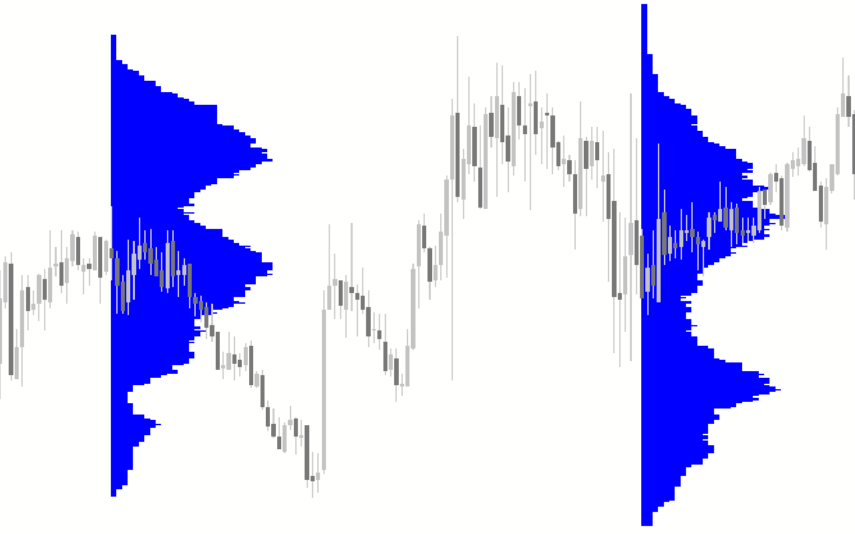

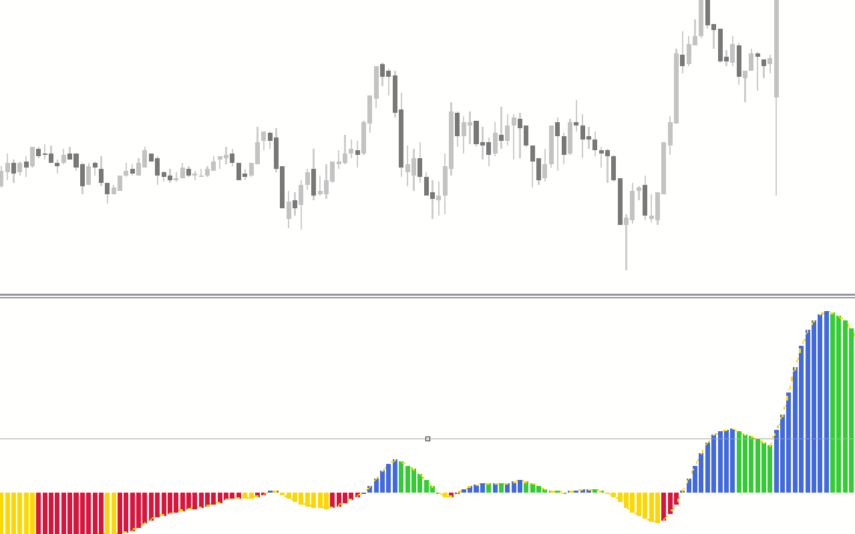

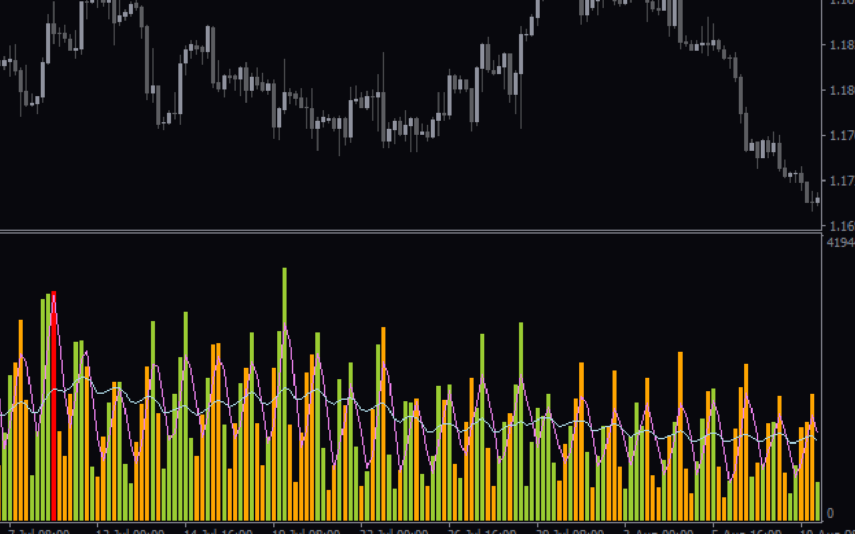

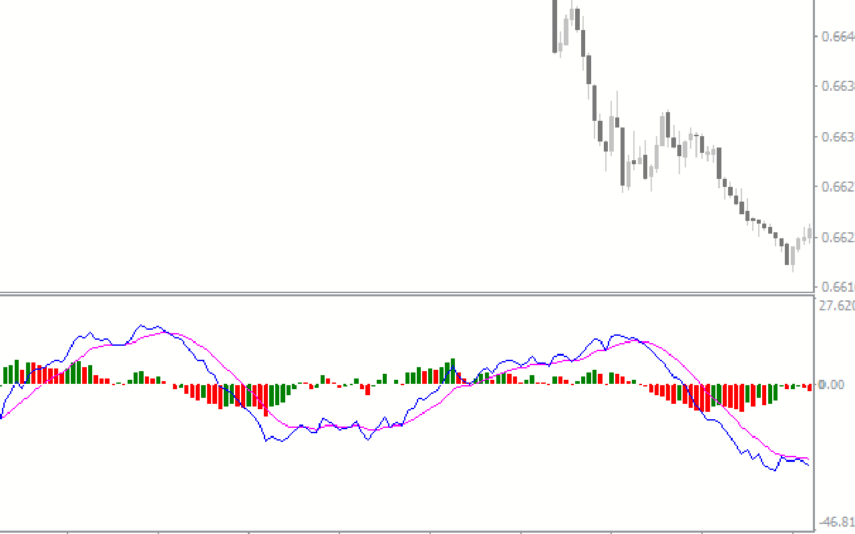

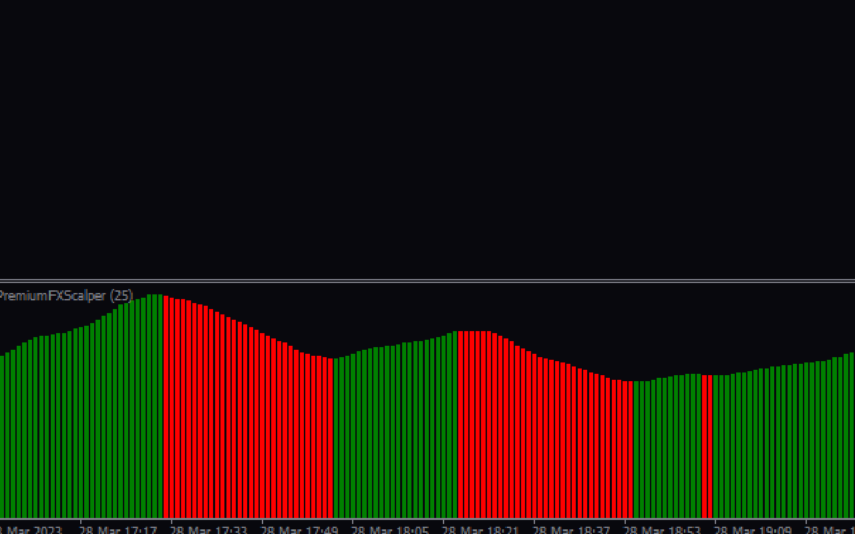

The Uni Volume Delta Indicator for MT4 is a volume-based trend analysis indicator that determines the volume turnover of an instrument in a trading session. It plots candlestick-like bars on a separate window below the chart. The bars depict the overview of the differences in the buying and selling volume of an instrument.

Essentially, the indicator compares the trading volume of the sellers and buyers to give traders insight into who dominates the market at a particular time. Thus, a market dominated by buyers would likely keep trending to the upside (bullish), while one dominated by sellers would trend to the downside (bearish).

Therefore, traders can use this indicator to interpret the trend condition of an asset to know if it is bullish or bearish to make informed trading decisions. However, it is required for traders to use it in conjunction with price action/other technical indicators before making a trade decision.

Features of the Indicator

The candlestick-like bar depicts the volume of the uptrend, downtrend, and neutral (no volume) trend conditions. The green bars show the trade volume for buyers in the market, while the red bars represent the trade volume for sellers in the market.

Furthermore, the indicator supports multiple time frame analyses, which enables it to display the trade volume of buyers’ and sellers’ trade across all timeframes. In addition, the indicator’s parameter settings are open for customization for traders to adjust to suit their trading style.

Benefits of Using the Indicator

- Trend Reversal Confirmation: The indicator displays the strength or weakness of buyers and sellers in the market. Therefore, traders can corroborate the signals with price action/other indicators to confirm a potential trend reversal.

