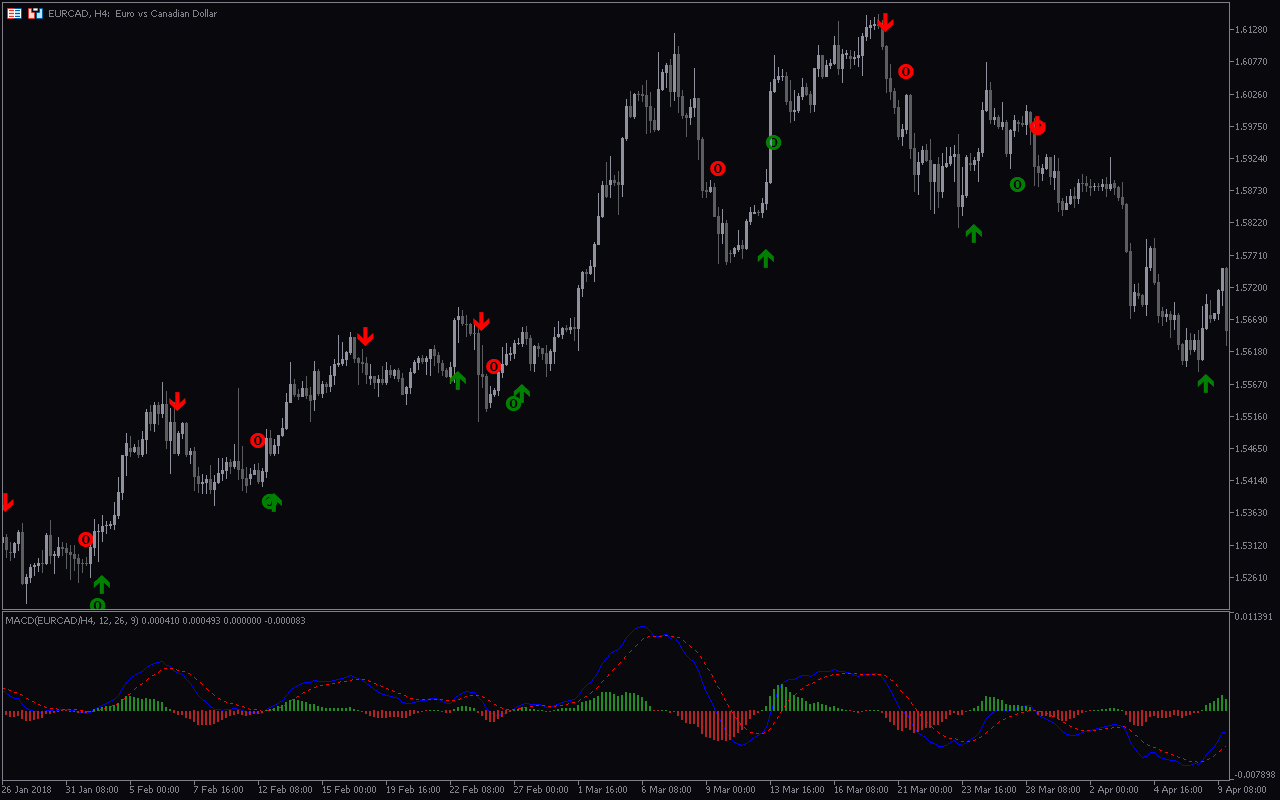

The MACD True Alert indicator for MT5 is a customized version of the traditional MACD indicator available on the MetaTrader platforms. This version generates buy and sell signal entries for financial trading instruments on the MetaTrader 5 platform. Besides, it notifies traders of buying and selling opportunities in the market.

What is the MACD indicator in MT5?

