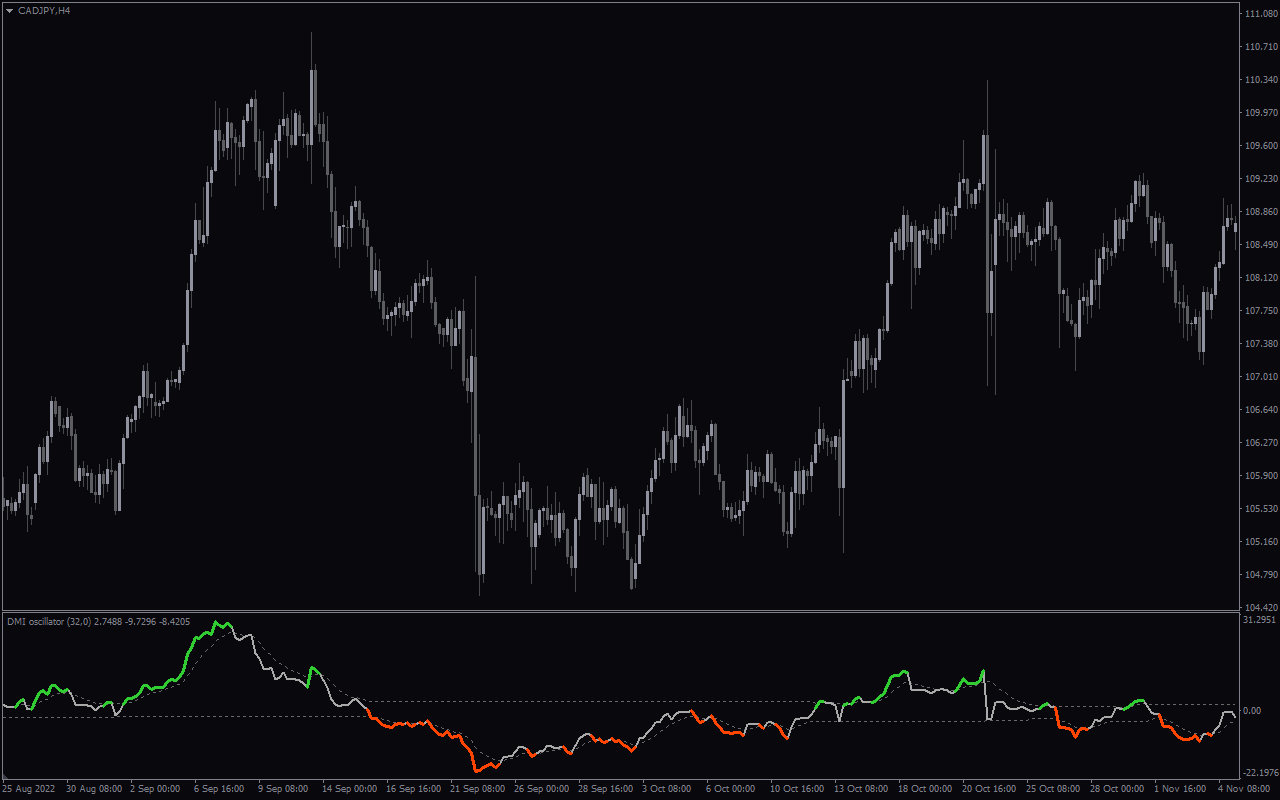

Features of the DMI Indicator

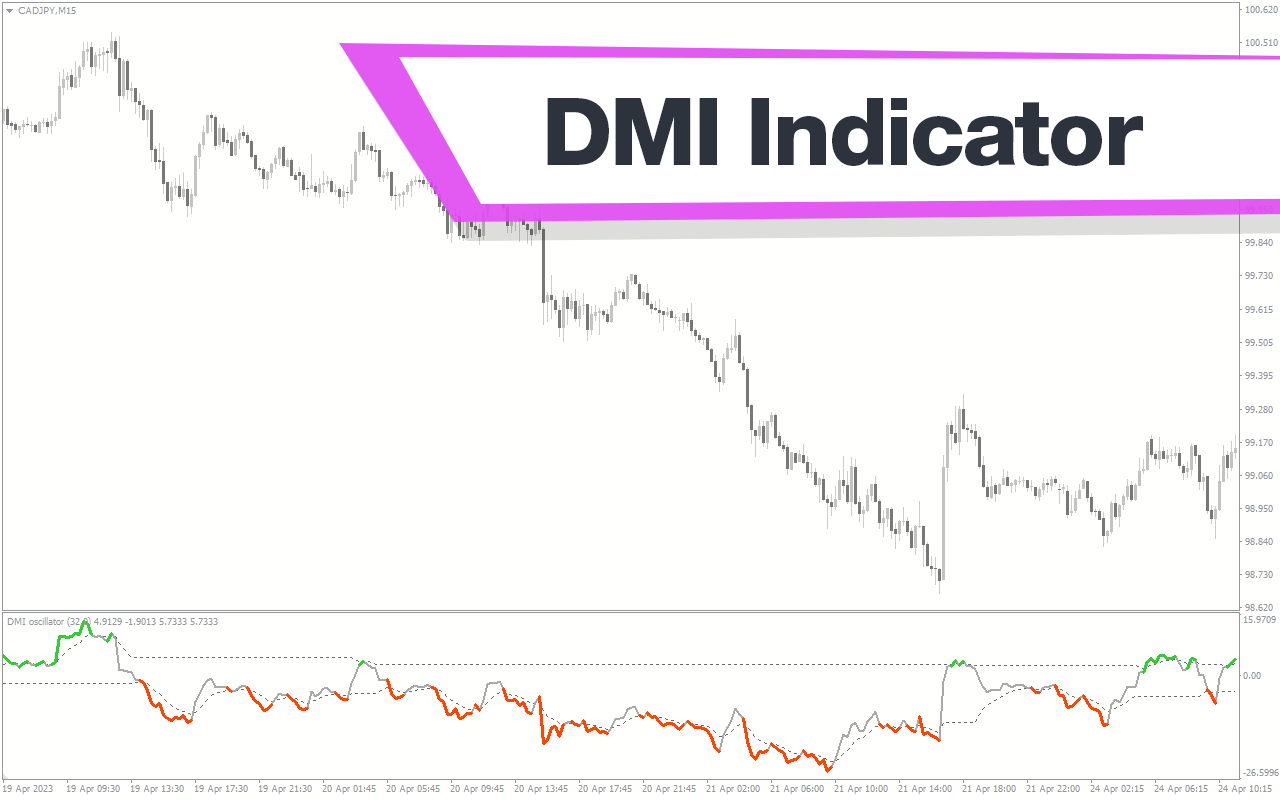

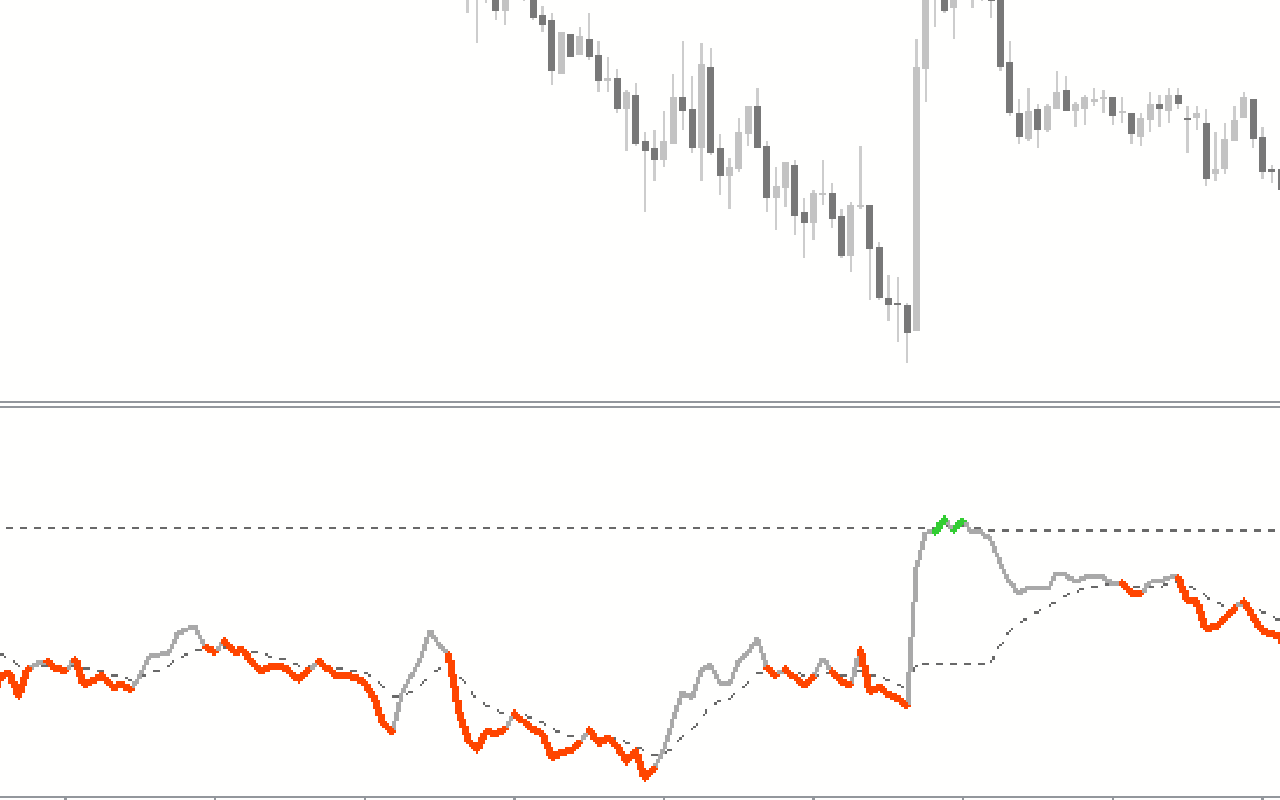

The Directional Movement Index (DMI) is a helpful tool for traders trying to spot patterns and pinpoint entry and exit positions. The positive directional indicator (+DI) and the negative directional indicator (-DI) are the two lines that make up the DMI. The +DI line indicates the strength of the uptrend, while the -DI line indicates the strength of the downtrend. To determine the DMI, compare the difference between a currency pair’s high and low prices over a certain period.

