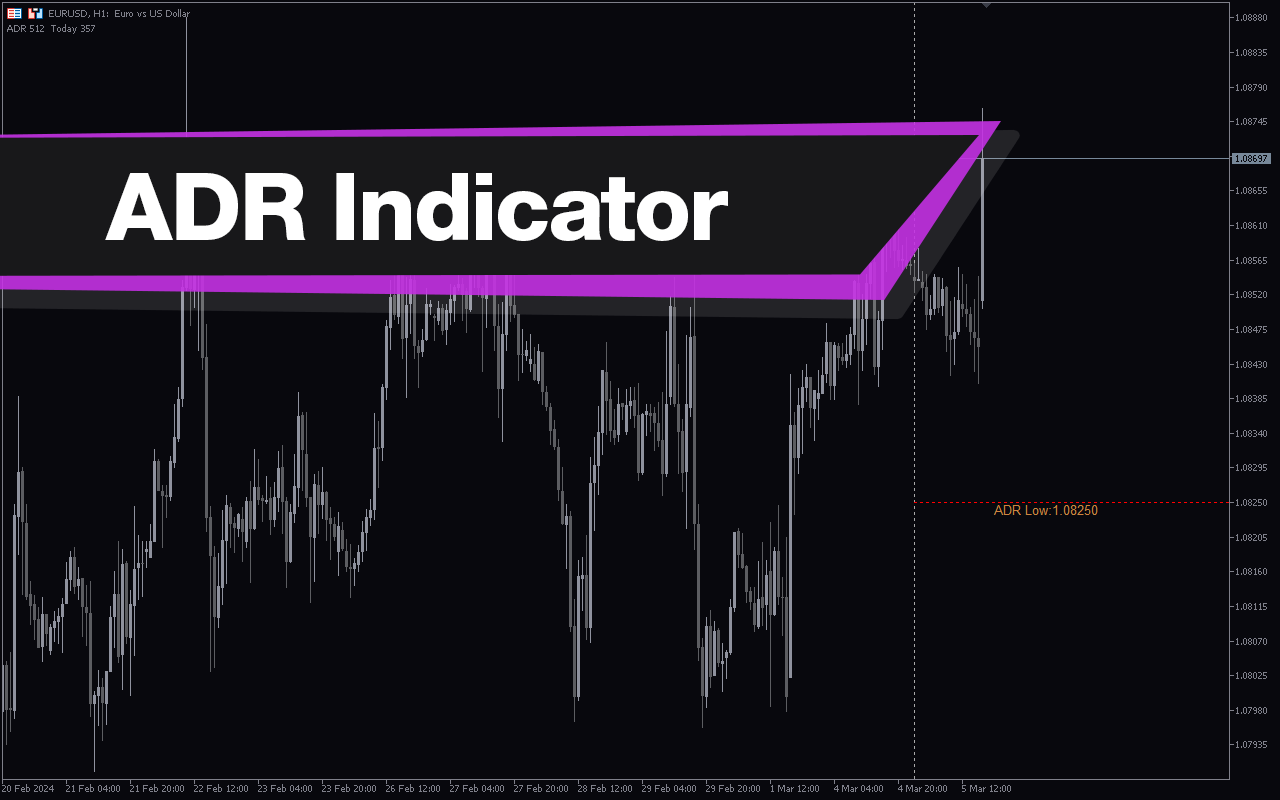

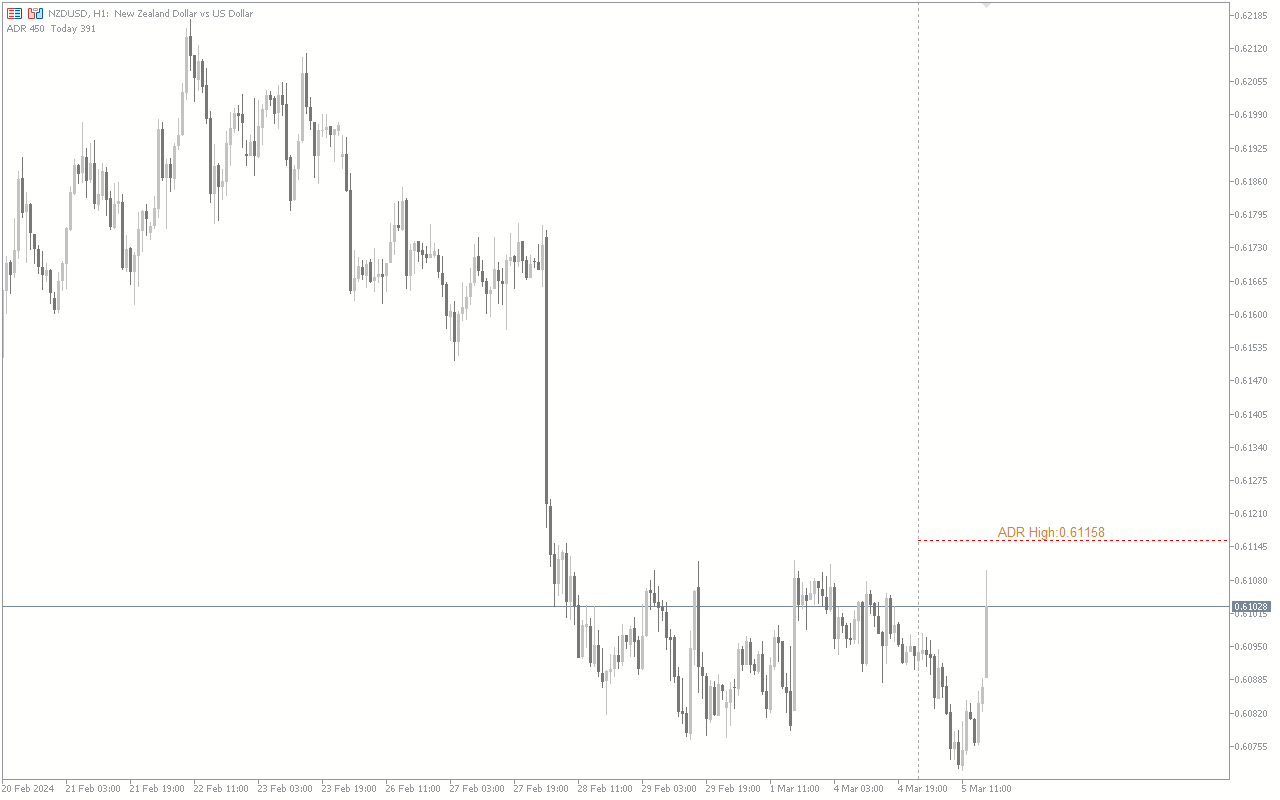

The Daily Average Daily Range (ADR) indicator for MT5 is a tool that measures the daily average price movement of financial instruments. It helps traders in gauging the average range of highs and lows an instrument can move daily.

Therefore, the indicator can be used to make trading projections in line with the average daily limits of a financial instrument of interest. For instance, Forex traders may use the ADR line as a take-profit zone. Thus, this chart-friendly indicator is recommended for scalpers, day/intraday, and swing traders.

