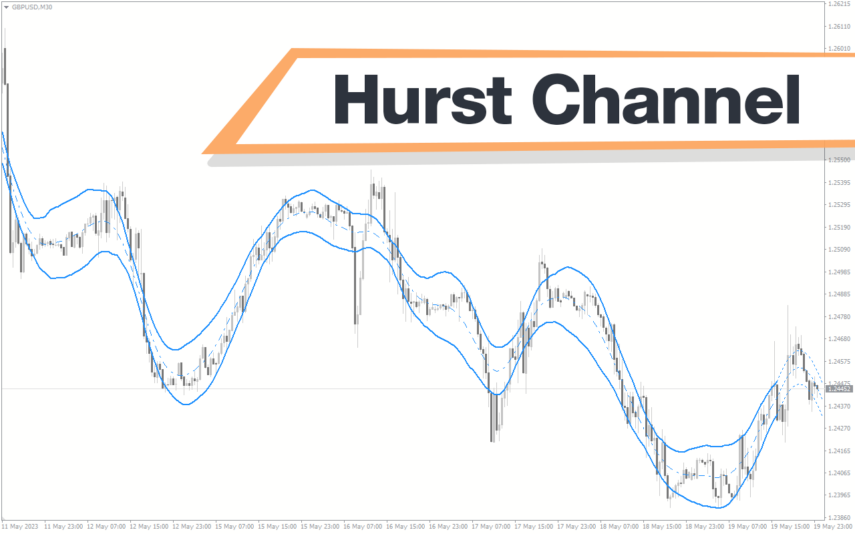

The Cap Channel Trading MT4 indicator is an amazing indicator to identify the overbought and oversold forex price conditions. It employs an advanced envelope theory to identify these extreme conditions. Additionally, it provides alerts at these levels so forex traders can trade the markets profitably.