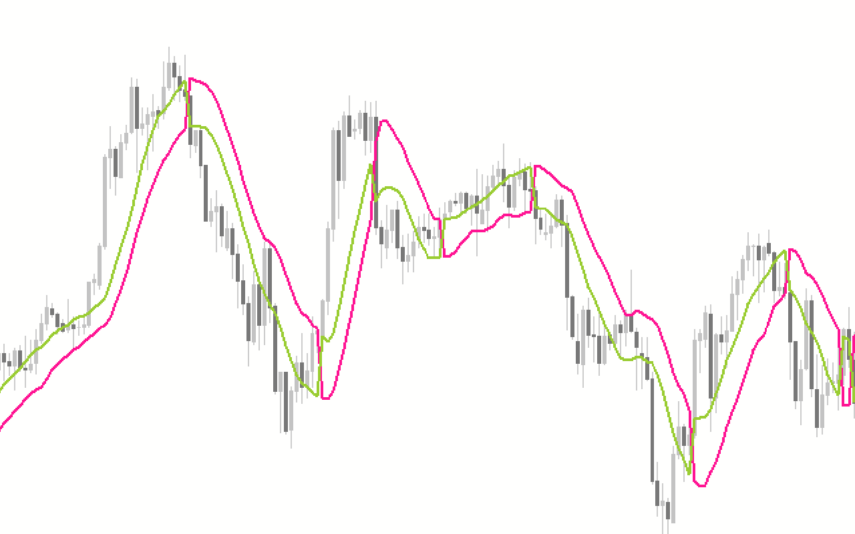

The MACD (Moving Average Convergence Divergence) indicator in MT5 is a momentum-based financial trading tool that detects potential trends and directions in the market. It suggests buying/selling opportunities when the moving averages of different periods cross to the upside/downside.

However, the regular MACD indicator doesn’t display arrows as signals for buying or selling entries, which makes it somewhat of a hassle to identify a confirmed signal. Therefore, this version of the indicator (MACD True Alert indicator for MT5) was developed to improve the original MACD, thereby increasing its efficiency and suitability for beginners and advanced traders.

