If your approach to forex trading revolves around price action and market flow principles, it’s important to recognize critical swing levels. Swing lows and swing highs are crucial considerations for identifying price direction and reversal points, where the zigzag arrow indicator comes in.

Features of The Indicator

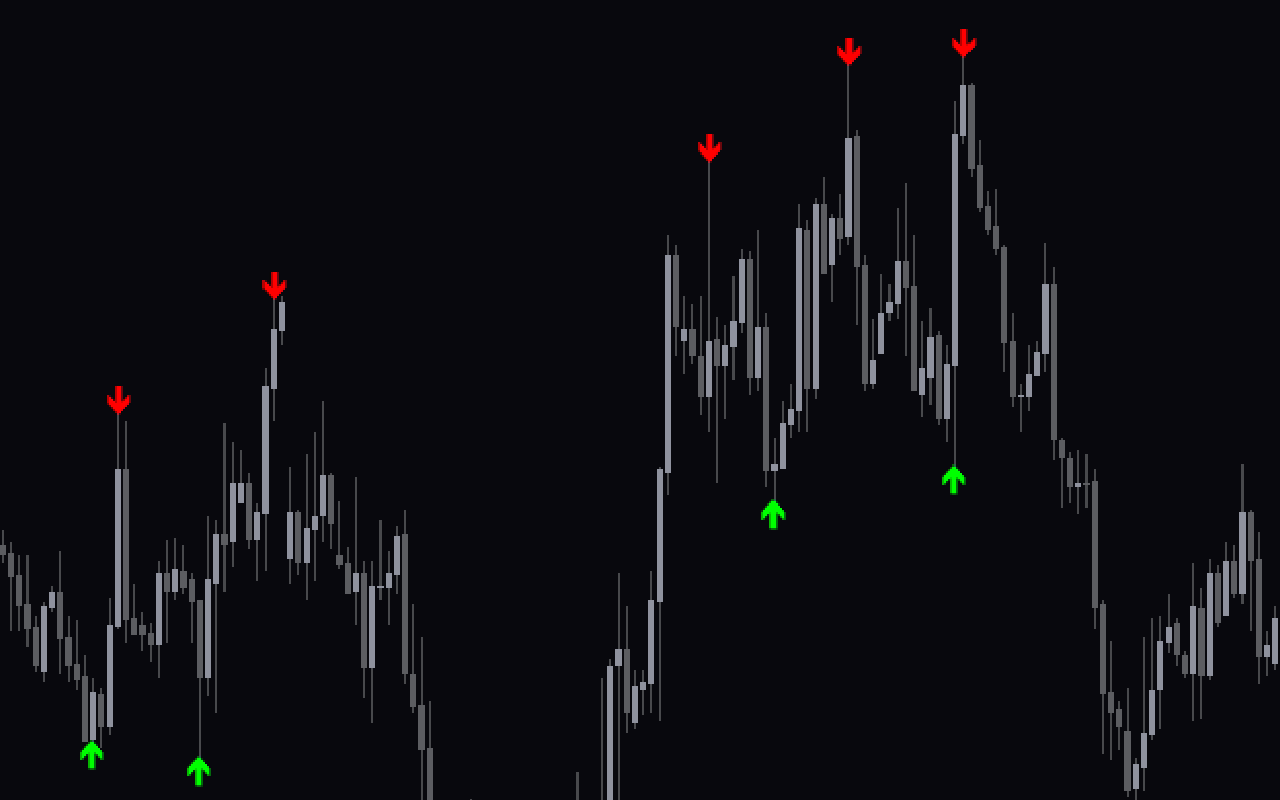

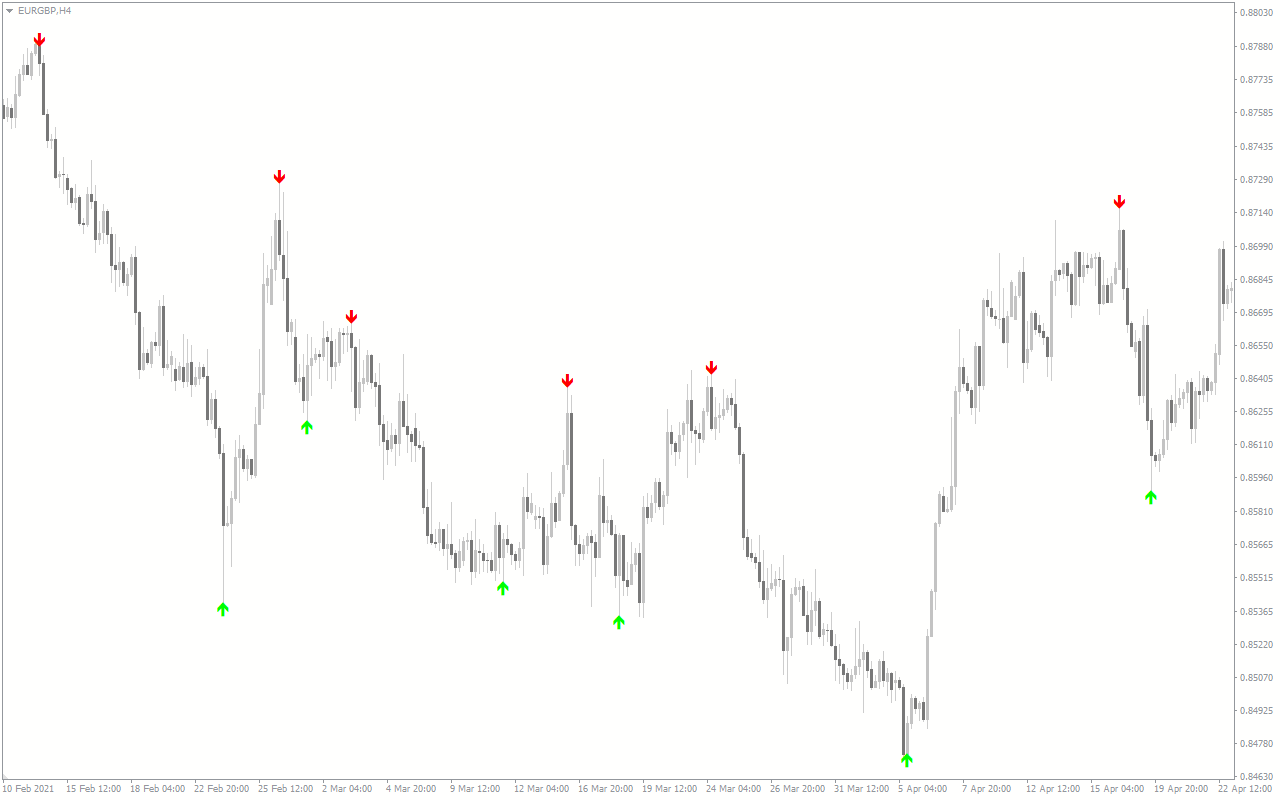

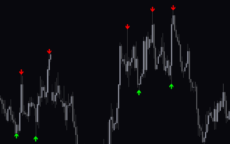

