In forex trading, the BOS (Break of Structure) and CHoCH (Change of Character) strategy is a technical analysis approach that helps traders identify potential trend reversals and continuation patterns. This strategy primarily relies on understanding price action of a currency pairs and market structure, making it valuable for both day traders and intraday traders. Integrating concepts from Smart Money trading, BOS signifies a breach of significant support or resistance levels, indicating a possible trend continuation. On the other hand, CHoCH signals a daily or weekly shift in market sentiment, suggesting a potential trend reversal. By analyzing these critical points on candlestick charts and combining them with key market indicators like support and resistance levels, traders can make informed decisions to optimize their trading strategies. The BOS and CHoCH strategy also involves understanding market orders, pending orders, and the use of trading signals to enhance precision in entry and exit points. This method is further supported by fundamental analysis, trading psychology, and effective risk management strategies, ensuring traders can navigate the forex market’s volatility and liquidity with confidence. Here, we explore the key components and practical application of the BOS and CHoCH strategy.

Understanding BOS (Break of Structure)

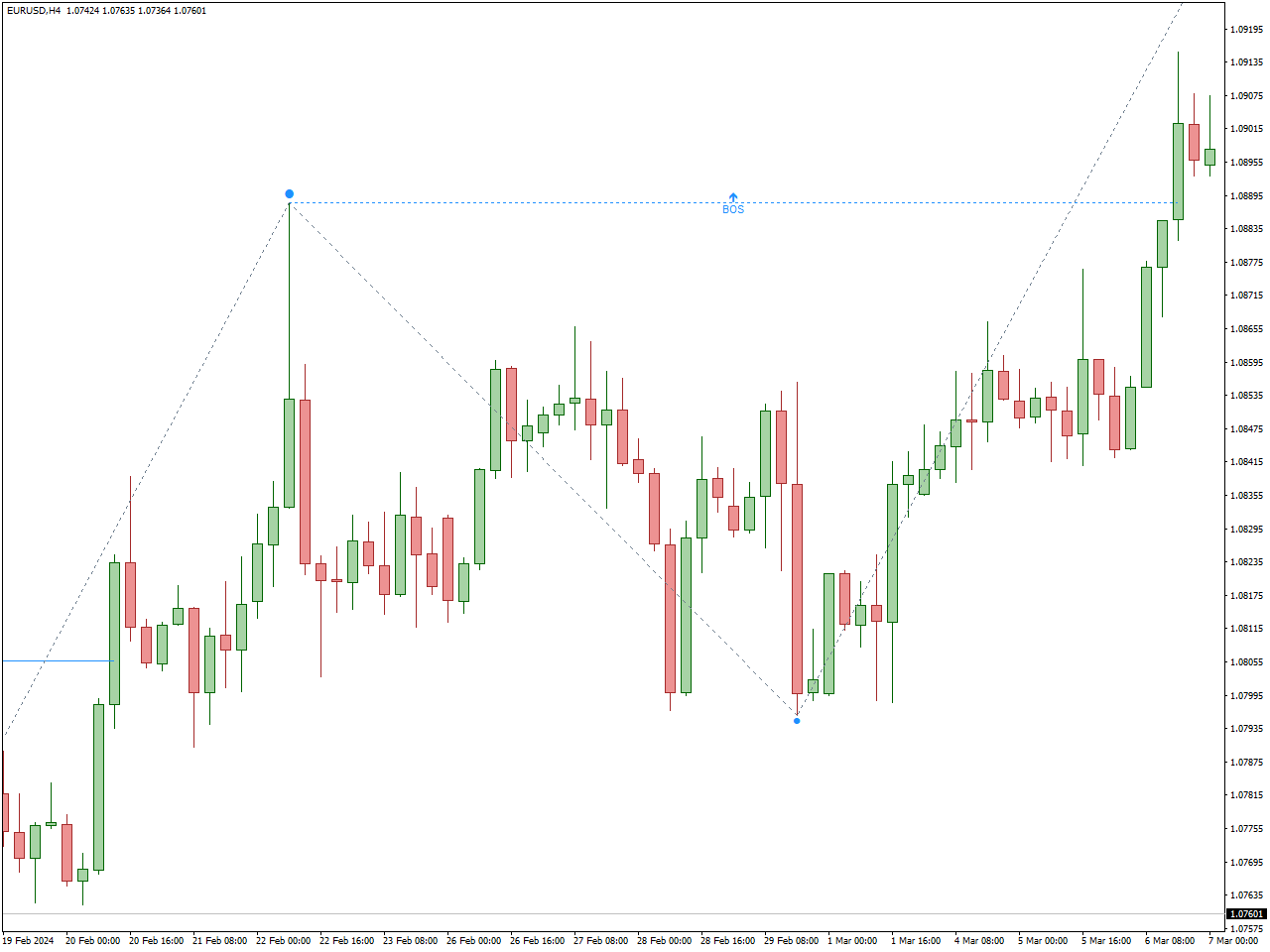

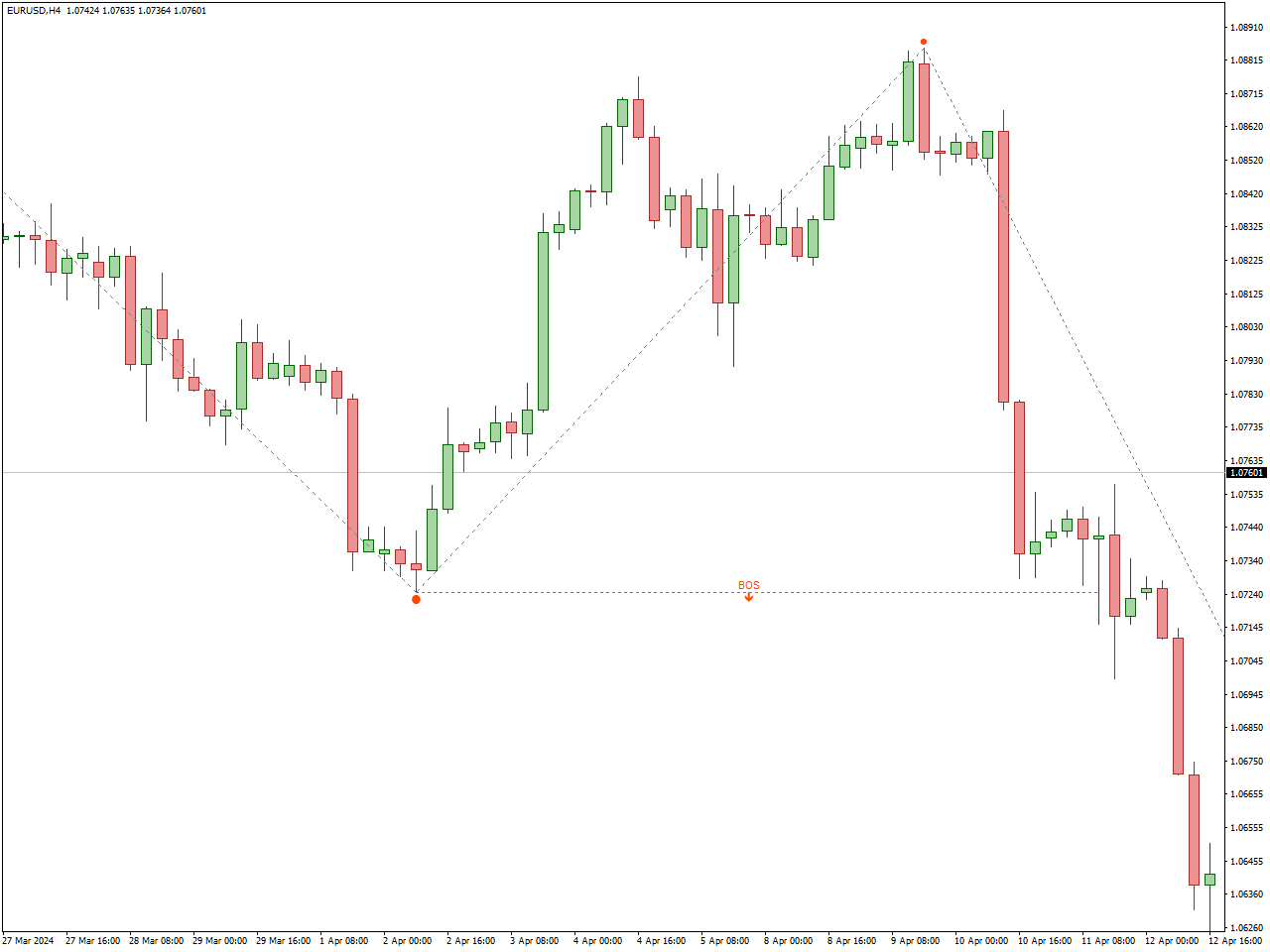

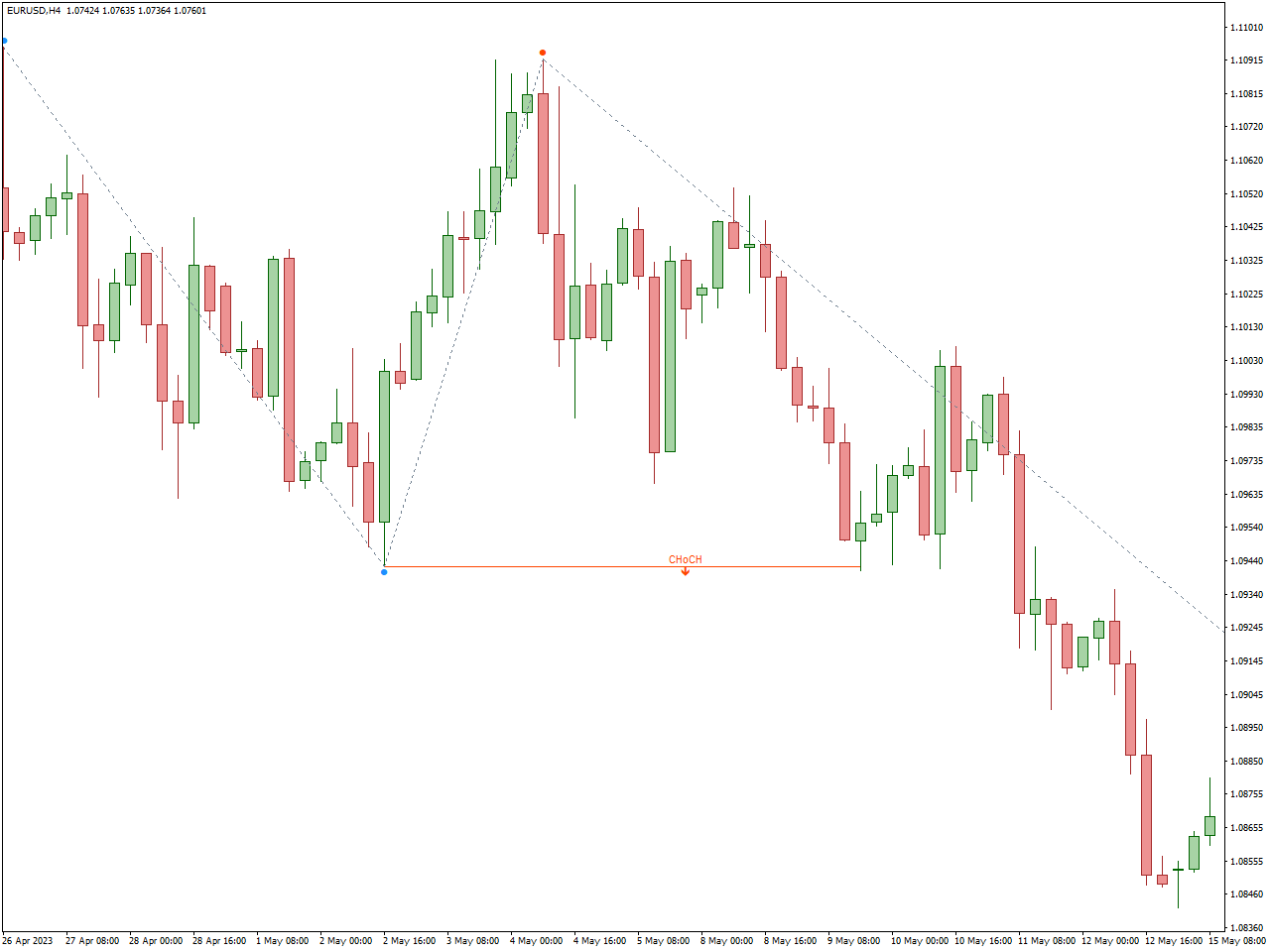

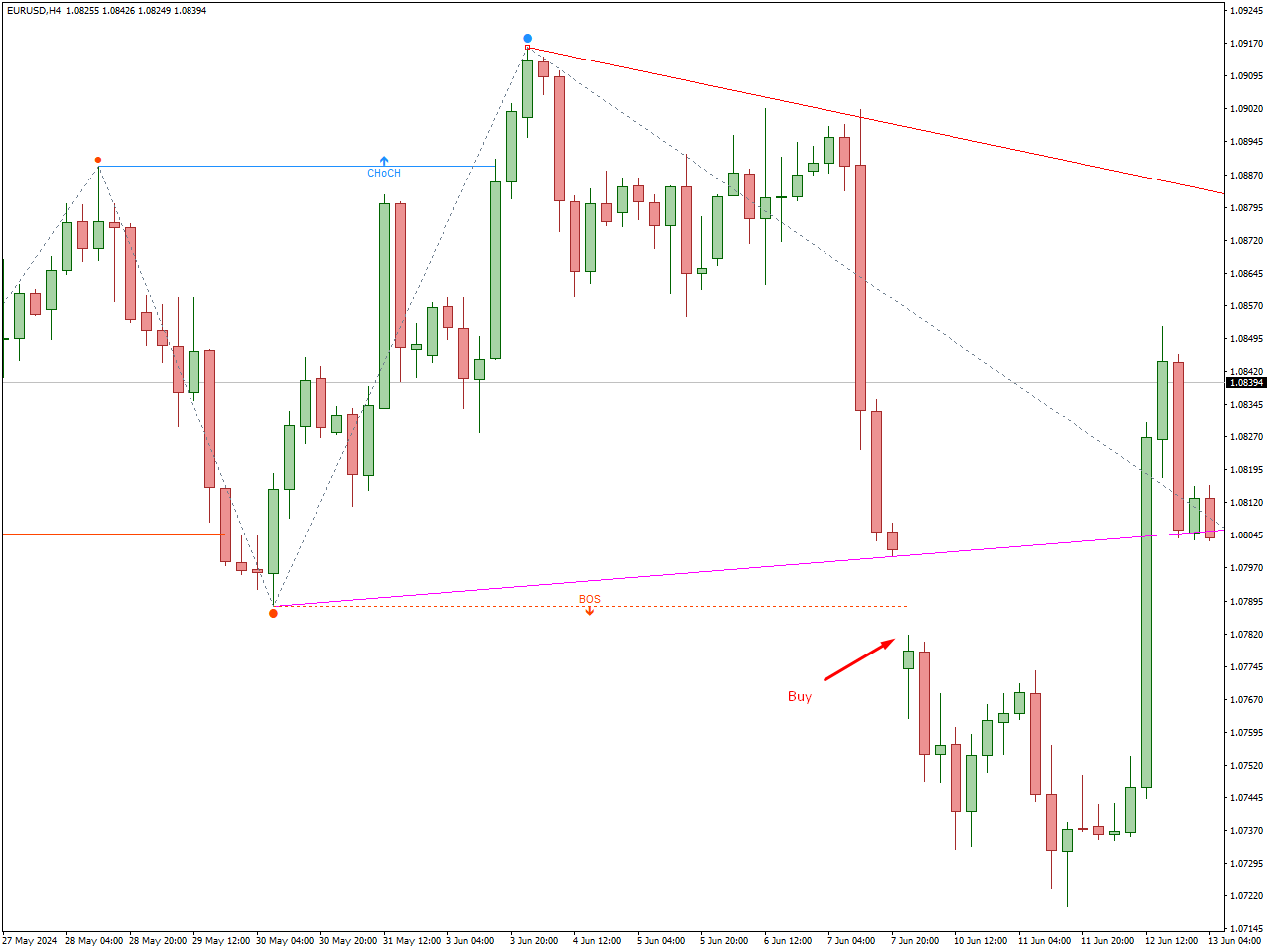

The Break of Structure (BOS) refers to a situation where the price breaks through a significant support or resistance level, indicating a potential continuation of the existing trend. In a bullish trend, a BOS occurs when the price breaks above a previous high, suggesting that buyers are still in control and the uptrend is likely to continue. Conversely, in a bearish trend, a BOS happens when the price breaks below a previous low, indicating that sellers are dominating and the downtrend may persist.

Key Points:

- Bullish BOS: Price breaks above a previous high.

- Bearish BOS: Price breaks below a previous low.

- Significance: Indicates trend continuation and strength of the current trend.

Understanding CHoCH (Change of Character)

