It is common knowledge that some forex traders (especially beginners) tend to close a running position prematurely due to the fear of losing profit. Emotion and little knowledge of the market structure are the major culprits responsible for the aforementioned practice.

To this end, the ATR Trailing Stop indicator was designed to help forex traders manage profits of an open trade position to minimize losses.

What is the ATR trailing stop indicator for MT4?

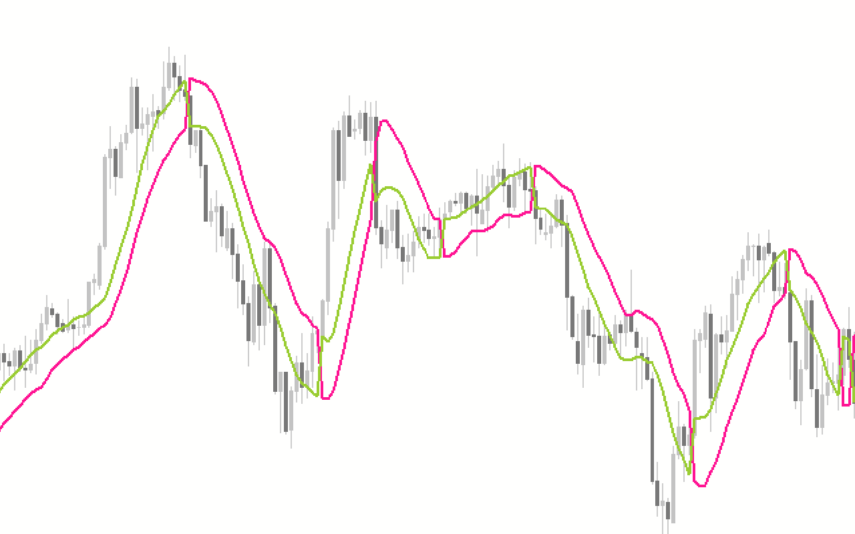

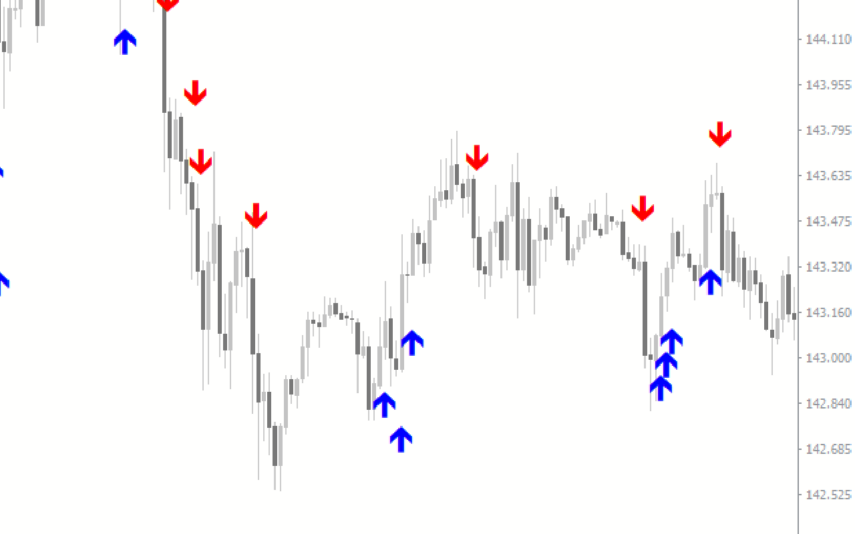

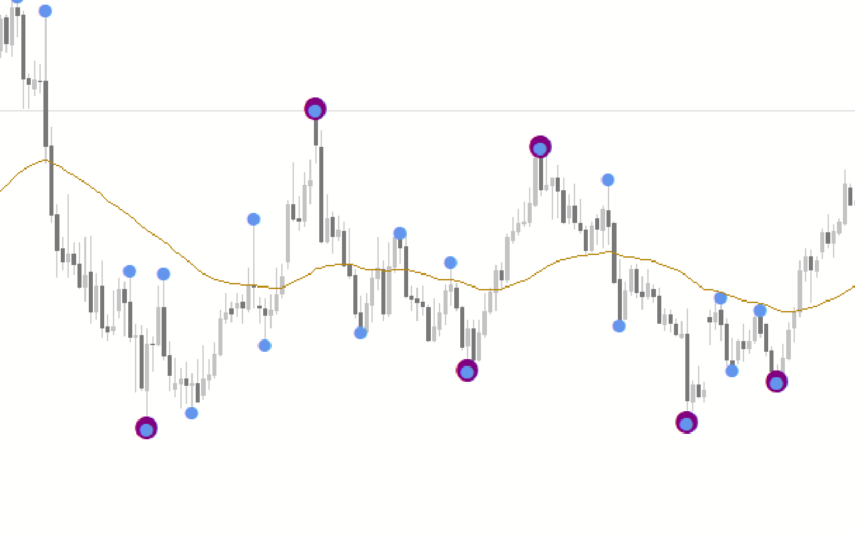