Features of the MACD True Alert Indicator for MT5

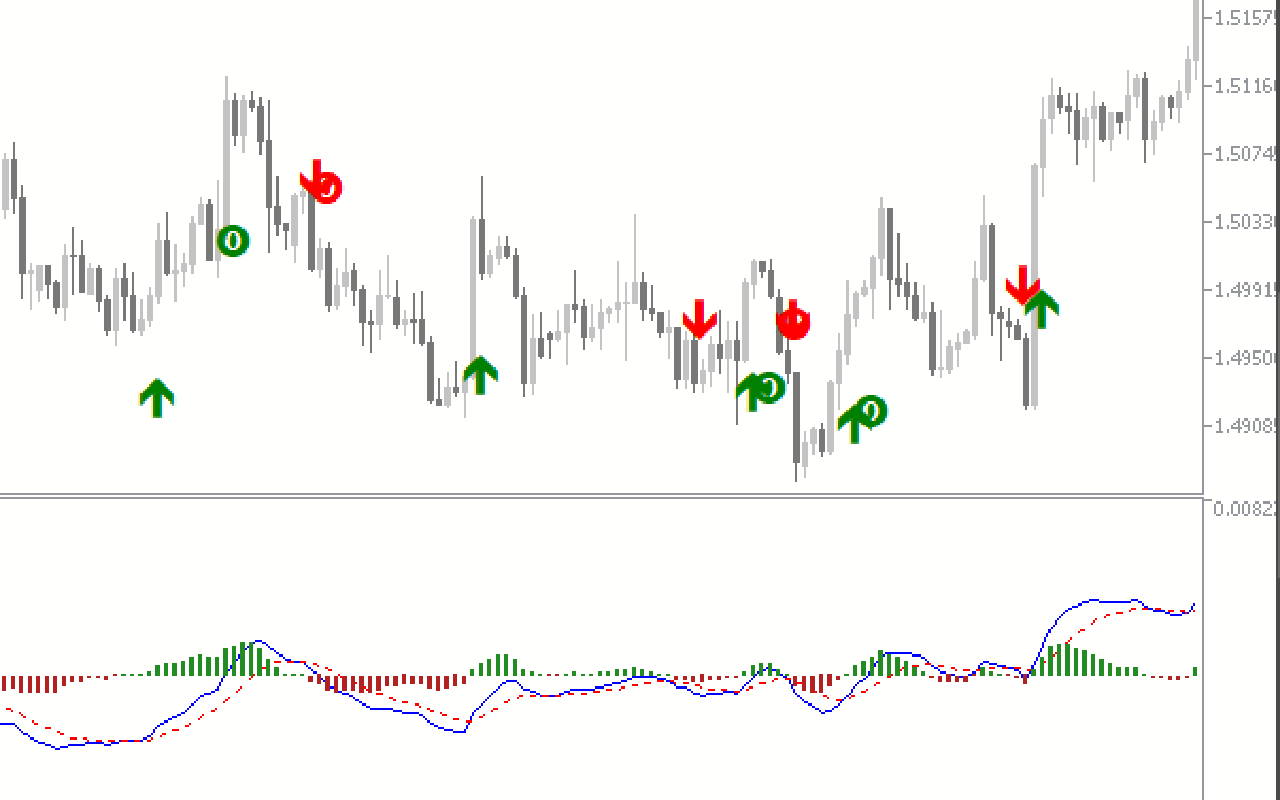

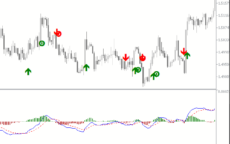

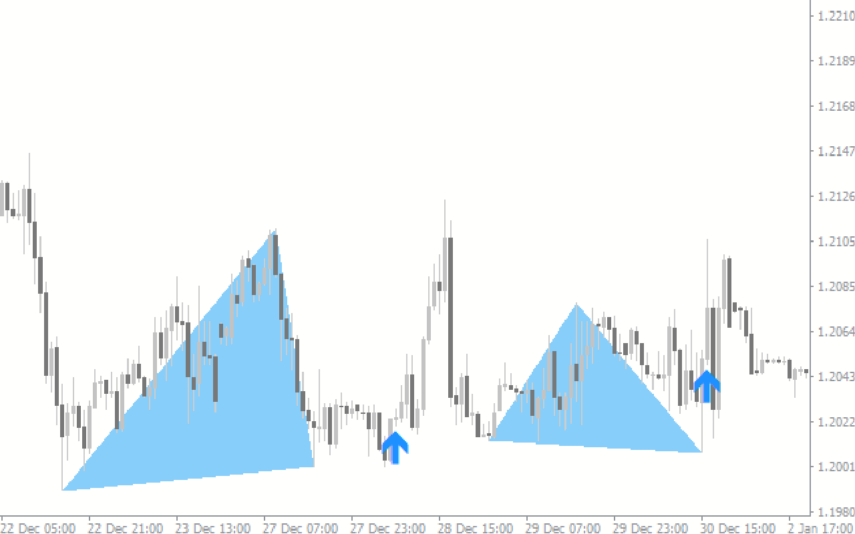

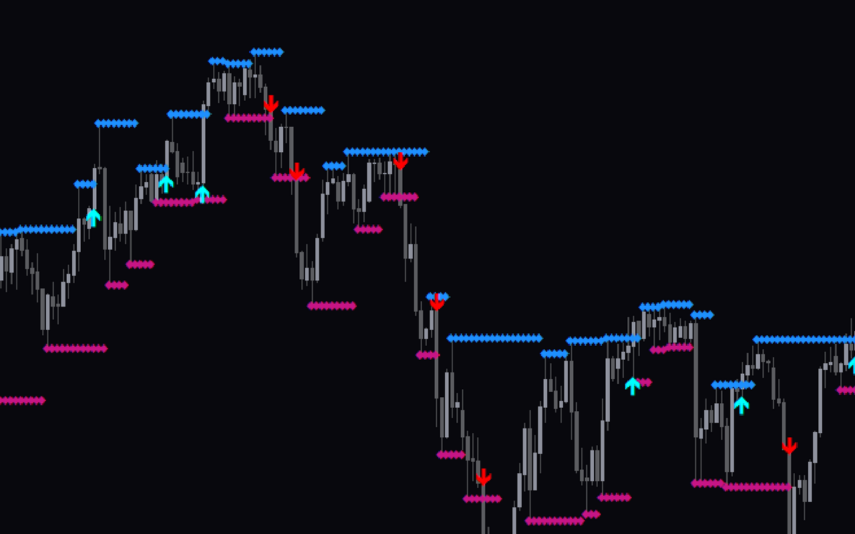

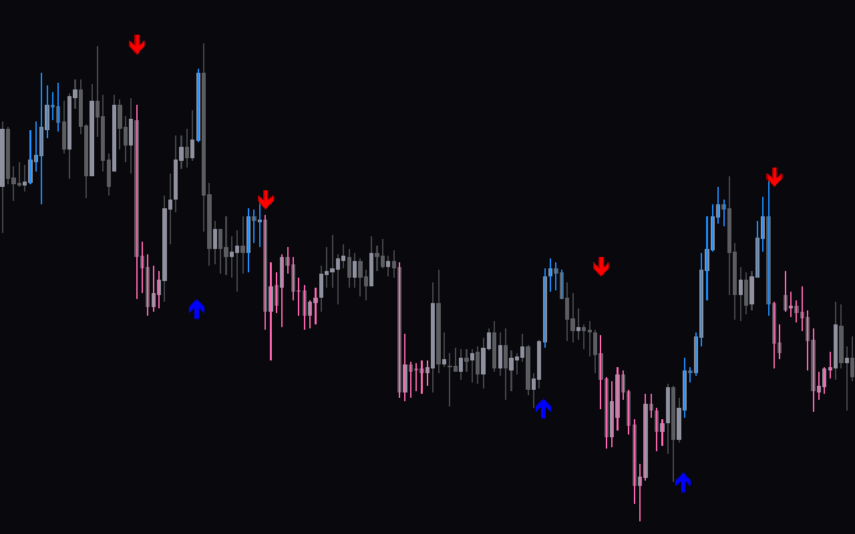

The indicator displays buy/sell signals using green and red arrows and dots. It paints the signal arrows/dots when the fast-moving average line crosses above/below the slow-moving average or when the moving average crosses above/below the zero line.

Additionally, the indicator has an alert system that notifies traders when there is a confirmed crossover, which implies a buying or selling opportunity. Furthermore, the indicator allows users to customize the parameters to their trading preferences.

Benefits of Using the Indicator

- Accurate Signal Generation: The MACD True Alert indicator for MT5 generates and displays confirmed buy/sell trading signals, which makes it suitable for beginners and advanced traders.

