this setup before initiating a trade.

A breakout above the high of the Inside Bar indicates a bullish move, whereas a breakout below the low signals a bearish move. Traders often set entry orders slightly above the high for bullish breakouts or slightly below the low for bearish breakouts. To enhance the likelihood of a successful trade, additional confirmation indicators, such as volume analysis, trendlines, or other technical indicators, may be considered.

Effectively managing the trade as it progresses is crucial. Continuous monitoring of price movements and adjusting the stop-loss level based on evolving market conditions is essential. Determining a profit-taking strategy, whether through a predetermined target, a trailing stop, or monitoring key support and resistance levels, contributes to successful trade management. It’s vital to acknowledge that while the Inside Bar pattern can identify potential breakout or continuation opportunities, relying solely on it for trading decisions is not recommended.

Here is an example on EUR/USD pair:

In the depicted example, a distinctive chart pattern has emerged, identified as an inside bar. This particular pattern, as elaborated upon in the preceding content, is accompanied by visual cues providing practical guidance. The visualization serves to enhance comprehension and application of the material discussed earlier in relation to inside bars on the chart.

Tips for Trading the Inside Bar Pattern in Forex

As a novice trader in the forex market, mastering the inside bar pattern involves aligning your approach with the dominant trend on the daily chart, commonly referred to as trading ‘in-line with the trend.’ It’s crucial to consider currency pairs and focus on key levels for potential reversals, as trading inside bars at these levels requires more experience.

The ideal time frame for inside bar trading is the daily chart, as lower time frames may inundate you with numerous inside bars, often leading to false breaks and making technical analysis challenging. Keep an eye on pips and employ trading strategies that factor in risk-reward ratios, particularly on currency pairs displaying clear trends.

Inside bars within a given range may present multiple layers, with 2, 3, or even 4 inside bars within the same mother bar structure, indicating prolonged consolidation periods that can result in stronger breakouts. ‘Coiling’ patterns, featuring smaller inside bars within the high to low range of the previous bar, are also worth noting.

Before transitioning to live trading, practice identifying inside bars on price charts, particularly on the daily chart for currency pairs in trending markets. Incorporate technical analysis tools such as indicators to refine your skills in recognizing chart patterns and price action. You may try this specific Inside Bar Indicator.

Consider the use of trading software like MetaTrader and leverage expert advisors (EAs) for backtesting your strategies. Be mindful of risk management strategies, especially when dealing with leverage and margin, to protect your capital. Understand the concepts of long and short positions, stop-loss orders, take-profit orders, market orders, and pending orders to enhance your trading proficiency.

Be aware of volatility and liquidity when navigating different trading sessions, such as the Asian, London, and New York sessions. Keep an eye on currency correlation, economic calendars, and market sentiment to make informed decisions based on fundamental analysis.

Utilize trading signals and support and resistance levels to enhance your entry and exit points. Incorporate different time frames, such as daily, weekly, and monthly, to capture varying market trends. Explore various chart patterns, including channels and trendlines, and use technical indicators to identify potential opportunities.

Remember to stay disciplined in your money management approach and be mindful of trading psychology. Choose reputable forex brokers and trading platforms, and stay updated with forex news to adapt to changing market conditions. Whether you’re a beginner or seasoned trader, understanding the intricacies of forex trading requires a comprehensive grasp of these keywords and concepts.

Pros and Cons of Implementing the Inside Bar Strategy in Forex Trading:

Pros:

- Versatility: The inside bar strategy can be applied to various currency pairs, accommodating the diverse nature of the forex market.

- Pips Potential: Successful identification of inside bars may lead to profitable trades with the potential to capture a significant number of pips.

- Forex Market Application: Inside bars are relevant in the forex market, offering insights into potential trend reversals or continuations.

- Technical Analysis Tool: This strategy aligns with technical analysis principles, using candlestick charts and chart patterns to make informed trading decisions.

- Risk-Reward Ratio: When integrated into trading strategies, inside bars can provide favorable risk-reward ratios, aiding in effective risk management.

- Adaptability: Suited for various trading styles, including scalping, day trading, and swing trading, offering adaptability to different market conditions.

Cons:

- False Signals: Like many technical strategies, the inside bar method can produce false signals, necessitating additional confirmation tools.

- Subjectivity: Identifying inside bars involves interpretation and subjective criteria, leading to potential inconsistencies among traders.

- Market Conditions: Performance may suffer in ranging markets or low volatility conditions, limiting its effectiveness in specific market scenarios.

- Limited Predictive Power: While signaling a consolidation period, inside bars do not inherently predict the direction of the subsequent breakout.

- Overtrading Risk: Traders may be tempted to overtrade if solely relying on inside bars, especially in shorter time frames, increasing transaction costs.

Conclusion

This all-encompassing guide transcends conventional boundaries, providing traders with a diverse wealth of knowledge that spans technical intricacies, advanced strategies, and pattern recognition. Whether you’re a novice seeking a robust foundation or an experienced trader looking to refine your skills, this guide equips you with the insights necessary to flourish in the intricate realm of forex trading.

By assimilating these lessons, traders can not only enhance their decision-making capabilities but also acquire mastery in the art of risk management, optimizing their trading potential within the ever-changing forex market. As the landscape continually evolves, those equipped with a comprehensive understanding of technical analysis, strategic depth, and advanced techniques will find themselves better positioned to navigate challenges and seize opportunities in the dynamic forex market.