Features Of Cap Channel Trading MT4 Indicator

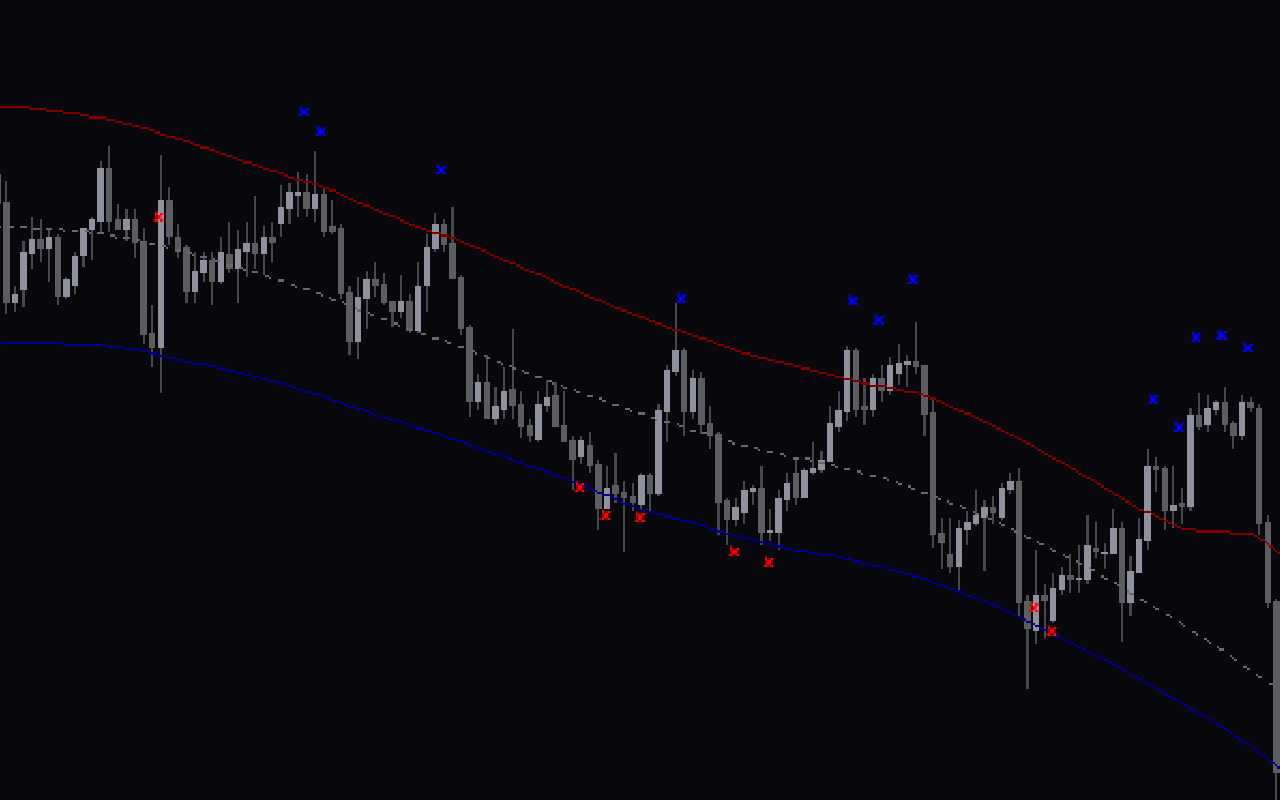

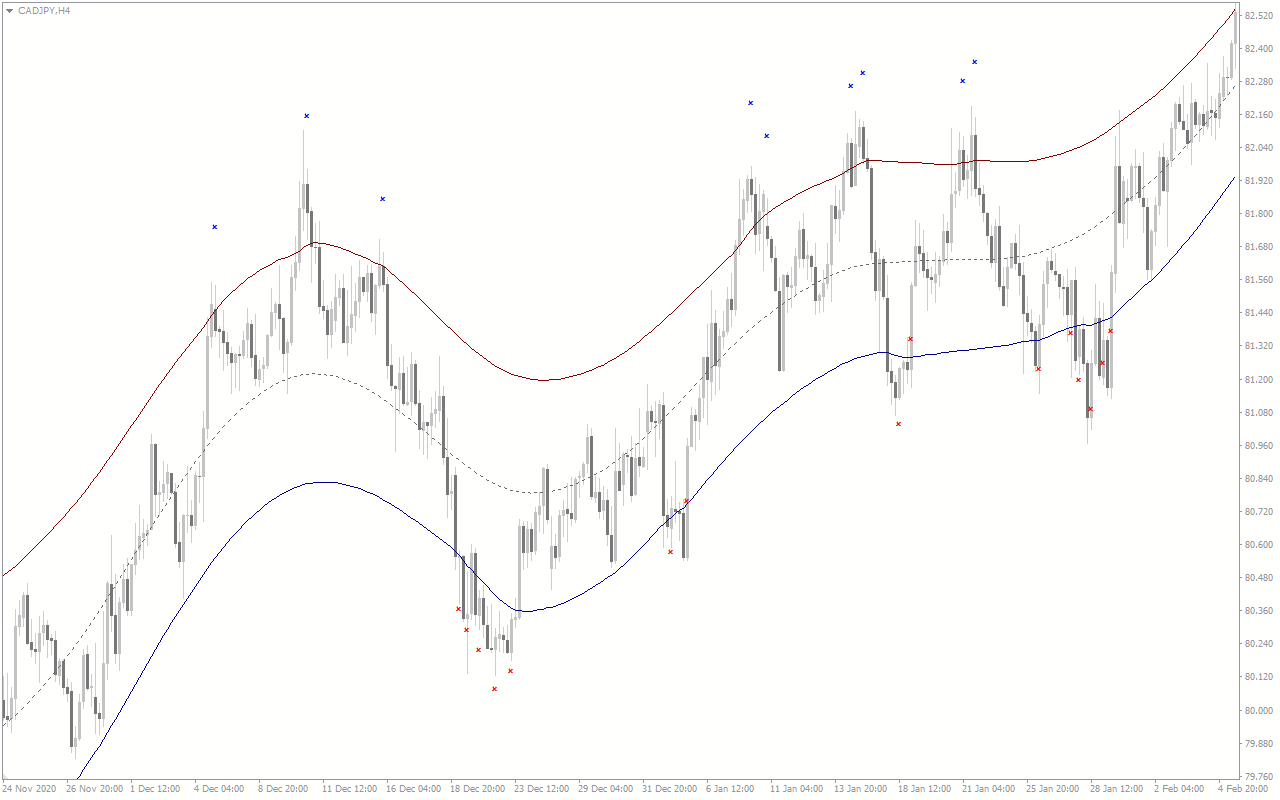

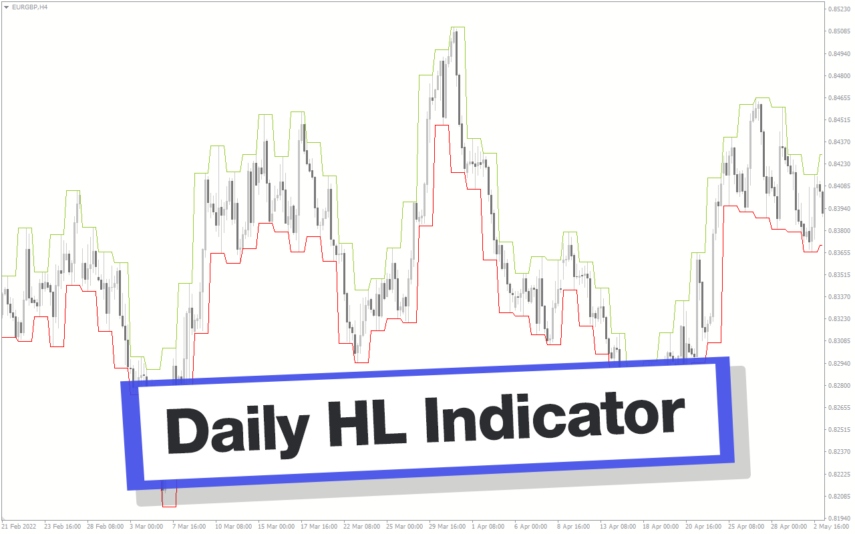

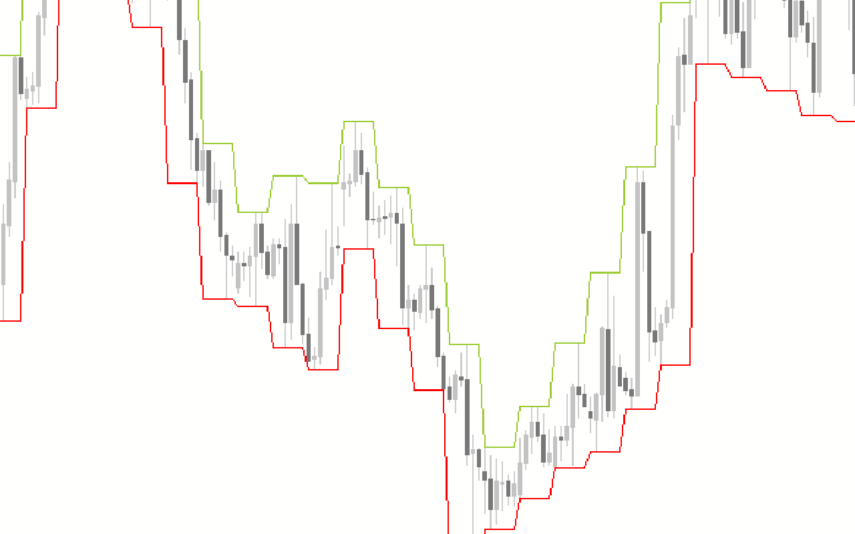