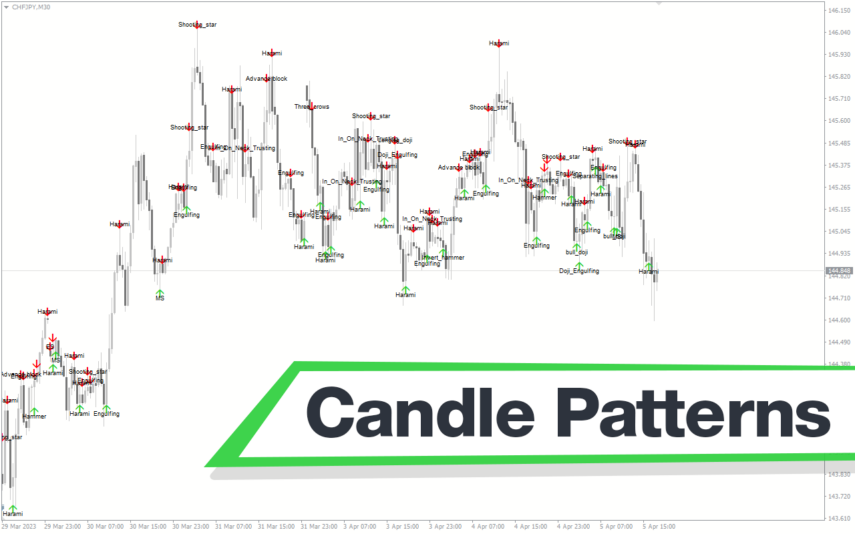

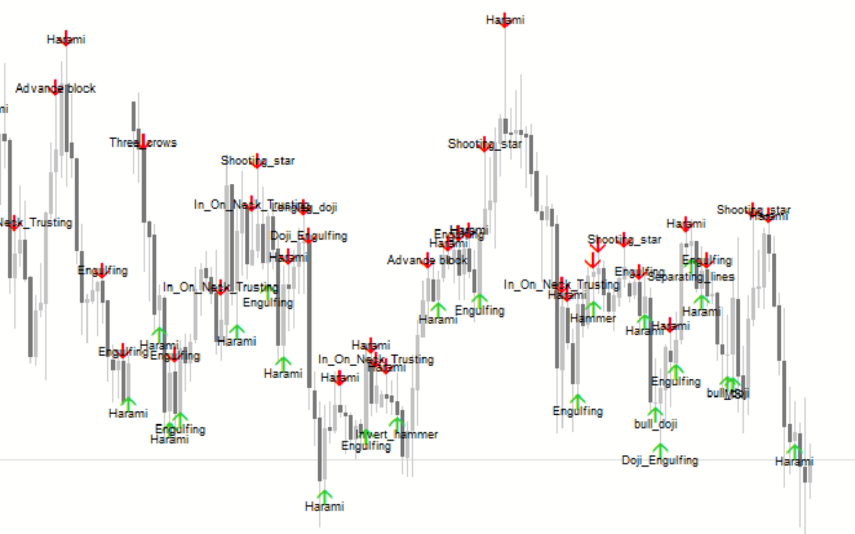

- Improves Trading Decisions: The indicator can serve as an incredible confluence with price action/other technical indicators to identify a high-probability trade setup, improving trading proficiency.

