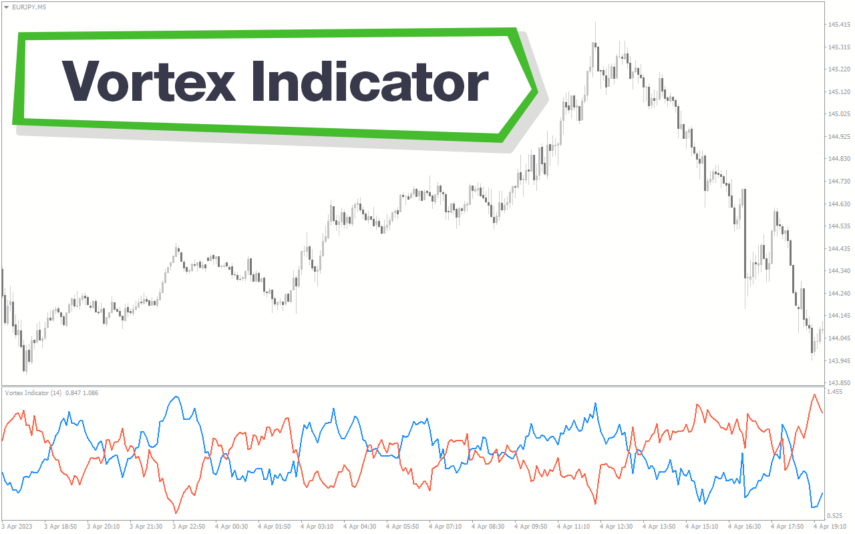

The Trend CCI (Commodity Channel Index) indicator for MT5 is an improved version of the traditional CCI indicator available on the MetaTrader platform. It is built with extra features and optimized to interpret the market condition with better accuracy.

The indicator can be used to identify trend reversal and direction of the market. Therefore, it is a suitable trading tool for scalpers, day/intraday, and swing Forex traders.

How to trade with CCI?