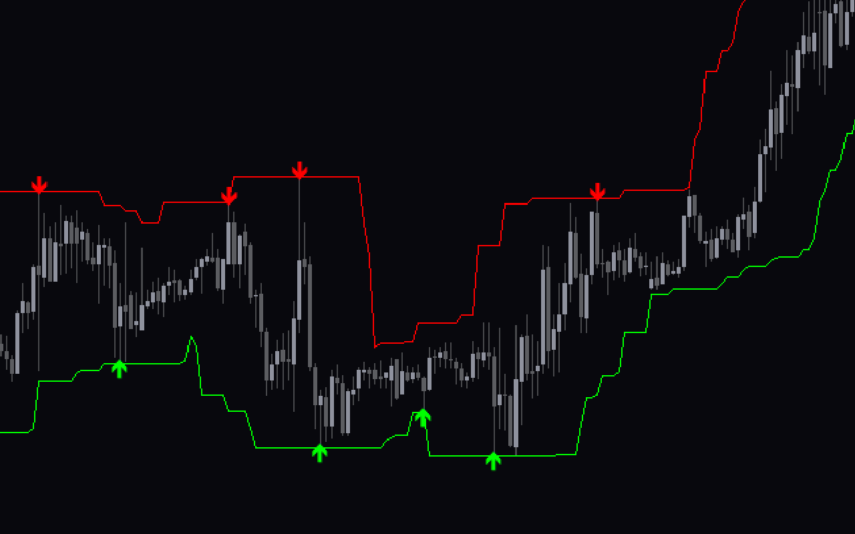

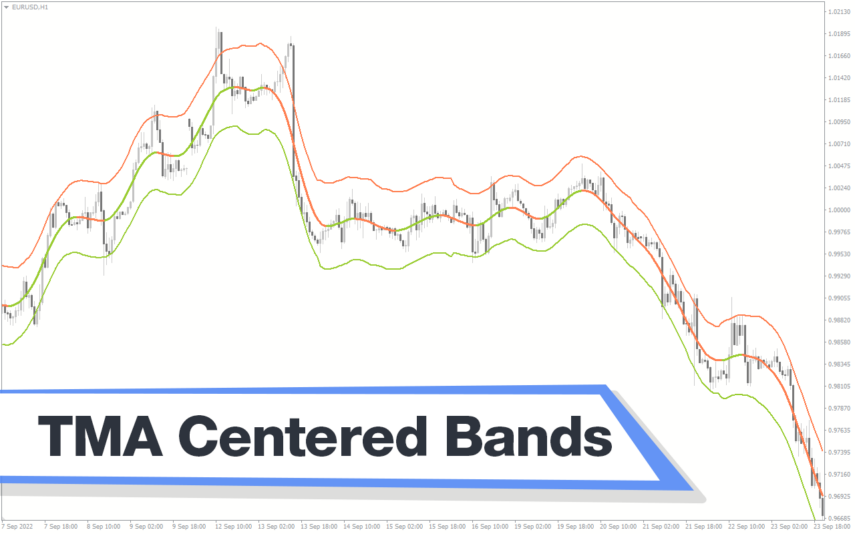

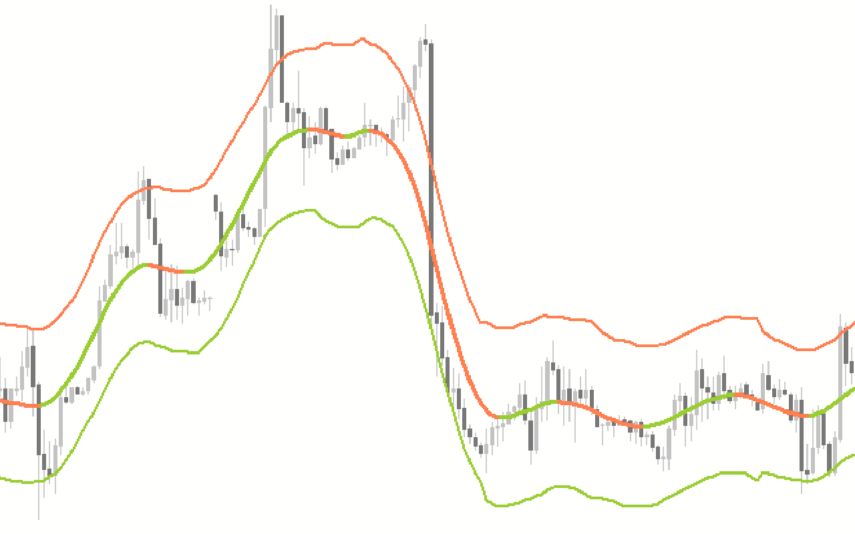

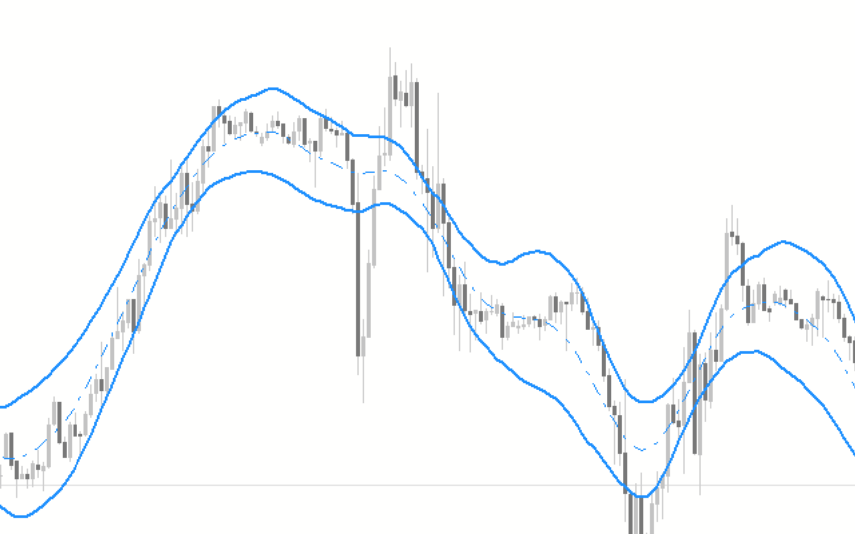

The indicator plots a mid line and upper and lower channels on the price chart. Moreover, it places blue dots if price moves above the upper band and a red dot if price breaches the lower channel. Additionally, it provides alerts so traders can capitalize on every trading opportunity of this forex technical analysis tool.

