The Anchored VWAP (Volume Weighted Average Price) Channel Indicator for MT4 is a technical analysis tool that identifies market sentiment and the potential price movement of a financial trading asset. It assists trades in determining the market trend and identifying potential support/resistance zones.

Features of the Anchored VWAP Channel Indicator

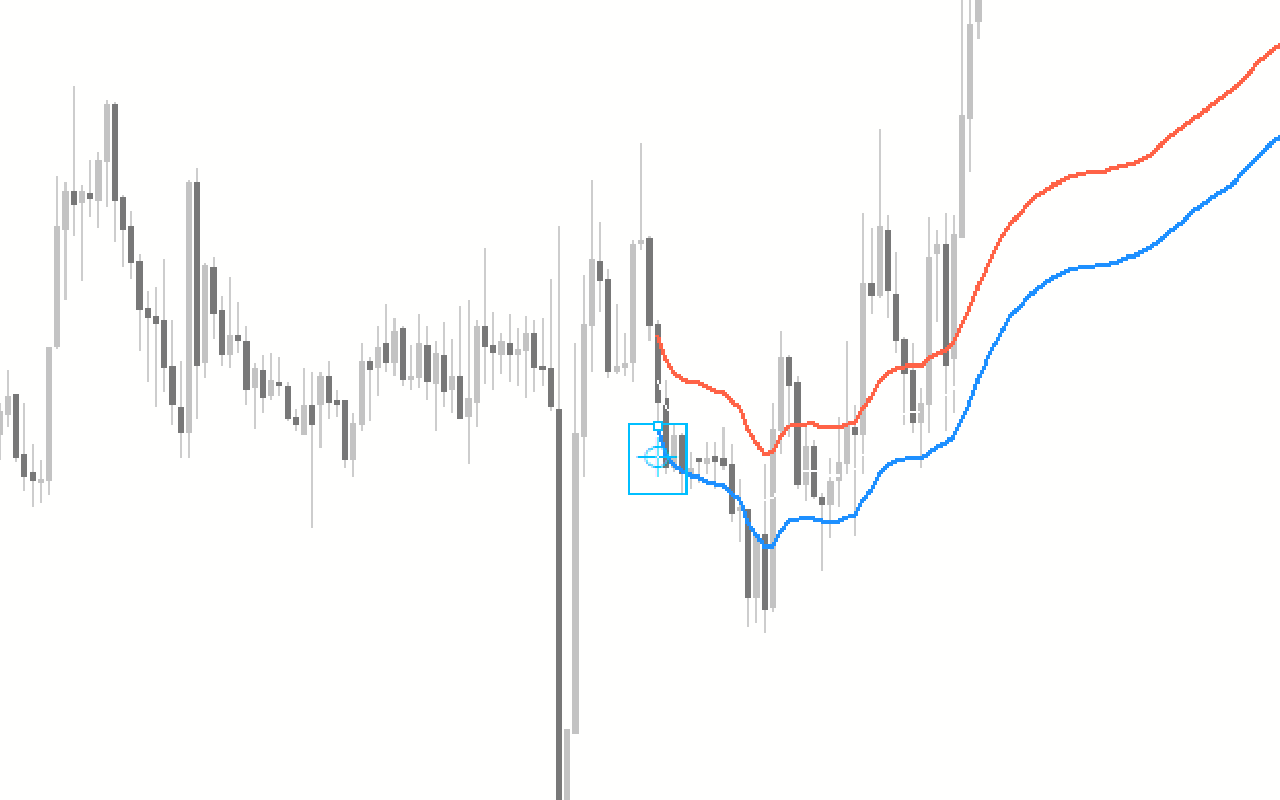