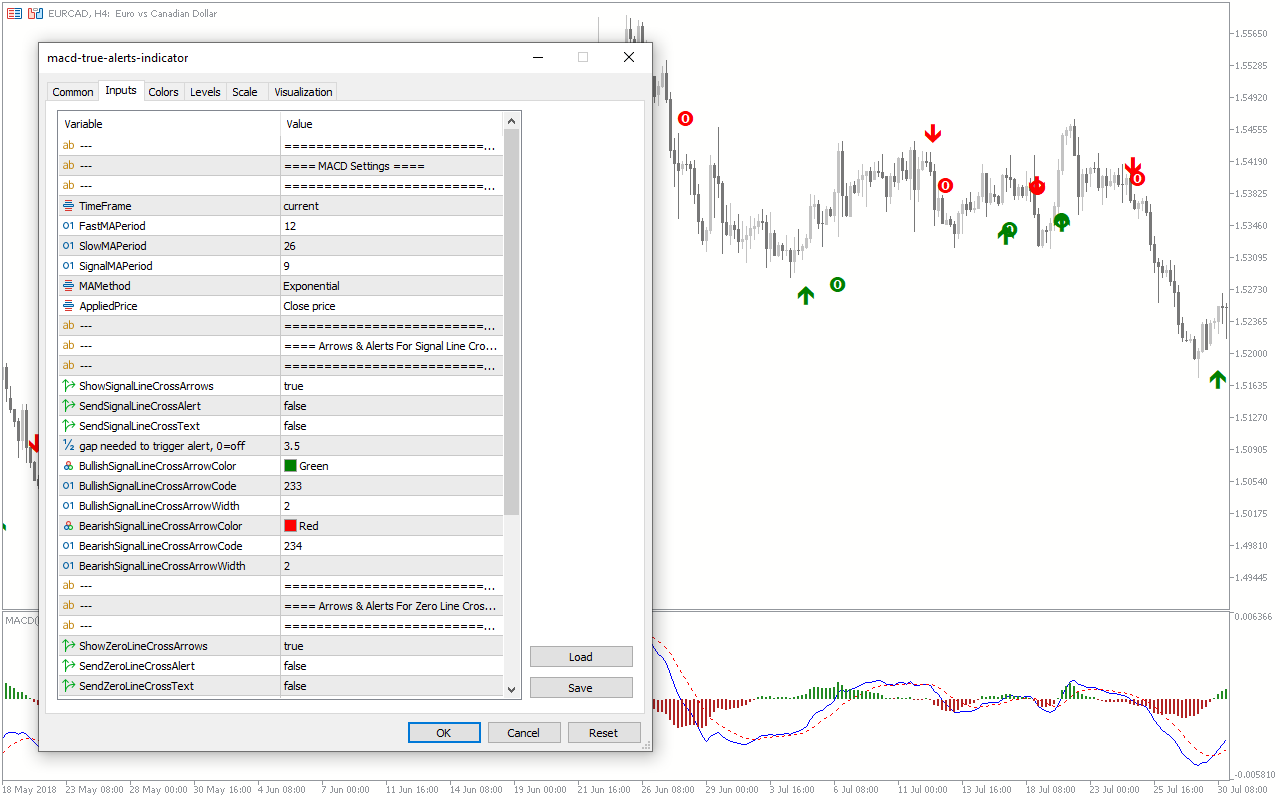

Indicator Settings Description

The indicator comes with the following customizable settings:

Timeframe: Determine the timeframe for analysis.

FastMAPeriod: Period of the fast-moving average.

SlowMAPeriod: Period for the slow-moving average.

SignalMAPeriod: Period for signal moving average.

MAMethod: Determines the method for calculating the moving average.

ShowSignalLineCrossArrows: Displays arrows for signal crosses.

SendSignalLinecrossAlert: Sends alerts for signal line crosses.

SendSignalLinecrossText: Send text for signal line crosses.

½ gap needed to trigger alert, 0=off: Maximum gap to trigger alerts.

BullishSignalLineCrossArrowColor: Defines the arrow color for bullish signal line crosses.

BullishSignalLineCrossArrowCode: Determines the arrow shape for bullish signal line crosses.

BullishSignalLineCrossArrowWidth: Defines the arrow width for bullish signal line crosses.

BearishSignalLineCrossArrowColor: Determines the arrow color for bearish signal line crosses.

BearishSignalLineCrossArrowCode: Determines the arrow shape for bearish signal line crosses.

BearishSignalLineCrossArrowWidth: Determines the arrow width for bearish signal line crosses.

ShowZeroLineCrossArrows: Display arrows for zero line crosses.

SendZeroLineCrossAlert: Send alerts for zero line crosses.

SendZeroLineCrossText: Send text for zero line crosses.

½ gap needed to trigger an alert, 0=off: Minimum gap required to trigger the alert for zero line crosses.

BullishZeroLineCrossArrowColor: Determines the arrow color for bullish zero line crosses.

BullishZeroLineCrossArrowCode: Determines the arrow shape for bullish zero line crosses.

BullishZeroLineCrossArrowWidth: Determines the arrow width for bullish zero line crosses.

BearishZeroLineCrossArrowColor: Determines the arrow color for bearish zero line crosses.

BearishZeroLineCrossArrowCode: Determines the arrow shape for bearish zero line crosses.

BearishZeroLineCrossArrowWidth: Determines the arrow width for bearish zero line crosses.

01 ATR PeriodArrows: Determines the period for the ATR.

½ ATRMultiplierArrows: Determines the multiplier for the ATR calculation.

Reviews

There are no reviews yet.