The ATR Trailing Stop indicator is a risk management technical tool developed to display the optimal zone to exit a trade. It was built for the Metatrader (MT4) platform, which uses the Average True Range (ATR) and a trend-following tool to trail behind the price.

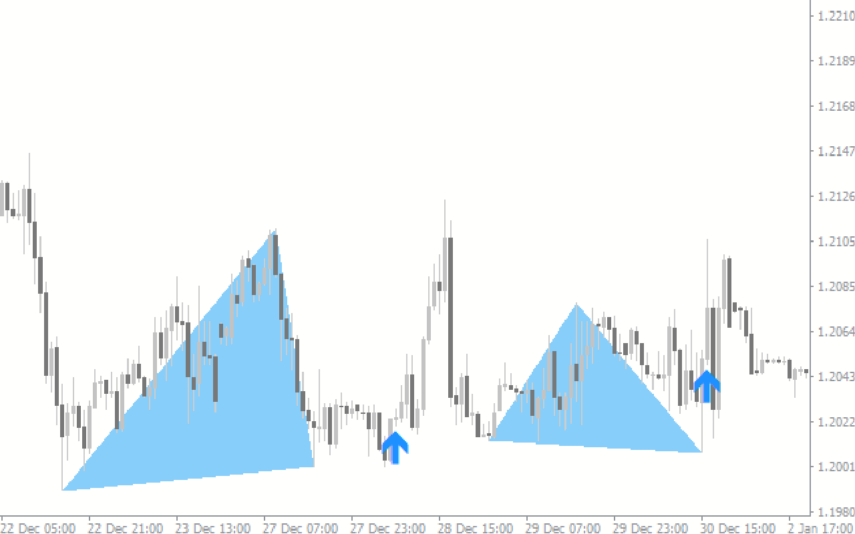

The indicator is an incredible system suited for managing an open position; it tells you when to keep holding or exit a trade. Furthermore, it signals that the trend is still bullish or bearish as long as the ATR Trailing Stop line is below/above the price.

This makes it convenient for forex traders to hold a running trade position for more profit with less fear of losing the already made profits to the market.