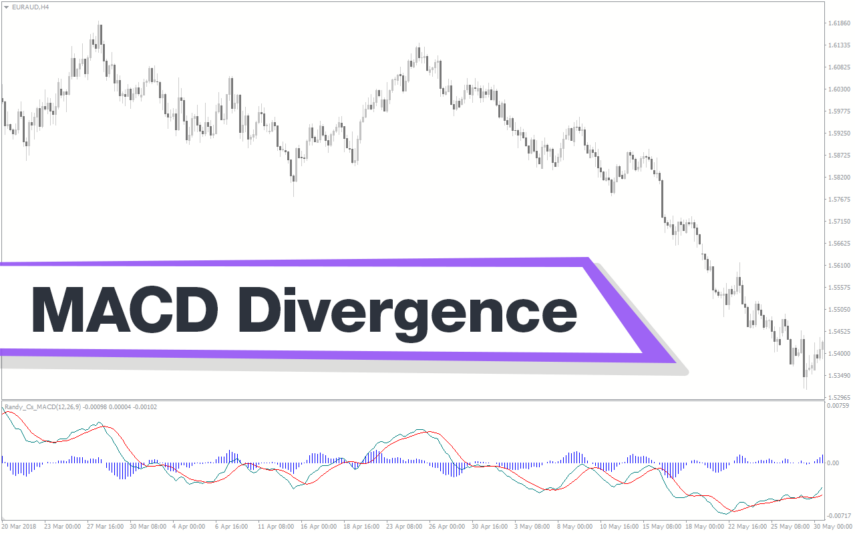

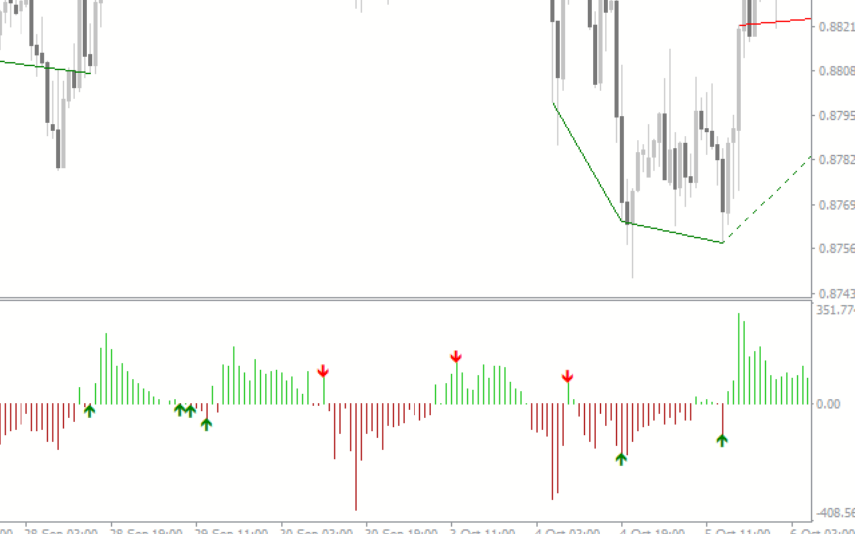

The CCI indicator can be used to identify trading opportunities when it forms a divergence with the price. So, traders may look for a buy entry when the indicator forms a bullish divergence with the price and sell when it forms a bearish divergence. Another way to trade with the CCI indicator is to look for buying or selling opportunities at the oversold/overbought zone of the indicator.