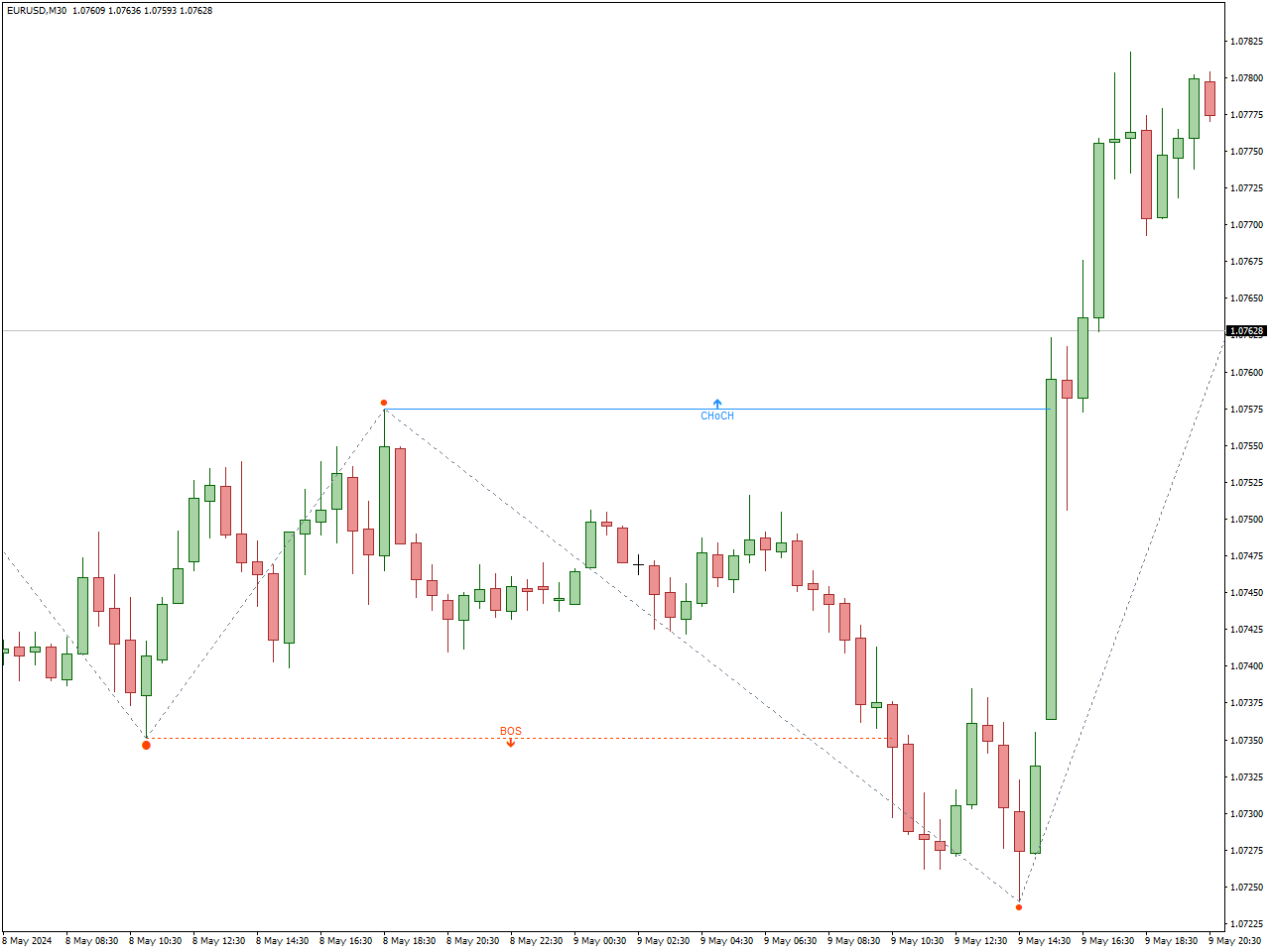

The Change of Character (CHoCH) is a concept that identifies potential trend reversals. It occurs when the price movement deviates from the established pattern, signaling a shift in market sentiment. For instance, in an uptrend, a CHoCH happens when the price fails to make a new high and instead breaks below a recent low. In a downtrend, a CHoCH is identified when the price fails to make a new low and breaks above a recent high.

Key Points:

- Bullish CHoCH: Price fails to make a new low and breaks above a recent high.

- Bearish CHoCH: Price fails to make a new high and breaks below a recent low.

- Significance: Indicates potential trend reversal and shift in market sentiment.

Practical Application of BOS and CHoCH Strategy

- Identify Market Structure: Begin by analyzing the current market structure to determine the prevailing trend. Use candlestick charts, support and resistance levels, and trendlines to identify key price levels.

- Monitor for BOS: Look for Breaks of Structure in the direction of the current trend. For a bullish trend, identify when the price breaks above previous highs. For a bearish trend, watch for breaks below previous lows.

- Confirm with CHoCH: After identifying a BOS, monitor for Changes of Character that could signal a potential reversal. In an uptrend, a CHoCH is confirmed when the price fails to make a new high and breaks below a recent low. In a downtrend, a CHoCH is confirmed when the price fails to make a new low and breaks above a recent high.

- Entry and Exit Points: Use BOS and CHoCH signals to determine buy and sell opportunities. This strategy enables the use of market order for quicker responses to market sentiment. Enter long position in the direction of the BOS for trend continuation strategies. For reversal strategies, consider entering short when a CHoCH is confirmed. Set stop-loss orders below recent lows for bullish trades and above recent highs for bearish trades to manage risk.