Features of the Daily ADR Indicator for MT5

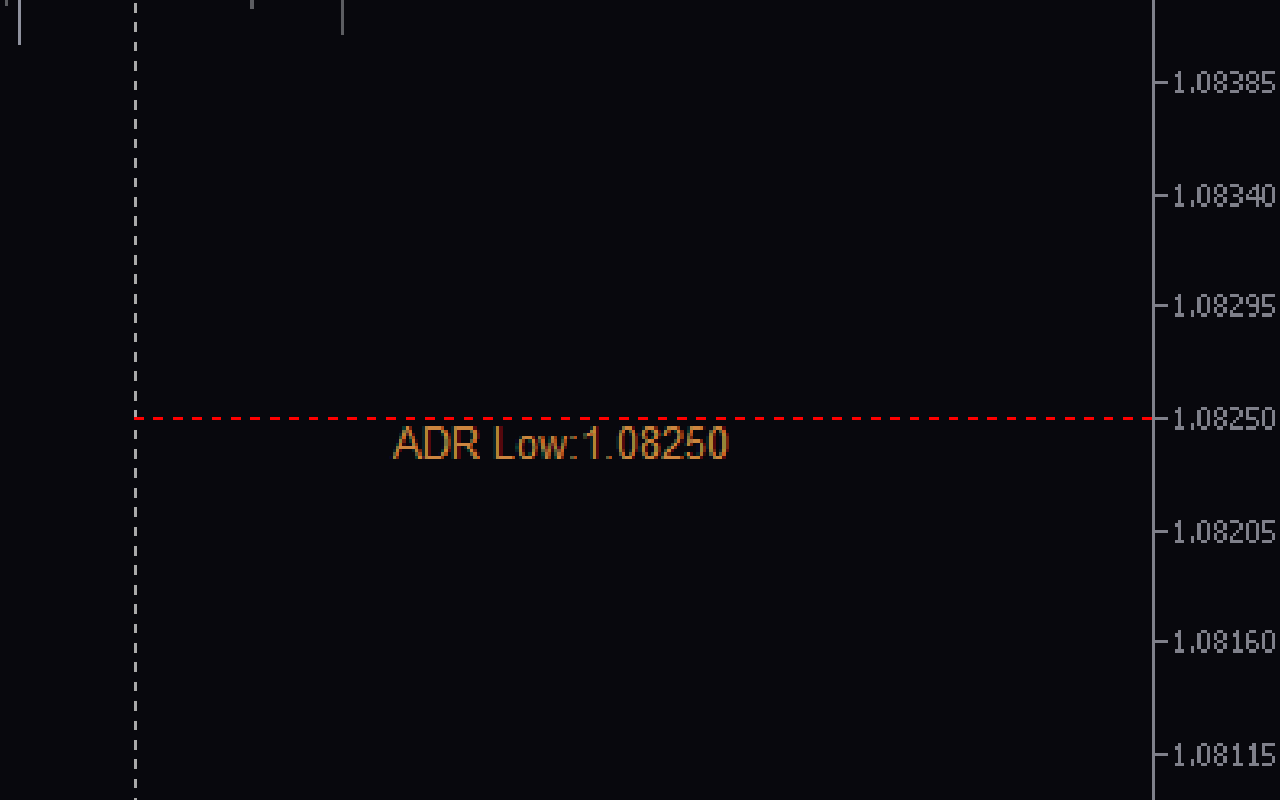

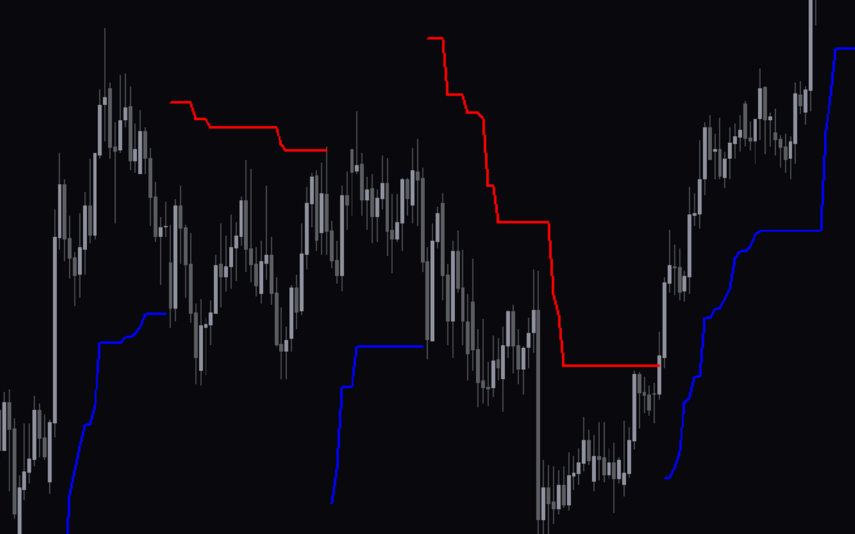

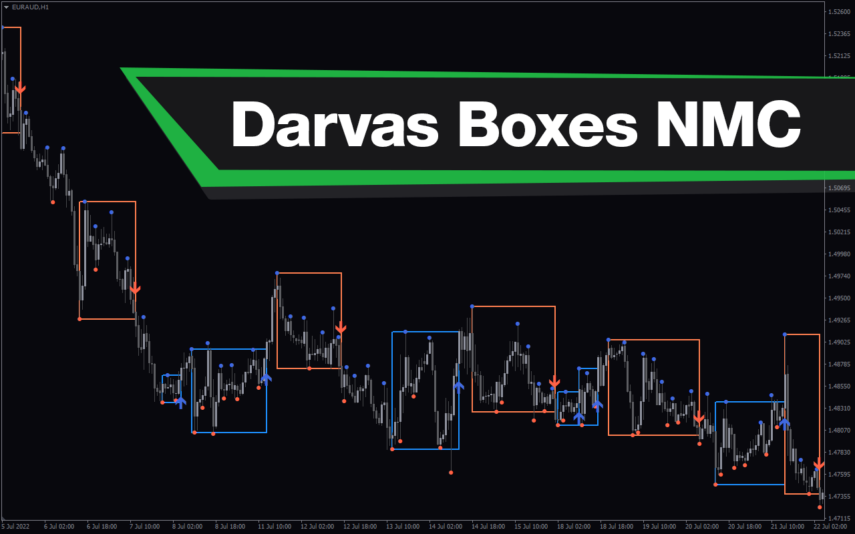

The indicator is a simple tool that plots short horizontal lines that depict the average daily highs and lows ranges of a financial instrument. Besides, it displays the ADR value along with the horizontal lines on the MT5 trading platform. Furthermore, the color of the ADR line changes when the price touches it.