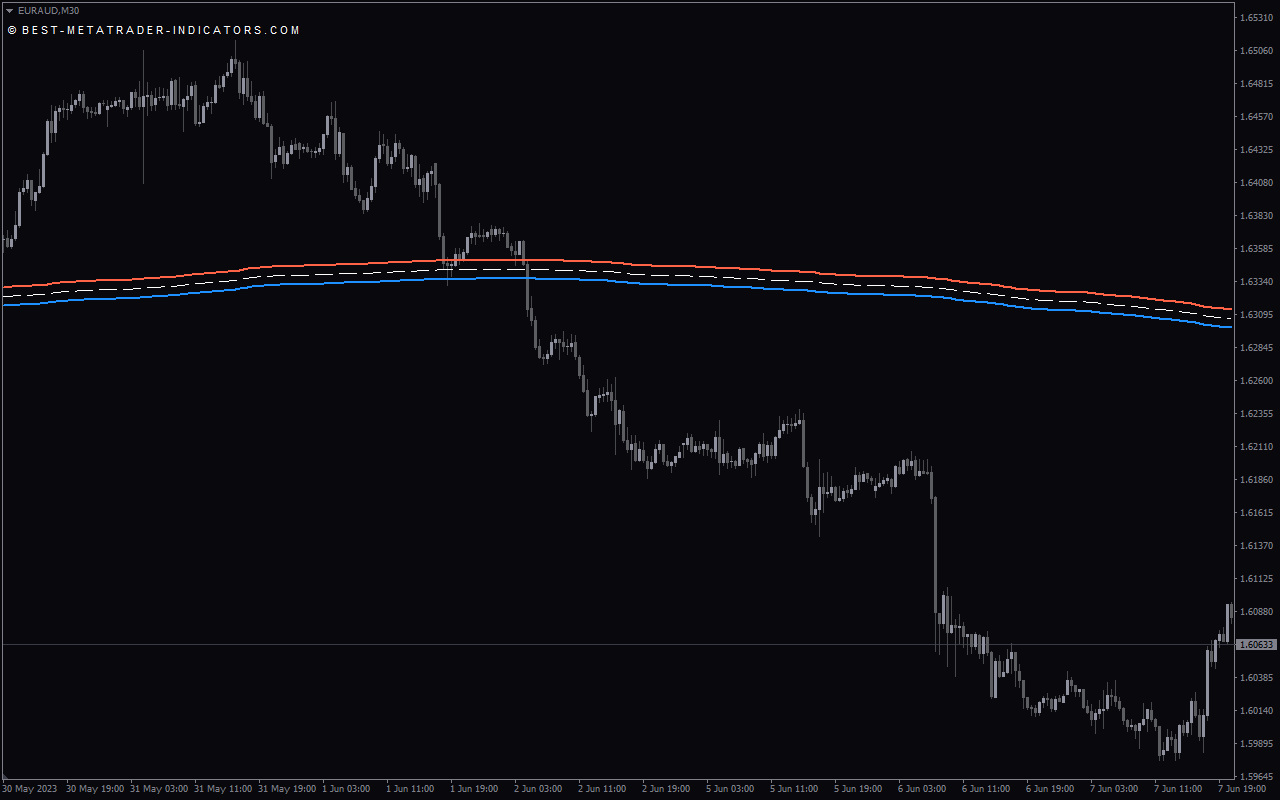

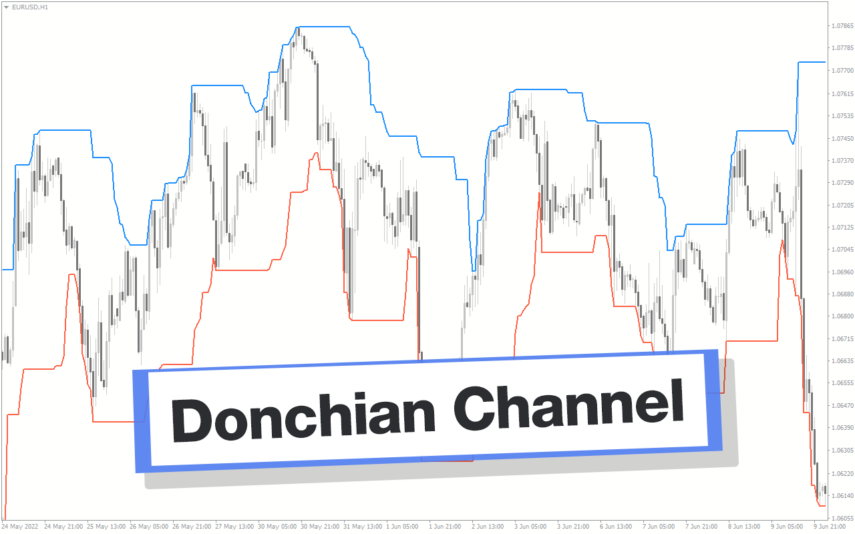

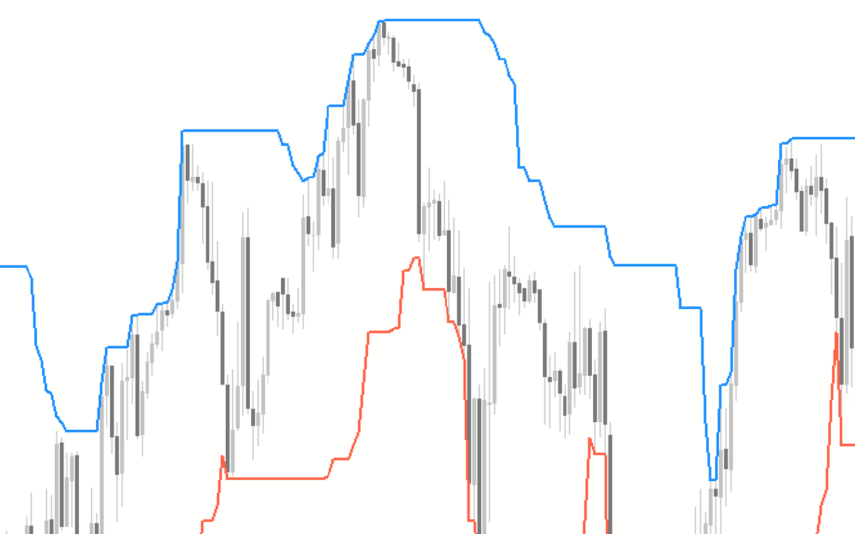

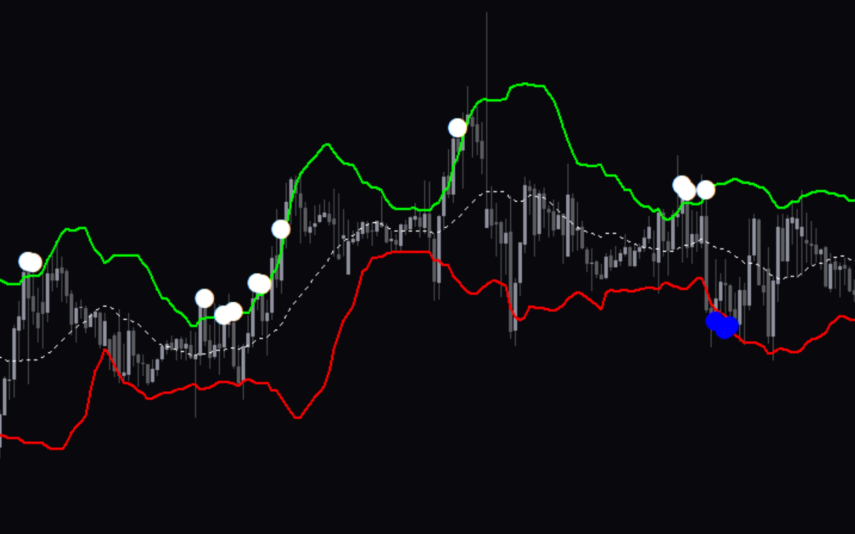

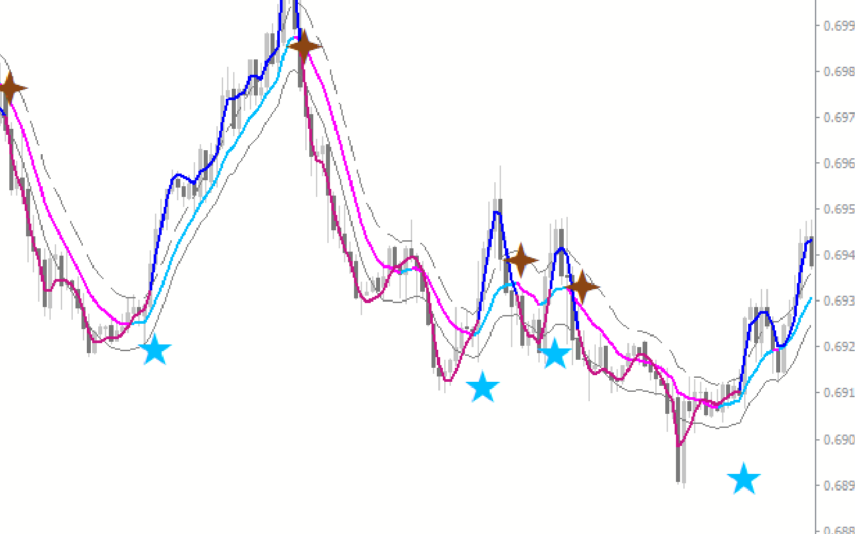

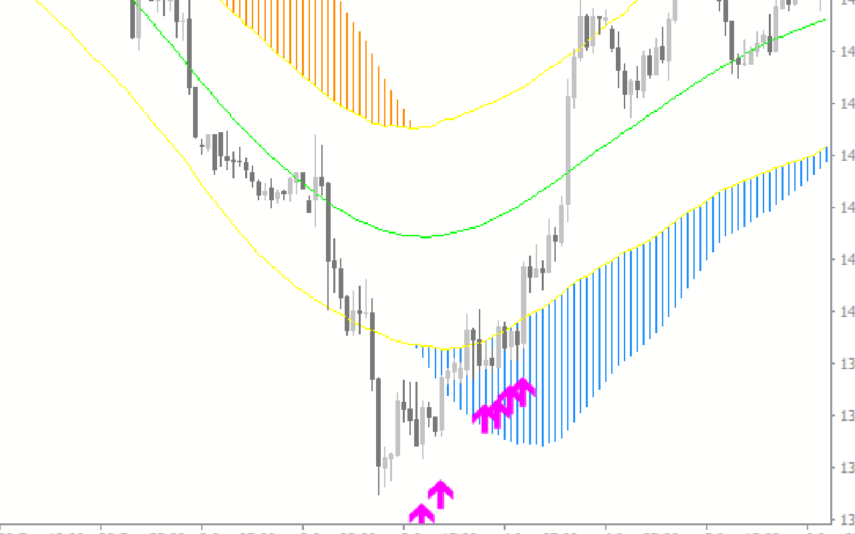

The indicator plots standard deviation bands on the chart, calculated based on the volume-weighted average price over a defined trading session. The upper and lower bands define the market trend and act as potential support and resistance levels. The bands can be used to identify breakouts, bounces, or trend reversal trading setups.

Furthermore, another indicator feature worth mentioning is its ability to anchor the VWAP to the open/close and high/low of a defined trading session. This feature enables the indicator to analyze price movement relative to a specific reference point.

Benefits of Using the Indicator

- Market Sentiment Analysis: The indicator is a valuable technical tool for trend analysis that defines the market’s direction. Price above the indicator’s bands suggests a bullish trend, while price below the bands posits a bearish market.