- Combine with Other Indicators: Enhance the BOS and CHoCH strategy by combining it with other technical indicators such as moving averages, RSI, and MACD to confirm signals and increase the reliability of your trades.

- Risk Management: Implement effective risk management strategies, including setting appropriate stop-loss order and take-profit order, to protect against adverse market movements. Appropriate risk-reward ratio will help with maximizing your profit.

What Is the Difference Between BOS and ChoCh?

In trading, BOS (Break of Structure) and ChoCh (Change of Character) are both significant concepts that traders use to analyze market trends and potential trading opportunities. BOS typically refers to a breakout or breakdown of a significant price level, such as a previous high or low, which can indicate the continuation of the current trend. For instance, a break above a previous high suggests bullish momentum and potential continuation of an uptrend, while a break below a previous low indicates bearish sentiment and potential continuation of a downtrend.

On the other hand, ChoCh (Change of Character) signifies a shift in the market’s behavior or trend direction. It is recognized by a noticeable change in the pattern of highs and lows, which may signal a potential reversal or the beginning of a new trend. For example, if a market has been making higher highs and higher lows (indicating an uptrend) and then starts forming lower highs and lower lows, it suggests a shift to a downtrend or consolidation phase.

Conlusion

In conclusion, the BOS (Break of Structure) and ChoCh (Change of Character) strategies are invaluable tools for Forex traders seeking to navigate market fluctuations with precision. BOS helps traders identify critical shifts in market trends by recognizing breaks in previous highs or lows, enabling them to spot potential reversals or continuations. Meanwhile, ChoCh offers early indications of trend changes by highlighting shifts in the pattern of highs and lows. Mastering these strategies allows traders to make informed decisions, optimize their entry and exit points, and enhance their overall trading performance by staying attuned to evolving market dynamics.