The Anchored Volume Weighted Average Price (Anchored VWAP) is a technical analysis tool used by traders to determine the average price of a currency pairs, weighted by volume, over a specific time period starting from a chosen anchor point. Unlike the traditional VWAP, which starts from the beginning of the trading session and resets each day, the Anchored VWAP can be set to start from any point in the past. This flexibility allows traders to pinpoint significant events such as earnings releases, economic data announcements, or market swings, and measure the average price from that specific point onward.

Key Features of Anchored VWAP

Custom Anchor Points: Traders can choose any point in time to start the calculation, allowing them to analyze the impact of specific events or time frames on the price chart.

Volume-Weighted: It takes into account the volume traded at each price level, providing a more accurate reflection of the average price where most trading activity occurred.

Trend Identification: Helps in identifying trends and potential reversal points by showing where the majority of trading activity has taken place.

Support and Resistance Levels: Acts as dynamic support or resistance levels, helping traders make informed decisions on entry and exit points.

How to trade with Anchored VWAP Indicator

Step 1: Selecting an Anchor Point

Choosing the right anchor point is crucial for effective use of Anchored VWAP. Consider the following anchor points:

Major Market Events: Economic releases, earnings reports, or geopolitical events.

Significant Price Levels: Swing highs and lows, breakout points, or the start of a new trend.

Custom Time Frames: Beginning of the trading day, week, month, or any period of interest.

Step 2: Plotting Anchored VWAP on Charts

Most trading platforms, such as MetaTrader 4/5 offer the Anchored VWAP indicator. Here’s how to plot it:

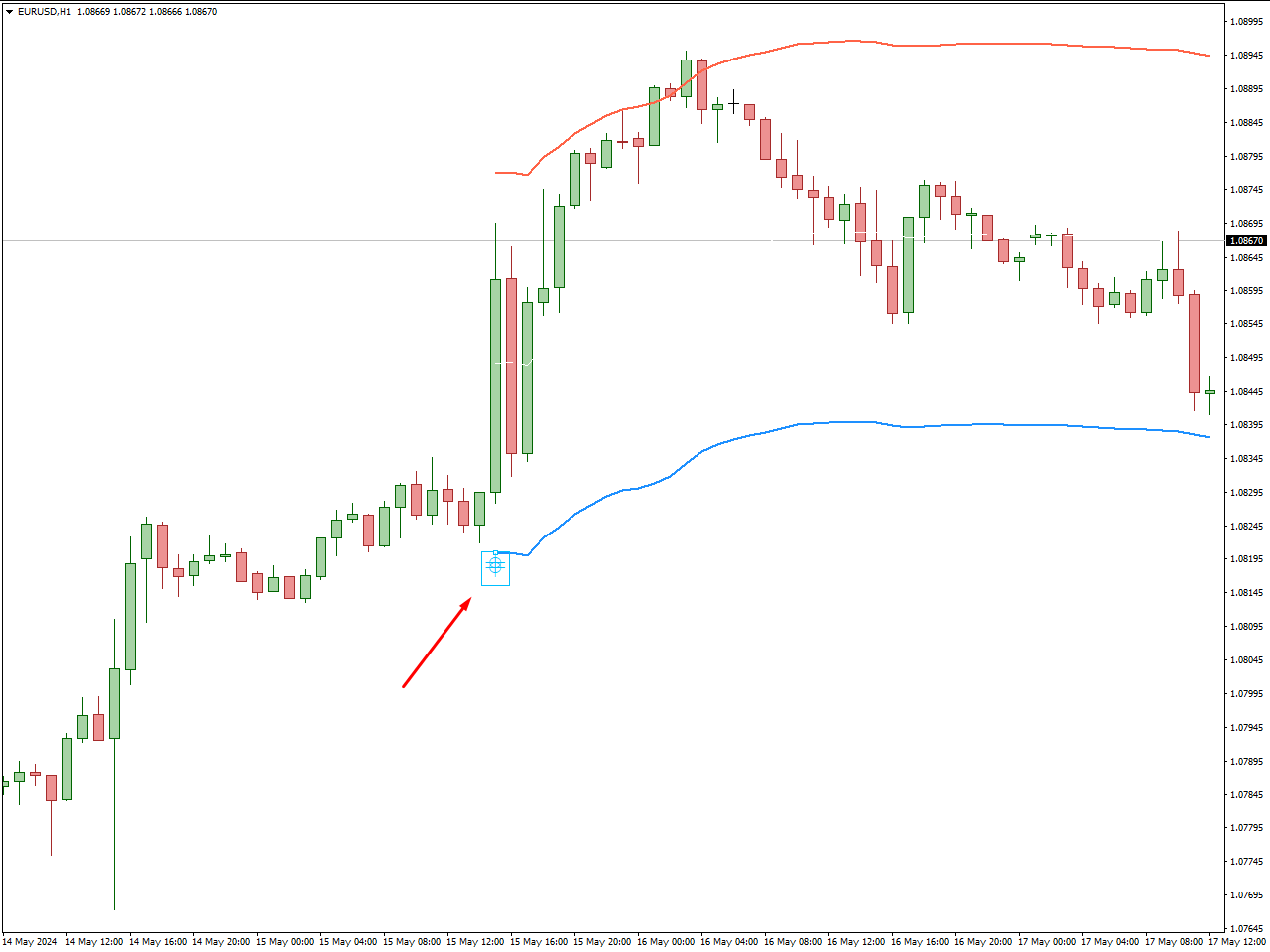

Select the Indicator: Add the Anchored VWAP indicator to your chart.

Choose the Anchor Point: Double click on the cross and drag it to the starting point on the chart.

Adjust Settings: Customize the appearance and settings as needed.

Step 3: Analyzing the Chart

Once the Anchored VWAP is plotted, observe how the price interacts with the VWAP line:

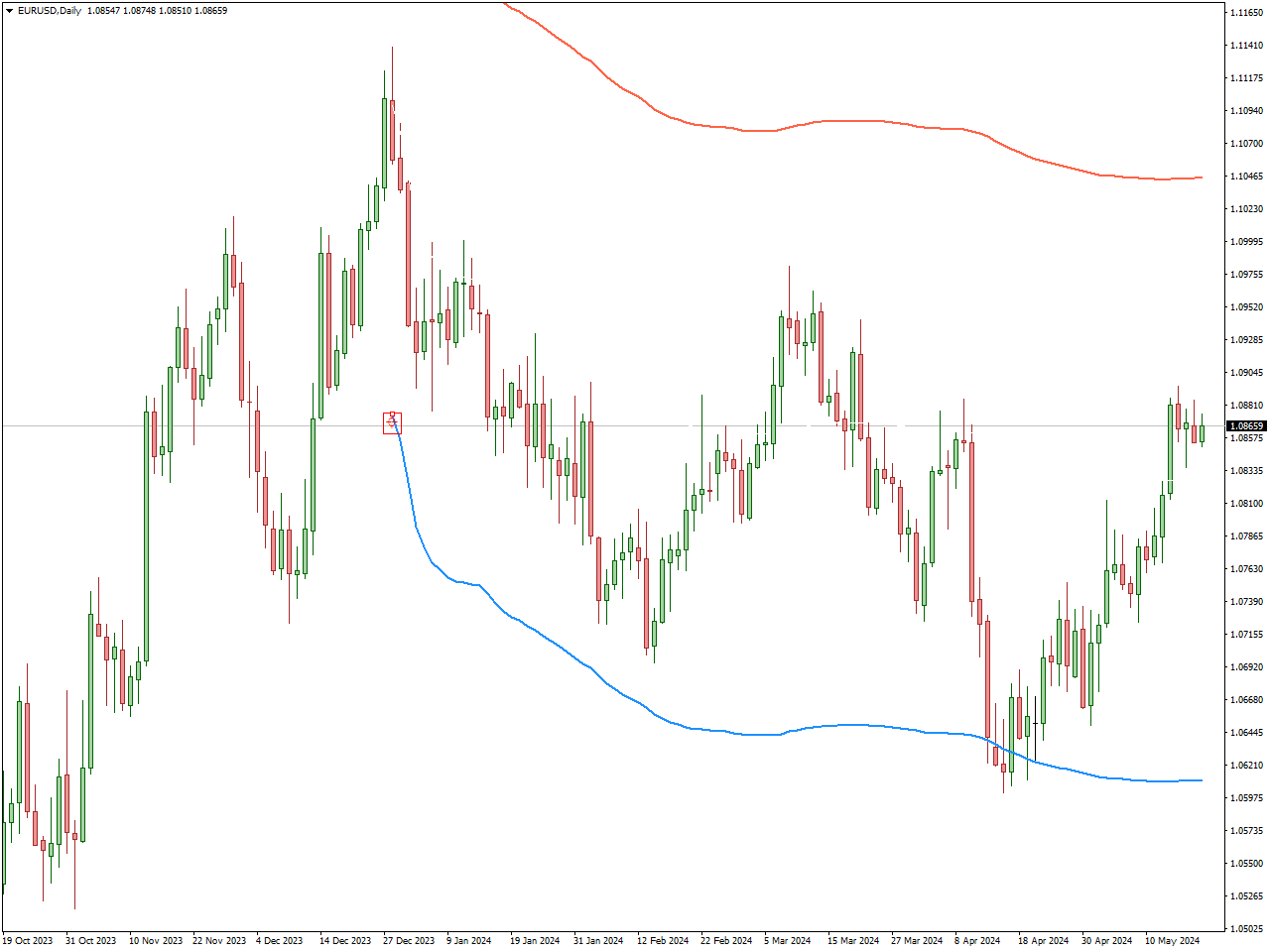

Support and Resistance: The Anchored VWAP often acts as dynamic support or resistance. Price bouncing off the VWAP indicates support, while price failing to rise above it suggests resistance.