Benefits of Using the Indicator

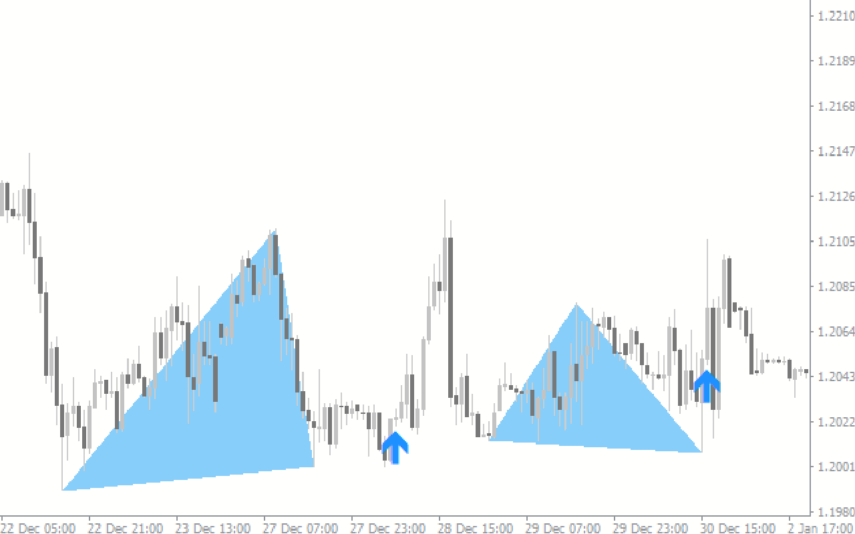

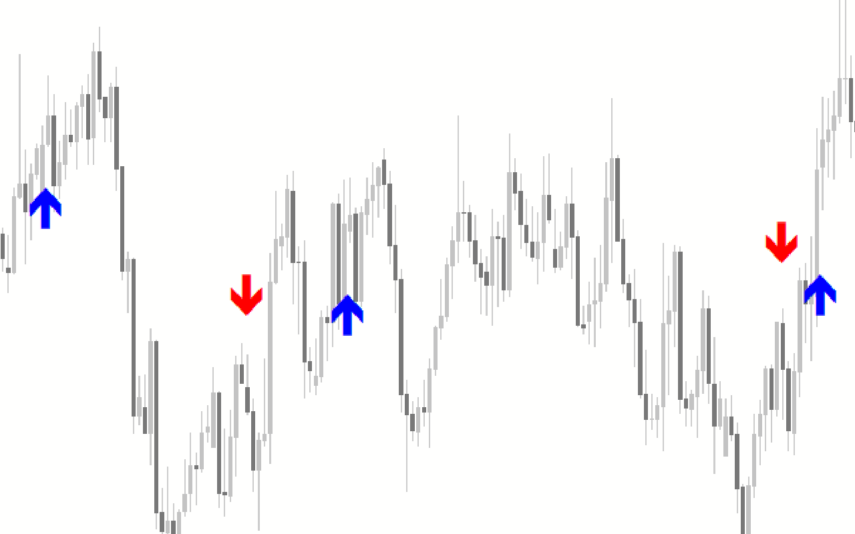

- Trend Reversal Identification: The indicator can be used to identify a potential zone for short-term trend reversal trading opportunities. For instance, scalpers and day traders may look for a selling opportunity when the price shows reversal signs at the ADR high.