Generally, price tends to stay between the bands and a breach of the bands is considered overbought or oversold condition and warrants an entry. If price moves above the upper band it is considered overbought so traders should look to open a sell trade. Similarly, if price moves below the lower band and signals an oversold condition, so traders should open a buy position.

Benefits Of Cap Channel Trading MT4 Indicator

Forex traders using oversold and overbought trading strategies to enter and exit the market will benefit the most from this indicator.

The trade signals originate from extreme conditions and tend to be more profitable. So, most traders hold the open positions from upper channel to lower and vice versa.

The indicator adapts according to the price swings and changes the width of the channel to accommodate all market conditions. So it is suitable for all types of forex traders including scalpers, short and long-term forex traders and works well on all chart time frames.

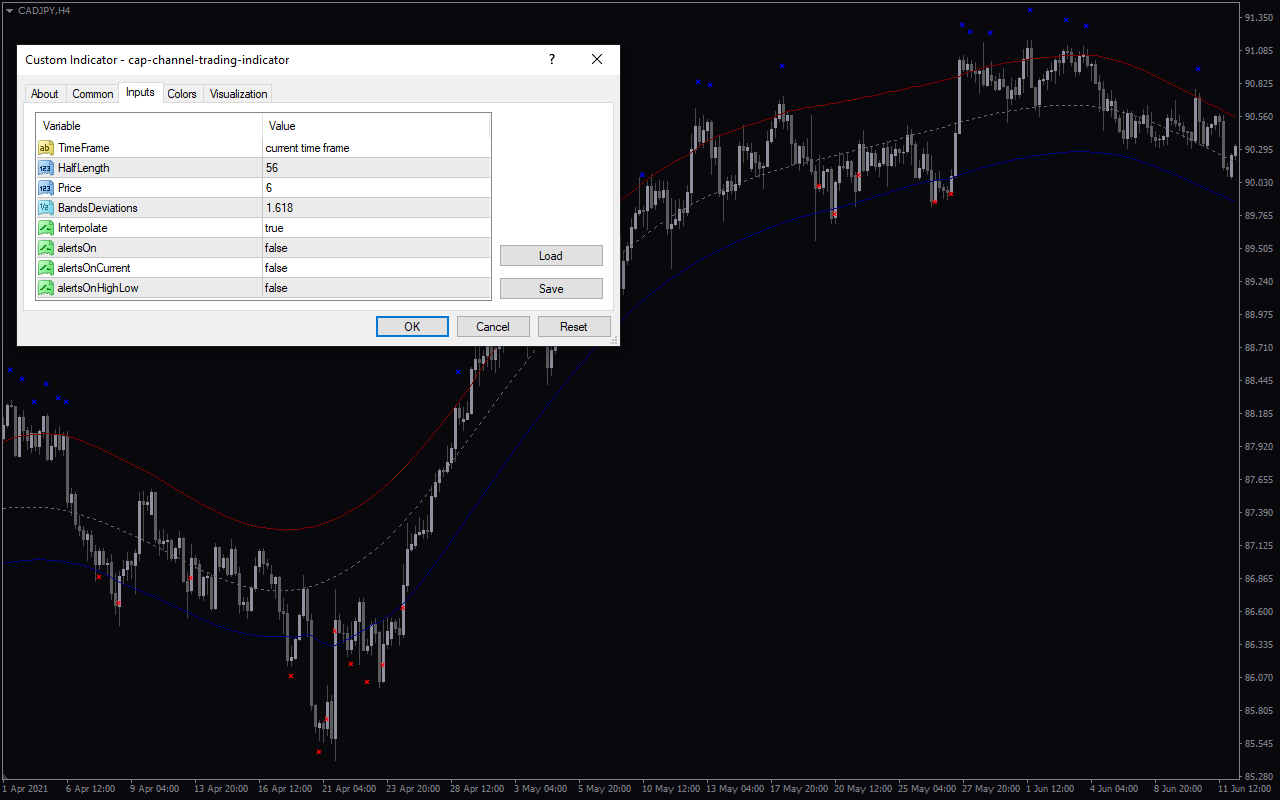

Indicator Settings Description

TimeFrame: Chart time frame for calculation.

HalfLength:, Price:, BandsDeviations:. Interpolate: A change in the value increases or decreases the width of upper and lower band.

alertsOn:, alertsOnCurrent:, alertsOnHigLow: Enables alerts.

Reviews

There are no reviews yet.