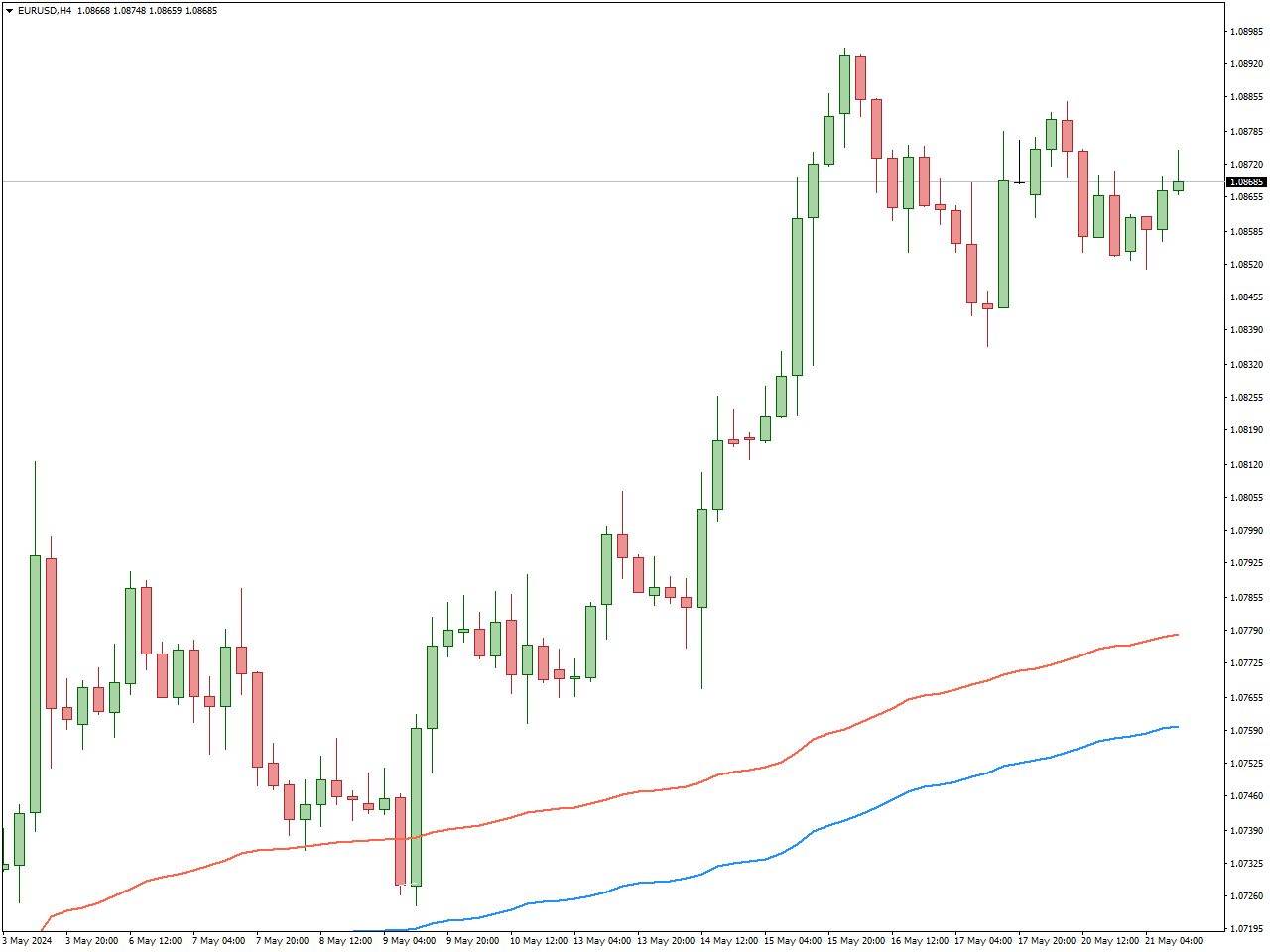

Trend Identification: A rising Anchored VWAP indicates an uptrend, while a falling Anchored VWAP signifies a downtrend.

Reversal Signals: Significant deviations from the Anchored VWAP can indicate potential reversals.

Step 4: Developing Trading Strategies

Integrate the Anchored VWAP into your trading strategies:

Day Trading and Scalping: Use Anchored VWAP to identify intraday support and resistance levels. Enter trades when price approaches the VWAP and shows signs of reversal.

Swing Trading: Anchor the VWAP to the start of a swing high or low to track the average price during the swing. This helps in identifying trend continuation or reversal points.

Trend-Following: Use Anchored VWAP to confirm trends. In an uptrend, look for buying opportunities when the price is near or above the Anchored VWAP. In a downtrend, look for selling opportunities when the price is near or below the Anchored VWAP.

Step 5: Locating Entry Points with Anchored VWAP

Finding precise entry points is crucial for successful trading, and the Anchored VWAP can significantly aid in this process. When the price approaches the Anchored VWAP, it often indicates a potential area of interest for initiating a trade. Here’s how you can locate entry points using the Anchored VWAP:

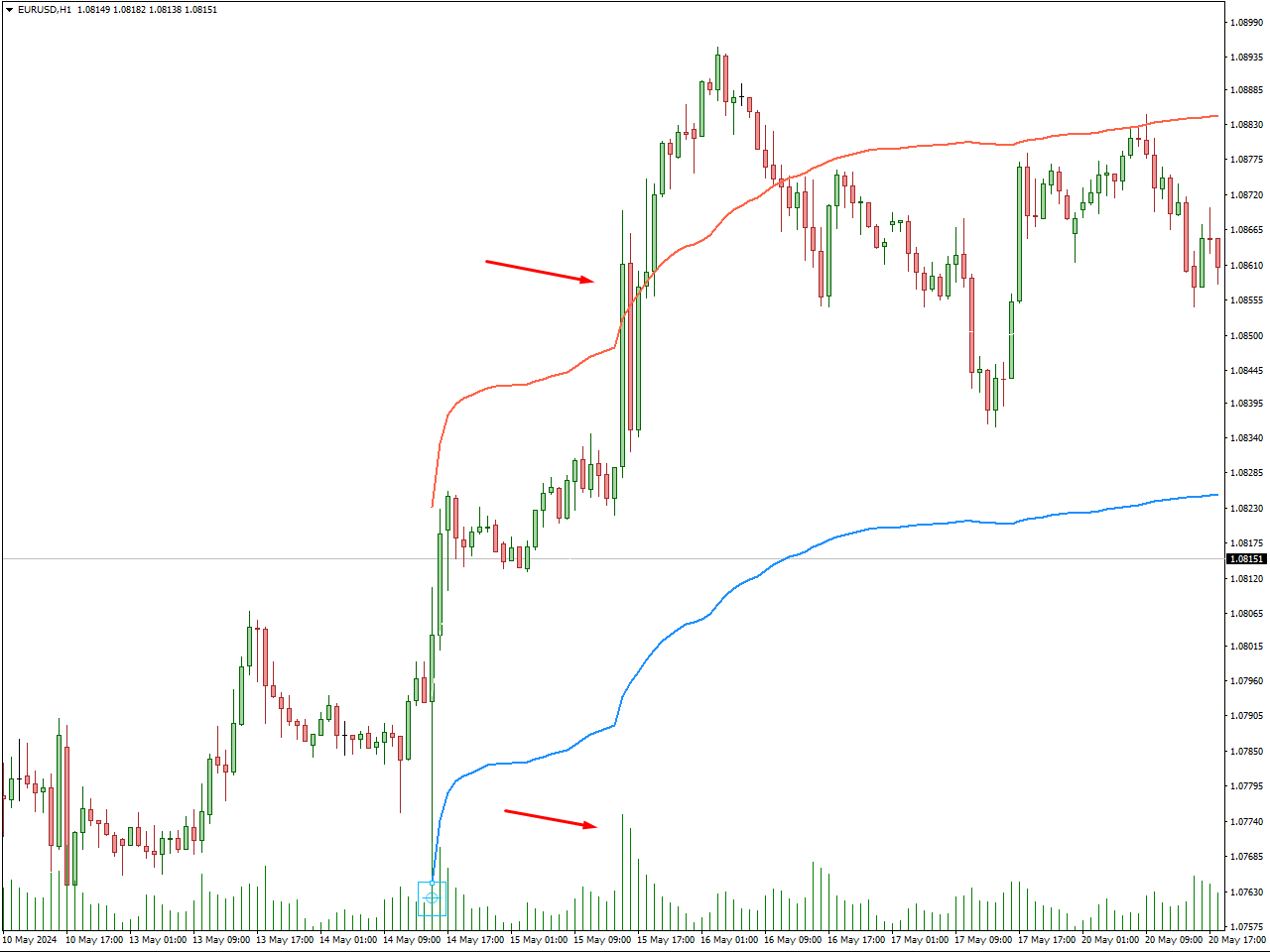

Price Pullback to VWAP: In an uptrend, look for instances where the price pulls back to the Anchored VWAP line. This often represents a strong support level where buying interest may re-emerge. Conversely, in a downtrend, a pullback to the Anchored VWAP can serve as a resistance level where selling pressure might increase.

Confirmation with Candlestick Patterns: Once the price reaches the Anchored VWAP, wait for confirmation through bullish or bearish candlestick patterns. For example, a bullish engulfing pattern near the VWAP in an uptrend can signal a potential entry for a long position. In a downtrend, a bearish engulfing pattern can indicate a sell opportunity.