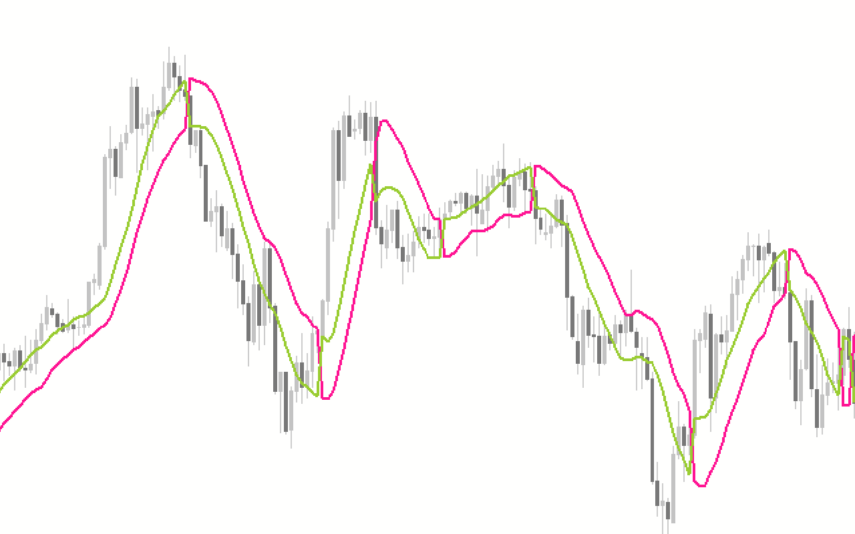

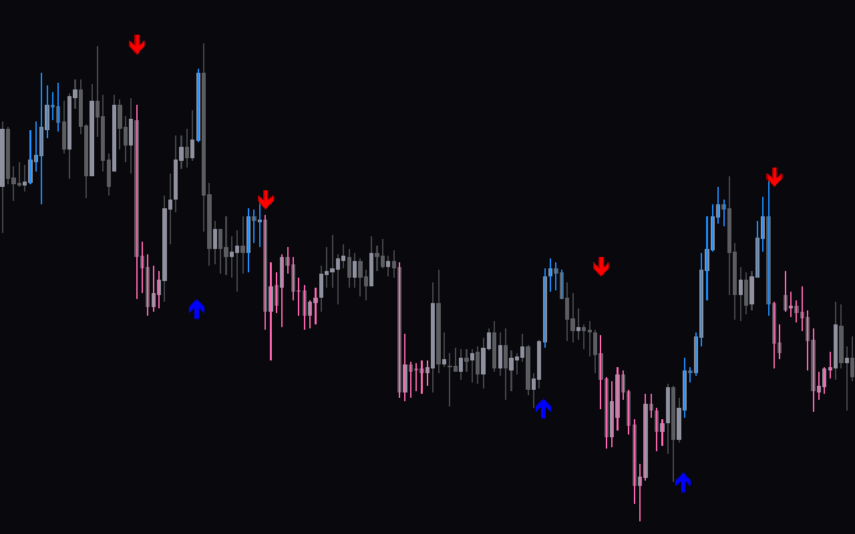

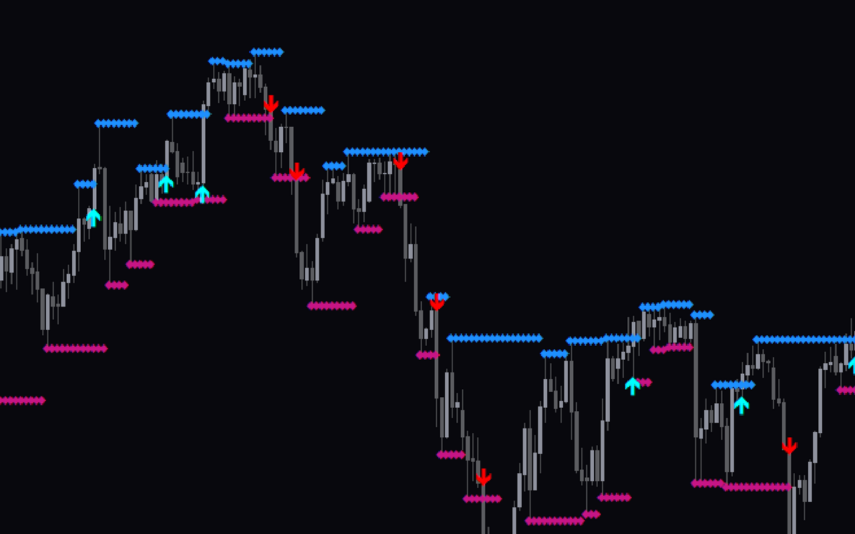

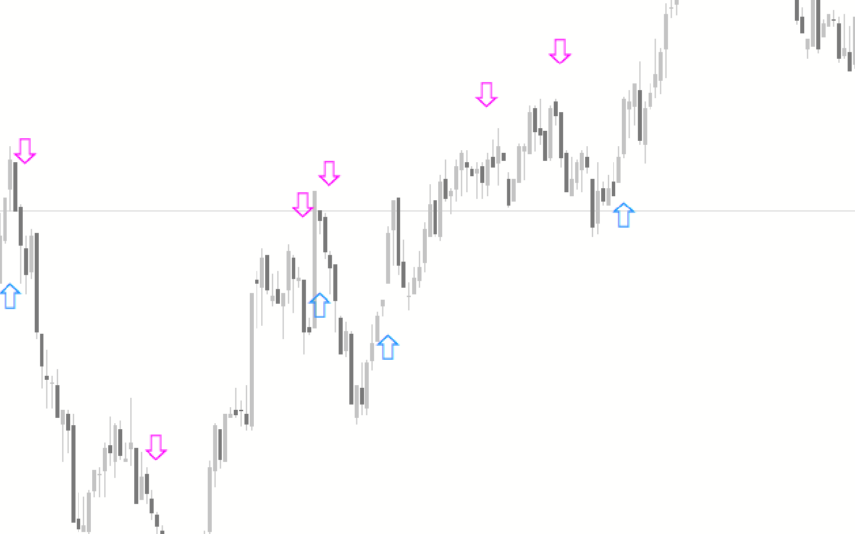

The ZigZag arrow is similar to the classic zigzag indicator. It helps traders to determine swing highs and swing lows objectively. On the other hand, the Zigzag arrow draws arrows, as opposed to the usual zigzag signal, connecting swing highs and swing lows to form a zigzag-like, downward structure. The blue arrow represents swing lows, whereas the red arrow represents swing highs. This feature helps declutter the chart and makes it easy for new and seasoned traders.

How the Indicator Can Benefit You

The indicator provides trade entry signals for those who use price action. The technique defines an uptrend as a market with rising highs and swing lows. Downtrends occur when current swing highs form at a lower level than the previous ones and swing lows are lower than the previous lows. This indicator assists in recognizing both swing highs and lows.

After identifying these points, you can use different candlestick patterns to establish when to enter trades. For example, you could wait for a bearish signal at the swing high of a downtrend. Similarly, you could enter after a bullish signal forms at the swing low of an uptrend.