- Improves Trading Efficiency: The ADR indicator for MT5 helps traders to identify optimal levels to set realistic targets for take-profits. This can improve success rates and overall trading performance.

Indicator Settings Description

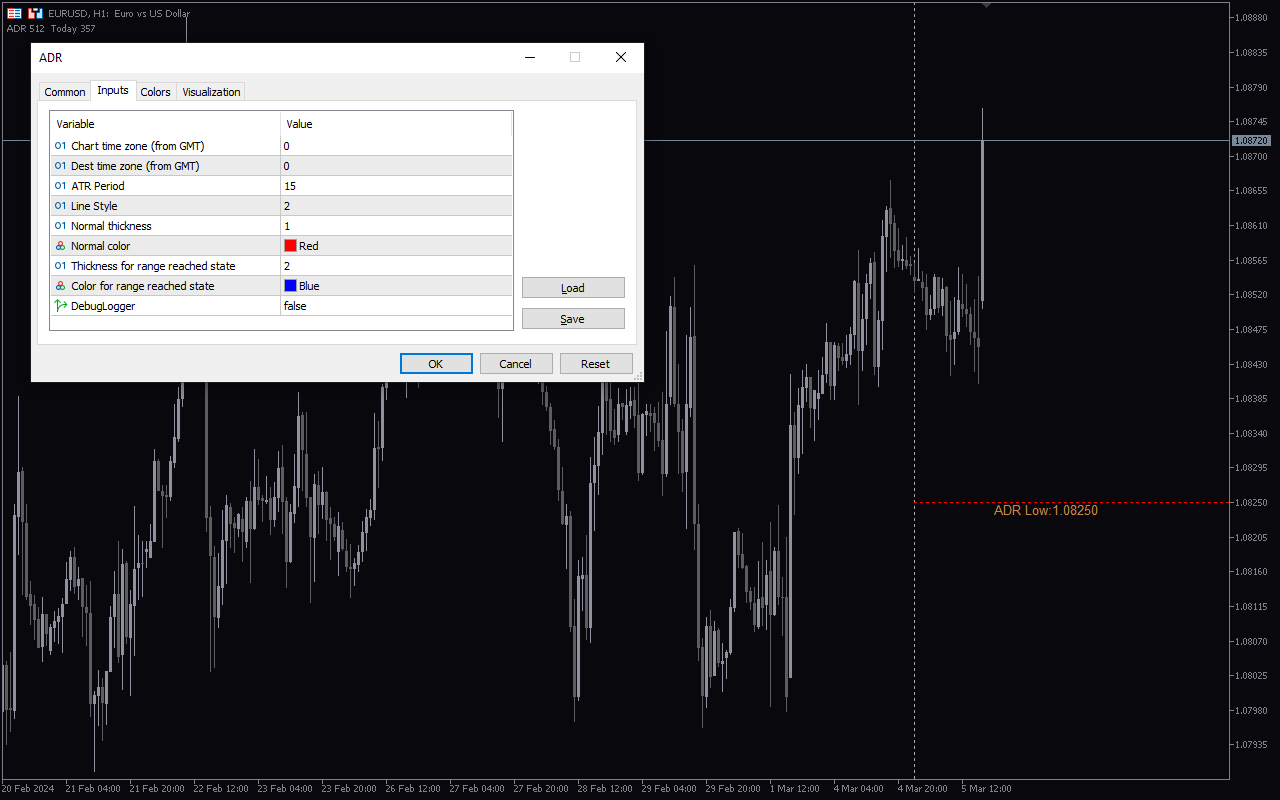

The indicator comes with the following customizable settings:

Chart time zone (from GMT): Define the time zone.

Dest time zone (from GMT): Used to set the time zone.

ATR period: Determines the period for ADR calculation.

Line style: Determines the ADR line style.

Normal thickness: Determines the thickness of the line.

Normal color: Defines the color of the line.

Thickness for range reached state: Defines the thickness of the ADR when the price touches it.

Color for range reached state: Defines the ADR color when the price touches it.

DebugLogger: No impact on the indicator.

Reviews

There are no reviews yet.