Volume Analysis: Examine the volume at the VWAP touchpoint. High volume at the VWAP suggests strong conviction and can provide additional confidence in the entry point. Low volume might indicate weaker interest and a potential for further price movement before a decisive entry point emerges.

Confluence with Other Indicators: Enhance the reliability of your entry points by seeking confluence with other technical indicators. For instance, a confluence of the Anchored VWAP with a moving average or a support/resistance level can strengthen the validity of the entry signal.

Step 6: Implementing Risk Management

Effective risk management strategies are keys to successful forex trading:

Stop-Loss Order: Place stop-loss orders below the Anchored VWAP in an uptrend and above it in a downtrend.

Take-Profit Order: Set take-profit levels based on historical price action and the distance from the Anchored VWAP.

Risk-Reward Ratio: Ensure a favorable risk-reward ratio by setting appropriate stop-loss and take-profit levels.

Anchored VWAP Pros and Cons

Pros of Anchored VWAP

- Customizable Anchor Points:

- Flexibility: Beginners can choose specific events or timeframes, such as earnings releases, market openings, or significant highs and lows, to anchor the VWAP. This customization allows for more precise analysis tailored to particular trading strategies.

- Event Impact Analysis: By anchoring VWAP to specific events, traders can assess the impact of those events on price movements and identify potential areas of support and resistance.

- Enhanced Accuracy:

- Volume-Weighted Analysis: Anchored VWAP considers the volume traded at each price level, providing a more accurate representation of the average price than simple moving averages.

- Dynamic Support and Resistance: The line often acts as dynamic support and resistance, helping traders make more informed daily trading decisions on entry and exit points.

- Trend Identification:

- Trend Confirmation: A rising Anchored VWAP indicates an uptrend, while a falling Anchored VWAP signals a downtrend. This helps traders confirm the direction of the trend and avoid trading against it.

- Reversal Signals: Significant deviations from the Anchored VWAP can indicate potential reversal points, offering opportunities for profitable trades.

- Versatility Across Markets:

- Wide Application: Anchored VWAP can be used across various financial markets, including forex, stocks, and commodities, making it a versatile tool for different trading environments.

- Compatibility with Other Indicators: It can be combined with other technical indicators, such as moving averages, RSI, and candlestick patterns, to enhance trading strategies.

Cons of Anchored VWAP

- Complexity in Selection:

- Choosing the Anchor Point: Selecting the appropriate anchor point requires experience and knowledge. An incorrect choice can lead to misleading analysis and poor trading decisions.

- Subjectivity: The process of choosing anchor points can be subjective, potentially introducing bias into the analysis.

- Lagging Indicator:

- Delayed Signals: Like many volume-weighted indicators, Anchored VWAP can lag, especially in fast-moving markets. This lag can result in late entries and exits, reducing potential profits.

- Limited Use in Highly Volatile Markets: In highly volatile or low-liquidity markets, the Anchored VWAP might not provide timely signals, making it less effective.

- Not Standalone:

- Requires Supplementation: While powerful, Anchored VWAP should not be used in isolation. It works best when combined with other technical analysis tools to provide a comprehensive trading strategy.

- Dependence on Market Conditions: The effectiveness of Anchored VWAP can vary based on market conditions. It may not perform well during periods of sideways or choppy markets where trends are not clearly defined.

- Platform Limitations:

- Availability: Not all trading platforms support Anchored VWAP. Traders may need to use specific platforms or software that offer this feature, which can limit accessibility.

- Learning Curve: For beginners, understanding and effectively using Anchored VWAP can involve a learning curve, requiring time and practice to master.

Conclusion

The Anchored VWAP is a powerful tool for traders looking to enhance their analysis and improve their trading strategies. By providing a customizable and volume-weighted view of the average price, it offers deeper insights into market trends and potential turning points. Whether you are a day trader, swing trader, or scalper, integrating the Anchored VWAP into your trading toolkit can help you make more informed and profitable trading decisions.