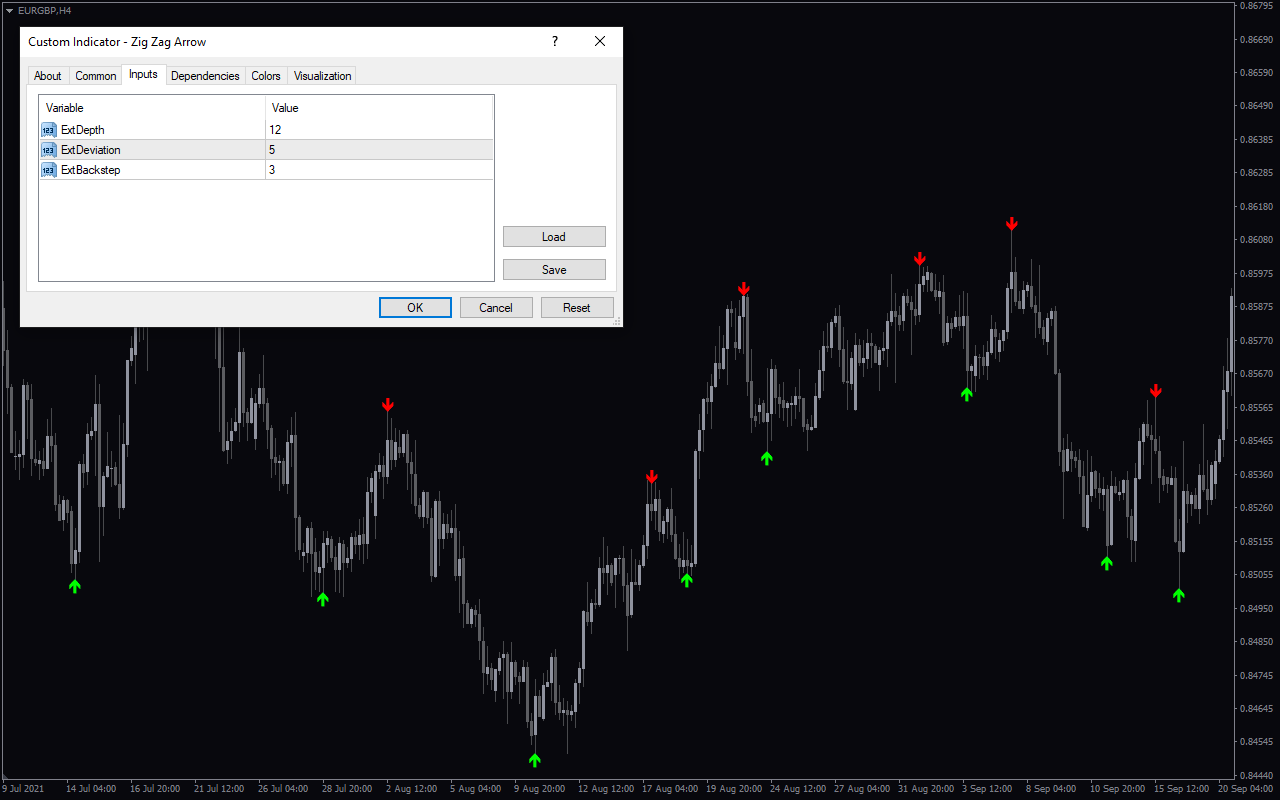

Indicator Setting Description

Below are the Indicator settings for Zig Zag Arrow:

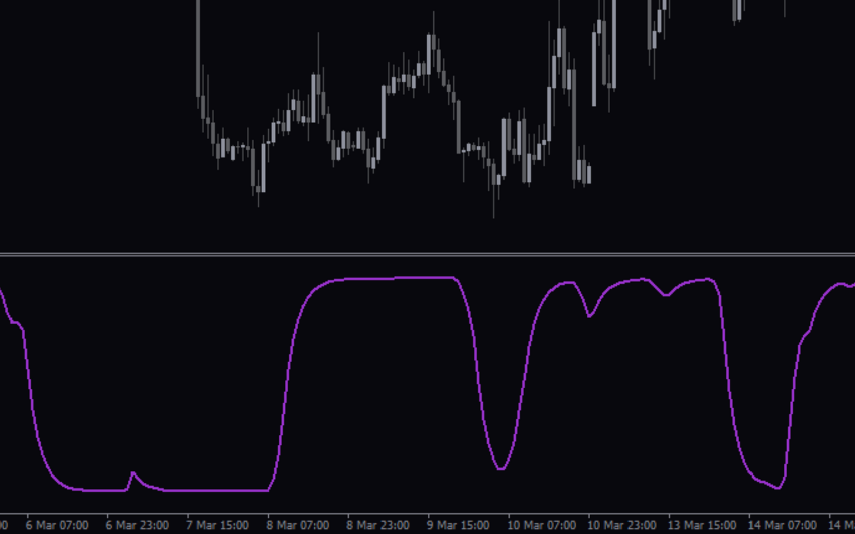

ExtDepth: This input changes the number of bars the indicator considers before creating the highs and the lows.

ExtDeviation: This input changes the percentage change in price for the trend line to change from positive to negative.

ExtBackstep: This input changes the minimum number of bars that the indicator can plot between the swing highs and lows.

Reviews

There are no reviews yet.