Features of the Indicator

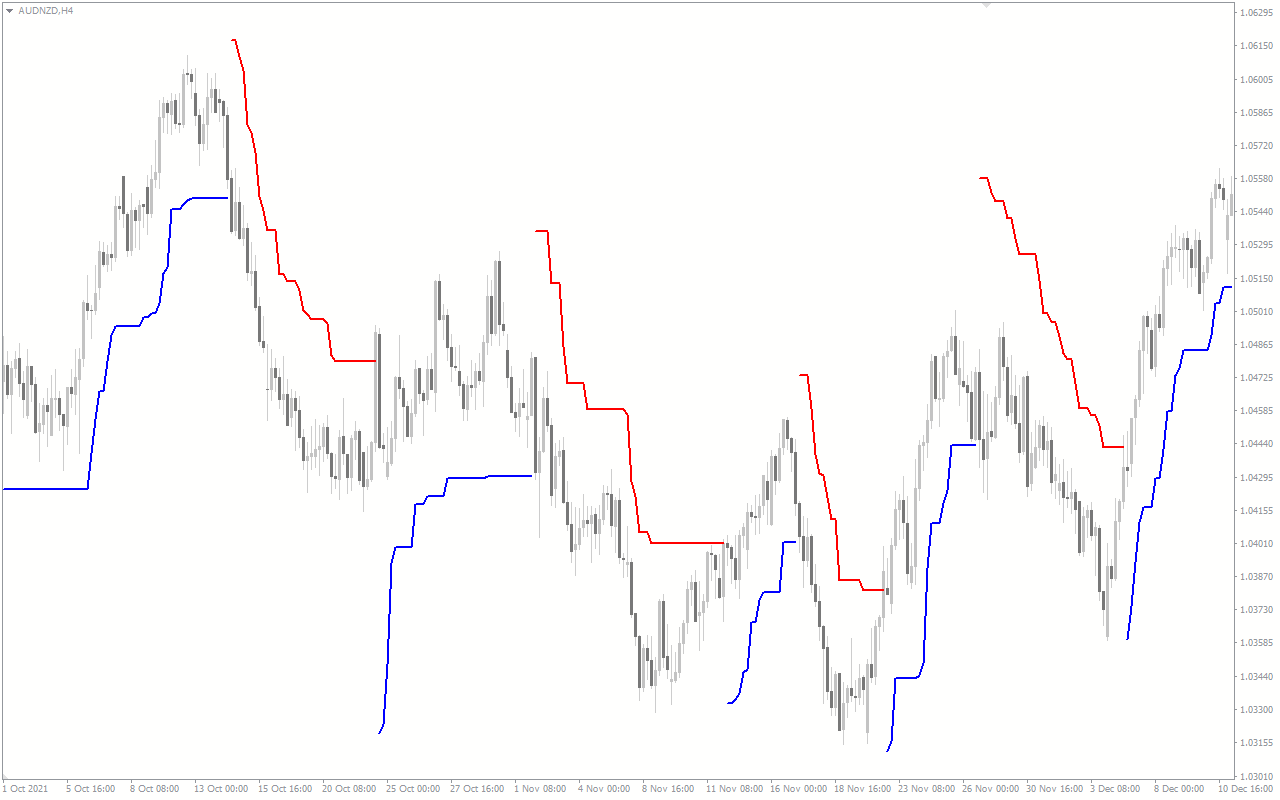

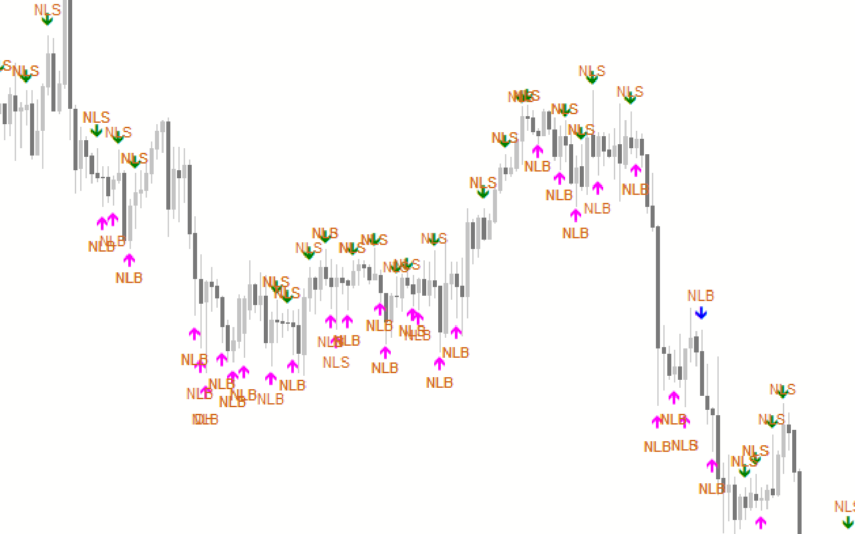

The indicator signifies a bullish/bearish market with a continuous blue/red line, which follows the trend as long as the market structure is maintained. Besides, the indicator’s ATR Trailing Stop line doesn’t repaint.

Furthermore, the indicator signals a possible end/beginning of a new trend when it paints an opposite ATR Trailing Stop line. For instance, you may expect a potential bullish move when the indicator line is displayed below the price in a bearish trend.