- Signal Generation: The indicator offers traders insight into price levels, which often act as support and resistance zones. So, a trade may consider buying or selling an instrument if the price prints a reversal pattern at the upper or lower band. Conversely, a Forex trader may look for a buying or selling entry opportunity if the price breaks above/below the bands.

- Reference Point for Market Analysis: Finally, the indicator plots the VWAP starting from key price levels such as open or the previous day’s close, for instance, enabling traders to keep track of the price movement.

Indicator Settings Description

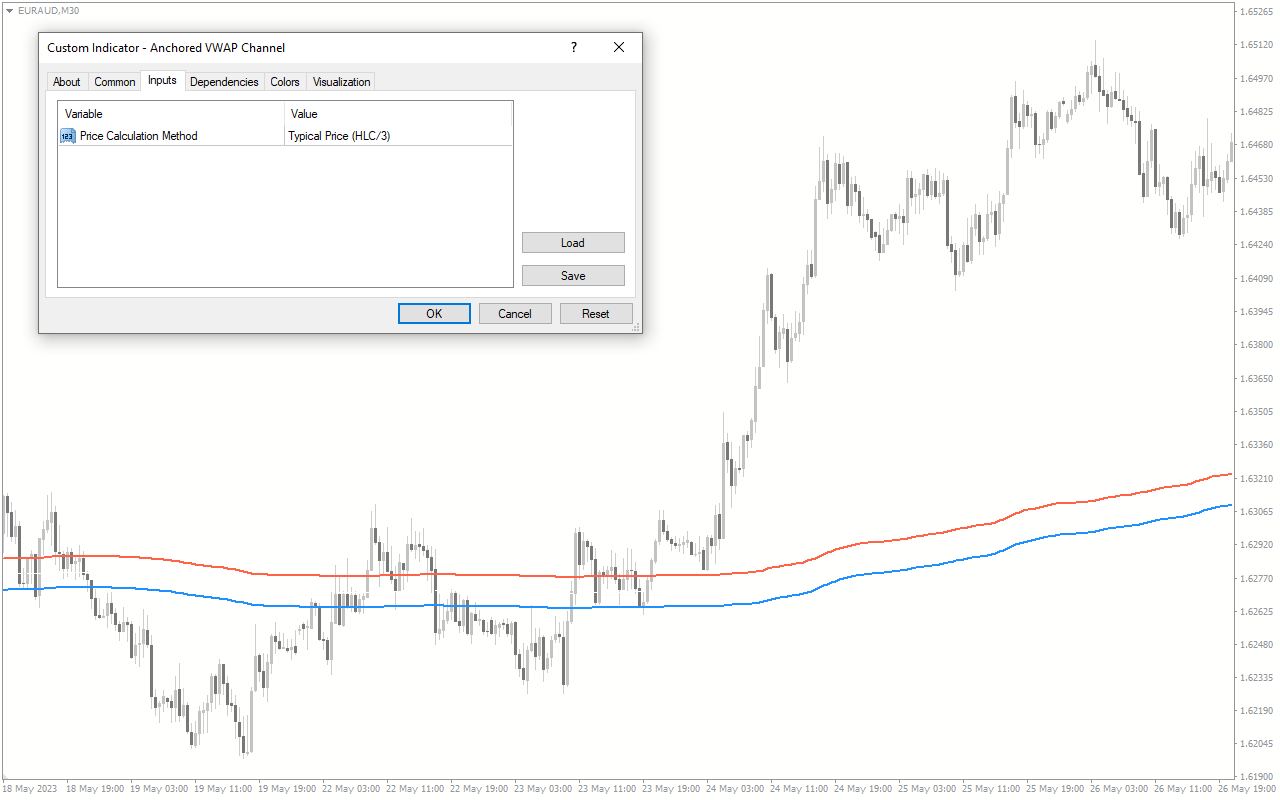

The indicator comes with the following customizable settings:

Price Calculation Method: Determines the method for trend analysis.

Reviews

There are no reviews yet.