- Detects the Potential End of a Trend: The indicator can also help a trader identify the potential end of a bullish or bearish trend. It signals the possibility of the end of a bullish trend when there is a drastic drop in buyer/seller volume.

- Risk management: Finally, the indicator is also a good risk management tool to help forex traders manage their trades efficiently. A scalper or day trader holding a buy/long position, for instance, may take profit, break even, or trail a stop loss when the indicator shows signs of depletion in volume, especially when the price is close to a support/resistance zone.

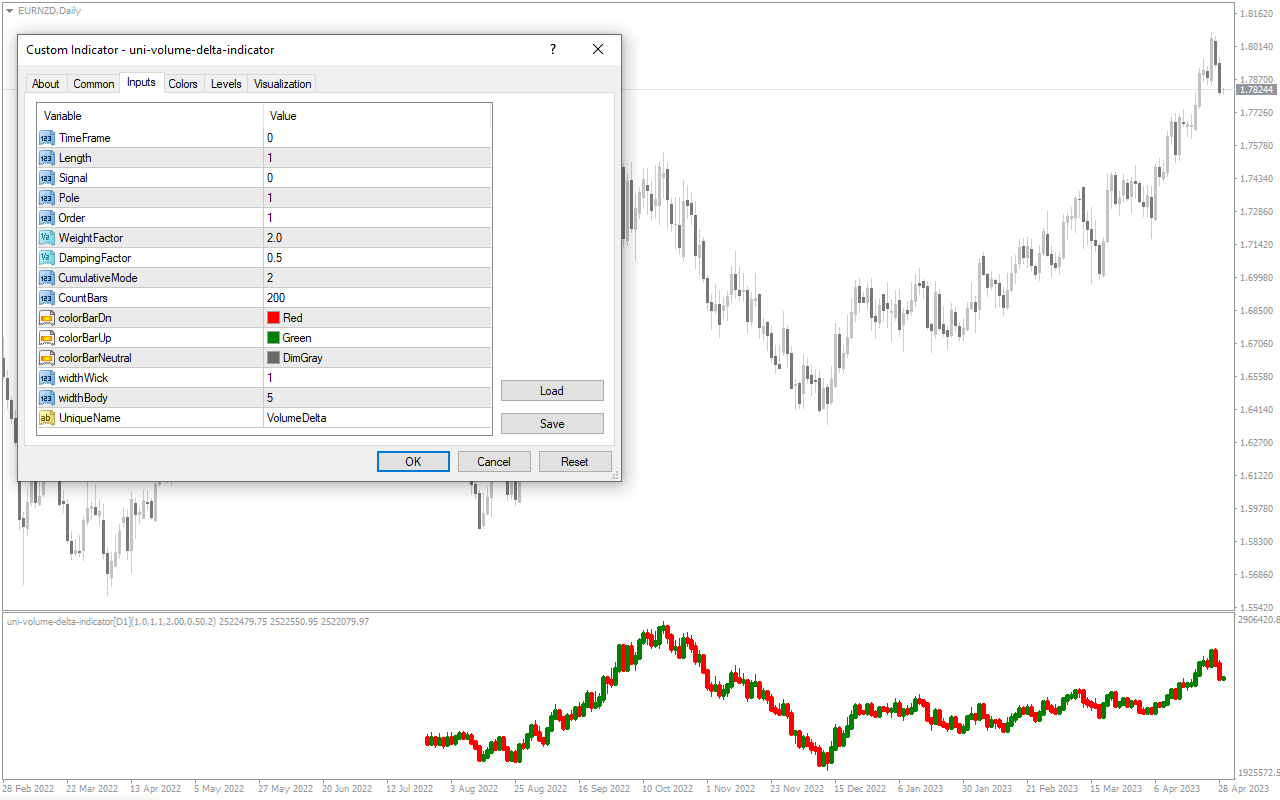

Indicator Description Settings

The indicator comes with the following customizable settings:

Timeframe: This sets the time frame for trend analysis.

Length: Defines the length of the indicator’s bars.

Signal: This shows the signal bars.

Pole: This shows the pole bar.

Order: This shows the market order.

WeightFactor: This shows the value of the weight factor for analysis.

DampingFactor: Determines the sensitivity of the indicator to price.

CummulativeMode: This determines the display mode.

CountBars: Determines the maximum number of bars to display.

ColorBarDn: Determines the color for a downtrend.

CountBarsUp: Determines the color for an uptrend.

ColorBarNeutral: Determines the color for a neutral (no volume) trend.

WidthWick: Determines the width of the indicator’s candlestick wick.

WidthBody: Determines the width of the indicator’s candlestick body.

Reviews

There are no reviews yet.