Features of the Trend CCI Indicator for MT5

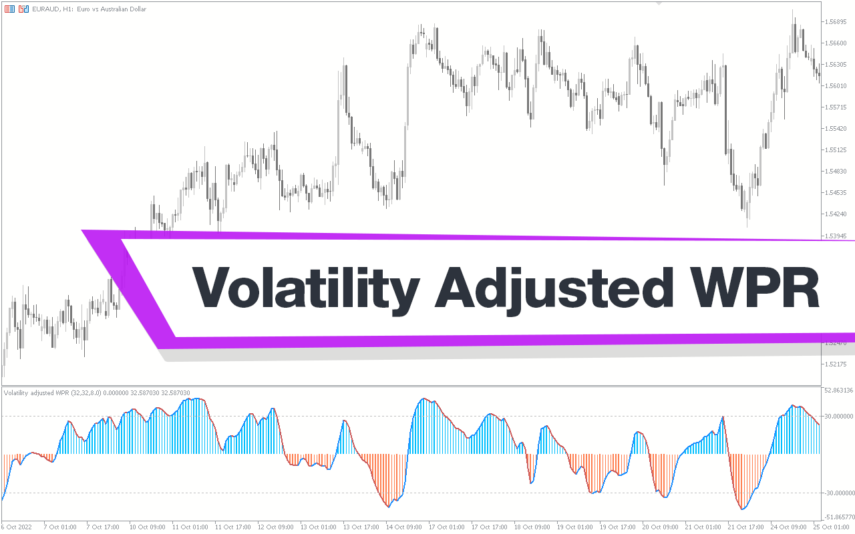

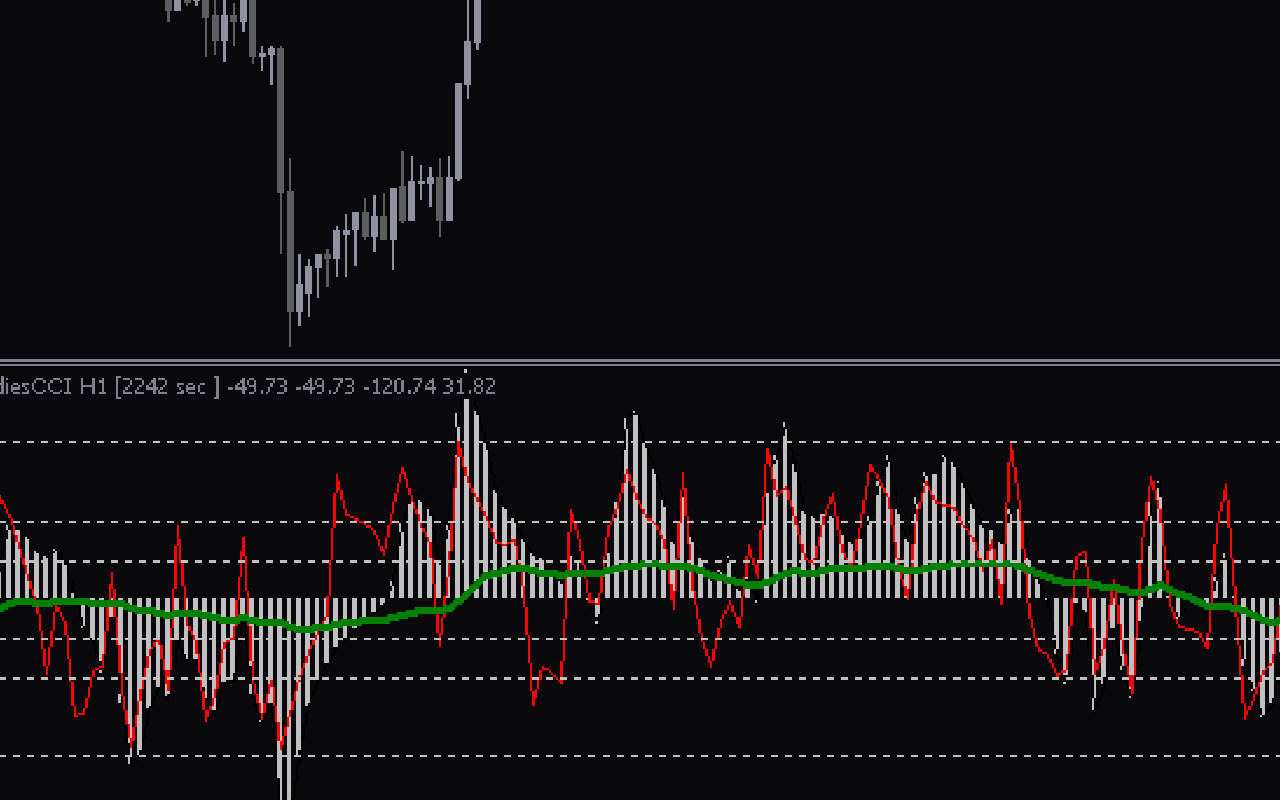

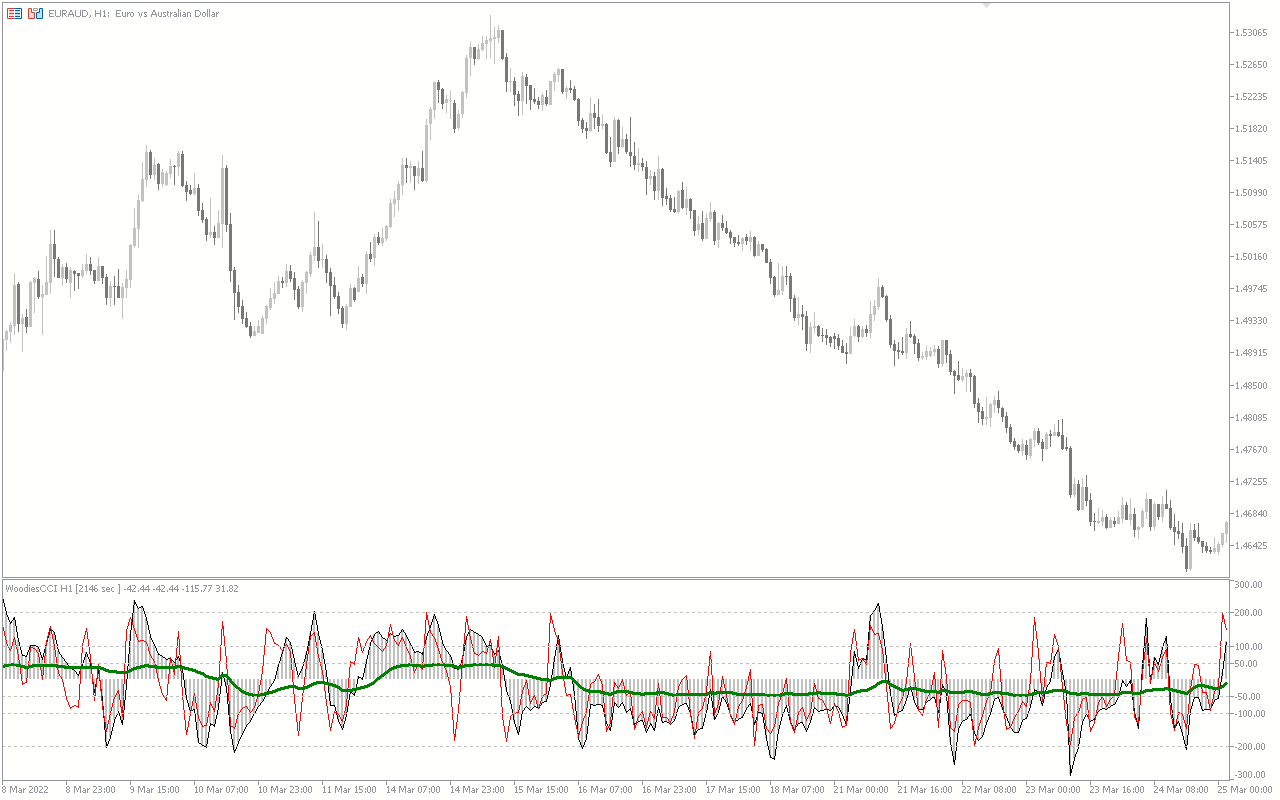

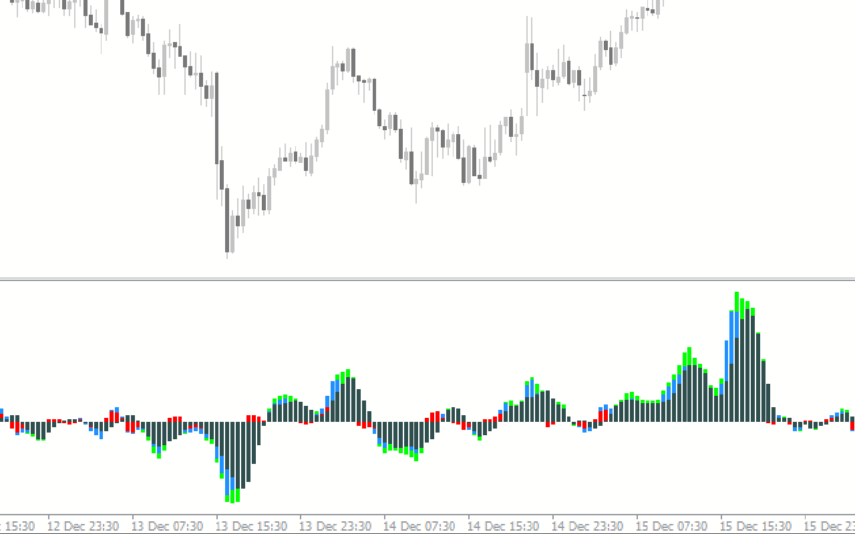

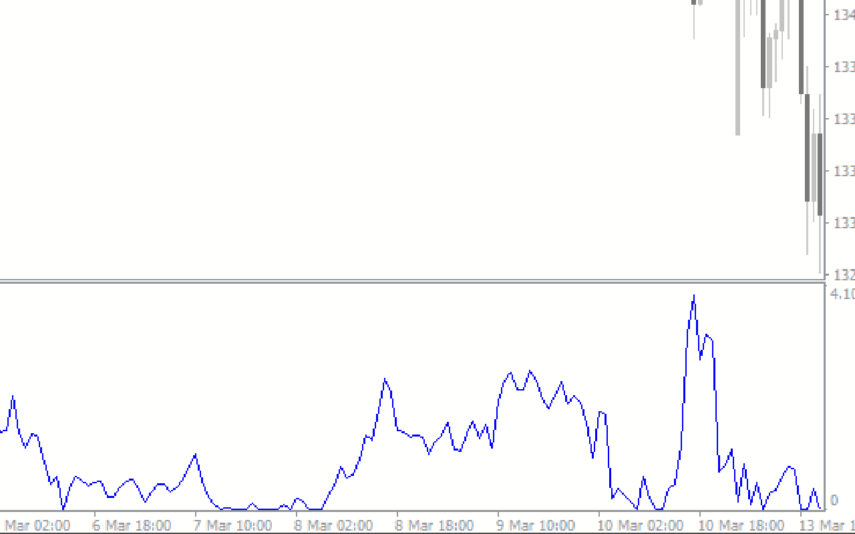

The indicator is built with the moving averages of different periods, histogram bars, and Least Squares Moving Average (LSMA). It operates within a range of +200 and -200, which depict overbought and oversold zones, respectively.

Furthermore, the histogram bars of the indicator show the prevailing momentum of the price. It signals bullish momentum when the bars are above the centerline, while bearish momentum is when the histogram bars are below the line.

Benefits of Using the Indicator

- Detects Overbought/Oversold zones: The indicator detects extreme zones in the market where the price may change direction, thereby enabling traders to anticipate trading opportunities at the overbought/oversold regions.

- Trend Confirmation/Confluence: The indicator can also be used as a supporting tool with price action to confirm potential trend reversal setups.

Indicator Settings Description

The indicator comes with the following customizable settings:

Time period: Determines the time to start the analysis.

Slow CCI: Determines the period of the slow CCI indicator.

Fast CCI: Determines the period of the fast CCI indicator.

Period LSMA: Determines the period of the Least Squares Moving Average (LSMA).

Bar of change of a trend: Defines the number of bars for a trend change.

How many bars: Determines the maximum bars for trend analysis.

Reviews

There are no reviews yet.