How the Indicator Can Benefit You

Traders can use the DMI to determine the trend’s strength and whether it is bearish or bullish, making it a very useful tool. A trend is bullish if the +DI line is above the -DI line. On the other hand, the trend is bearish if the -DI line is above the +DI line. Another way you can use the DMI is to locate possible trade entry and exit points. The trend is weakening if the +DI and -DI lines are near one another, and traders should look for breakout entry or exit positions during this time.

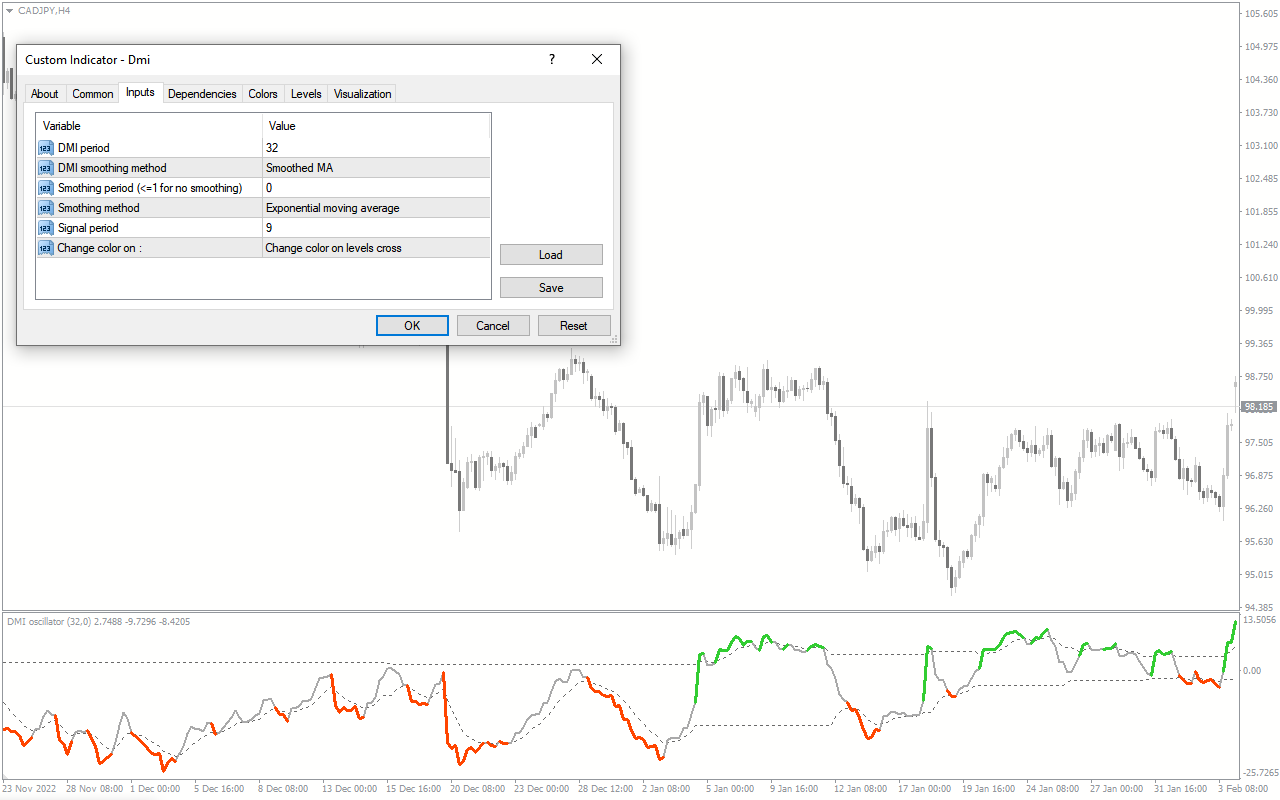

Indicator Setting Description

Below are the indicator inputs that you can change to your specifications.

DMI period: This input allows you to change the analysis period on the last x bars.

DMI smoothing method: This input shows the method. You can choose exponential, weighted, or simple as well.

Smoothing period: This input enables you to change the smoothing period. By default, it’s zero for no smoothing.

Signal period: It indicates the analysis period on the last x bars. Increasing the number gives fewer signals.

Change color: This input lets you choose the color changes when the indicator value goes above or below the zero line.

Reviews

There are no reviews yet.