The benefit of using the ATR Trailing Stop indicator

a) Maximize Profits: The indicator would help all classes of forex traders to maximize profits from the market. Simply put, it gives you more confidence to hold a running position for higher yields.

b) Trend Reversal Signals: Besides trailing stop orders with the indicator, it also doubles as a technical tool to detect a potential trend reversal.

Indicator Settings Description

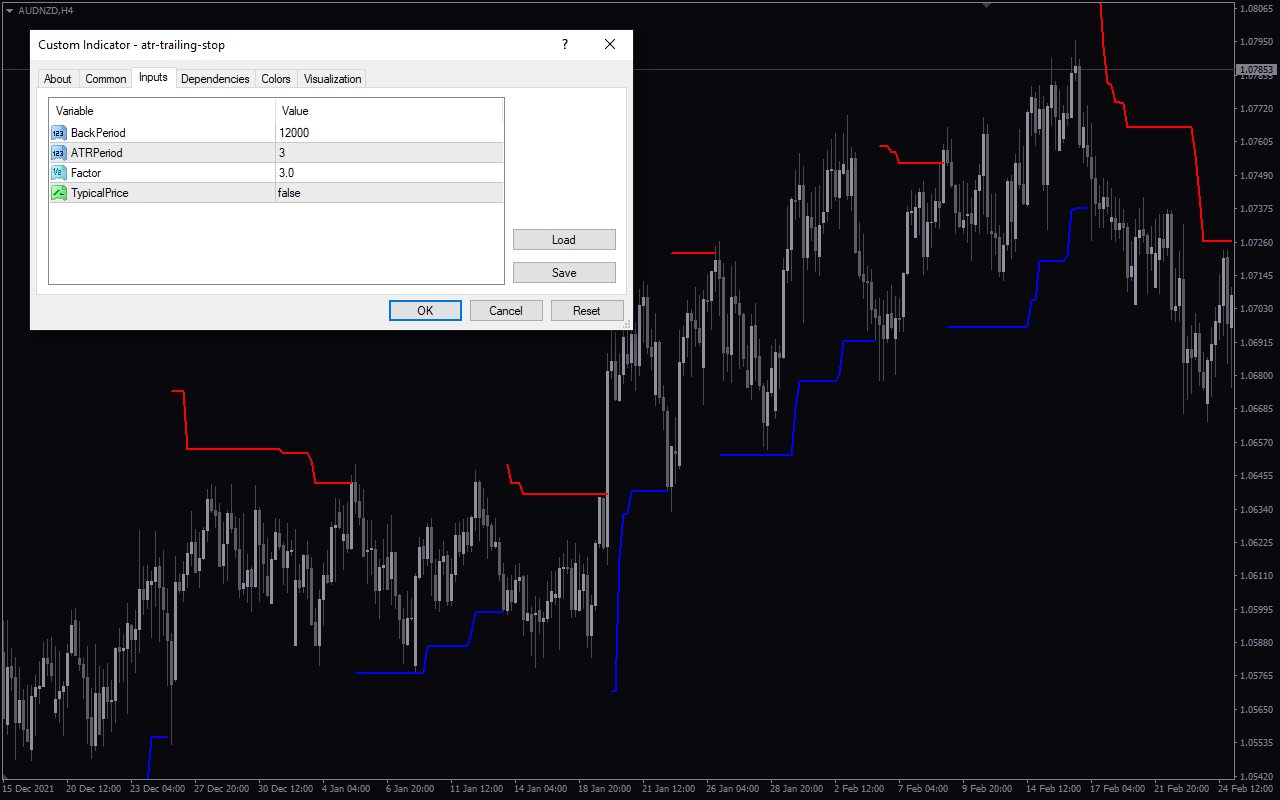

The indicator comes with the following customizable settings:

Back period: This defines the maximum number of candlesticks for trend analysis.

AFTER period: This shows the ATR period for trend analysis.

Factor: This shows the multiplier value for stop loss trailing.

Typical price: This enables/disables the determined stop loss with the closing price.

Reviews

There are no reviews yet.