Features of The Indicator

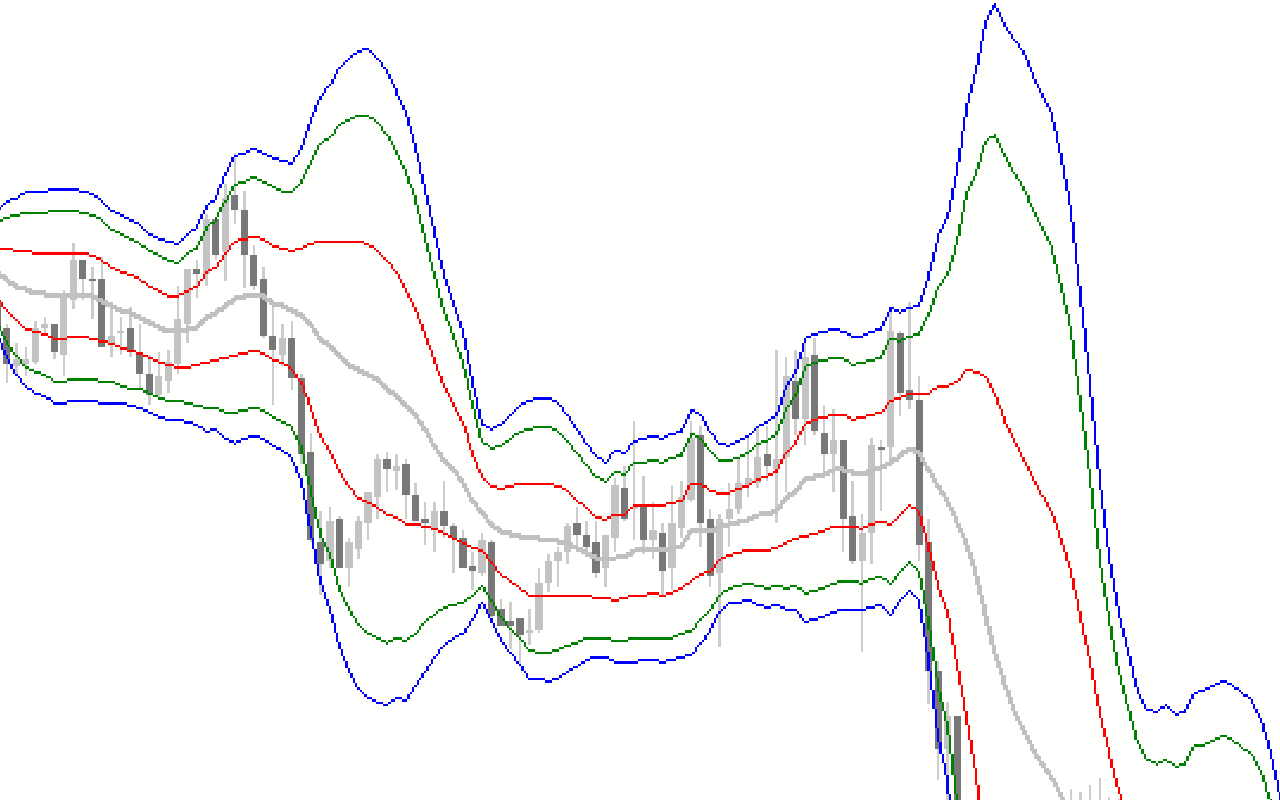

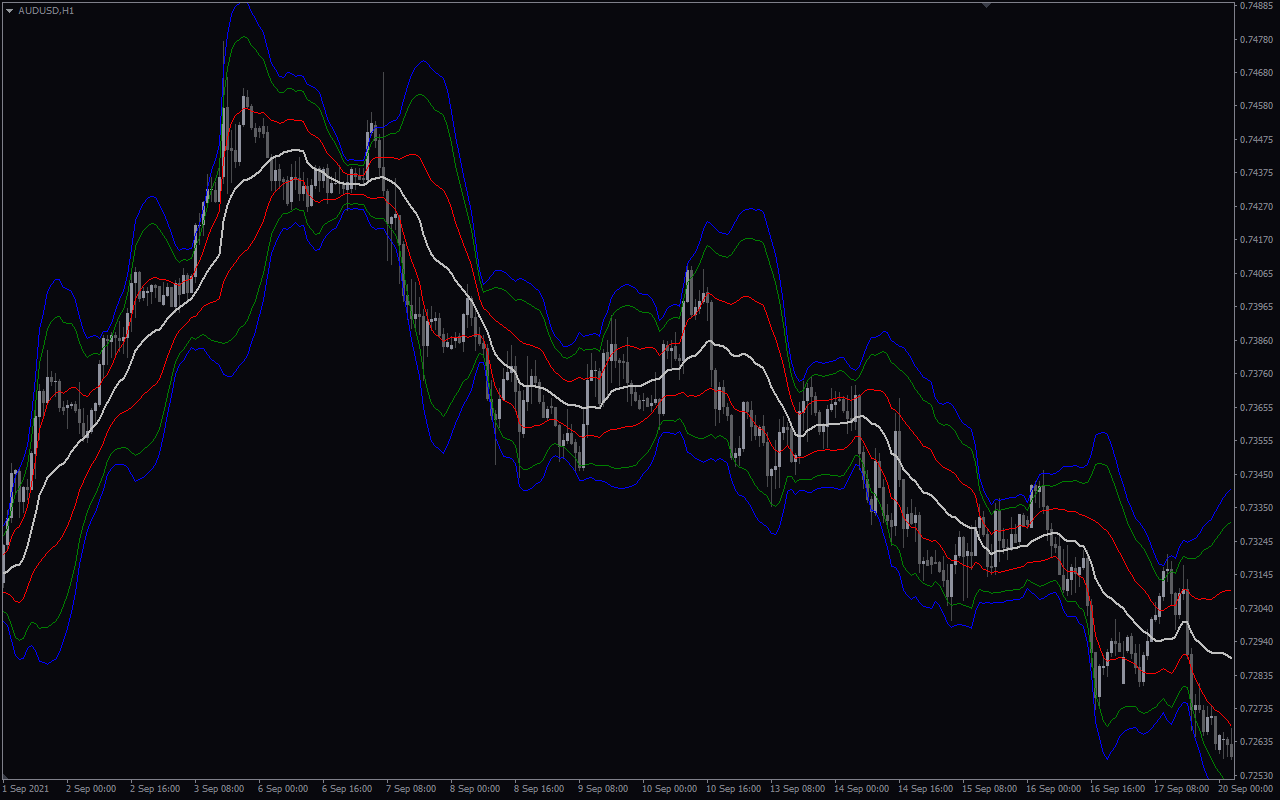

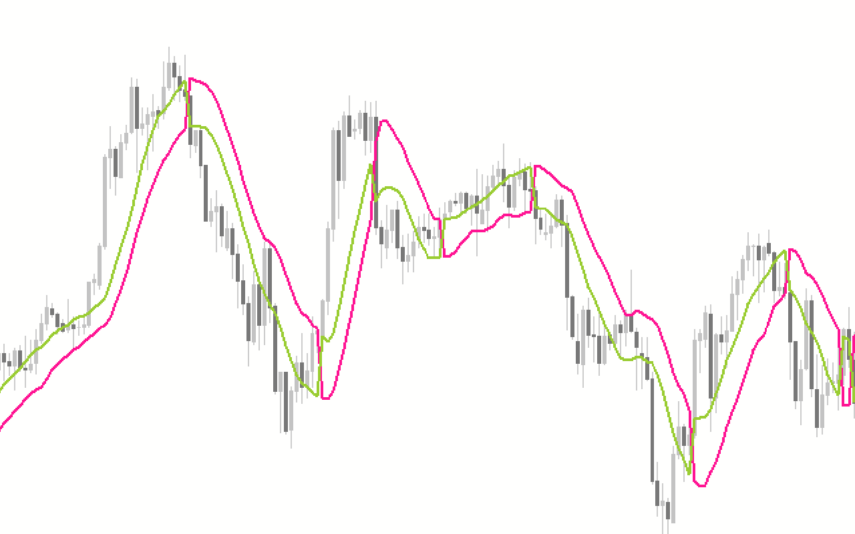

The VWAP (Volume Weighted Average Price) Bands indicator shares similarities with Moving Averages and Bollinger Bands. It places greater emphasis on volume in its calculation. This indicator offers valuable information about support and resistance levels on the chart and indicates a trading instrument’s fair value. As a result, traders can use it to pinpoint good opportunities for entering the market. Moreover, you can use the indicator on multiple timeframes.

How the Indicator Can Be Iseful

New traders can use this indicator to understand the value of a given trading instrument and strategically buy at lower prices and sell at higher prices or the reverse.

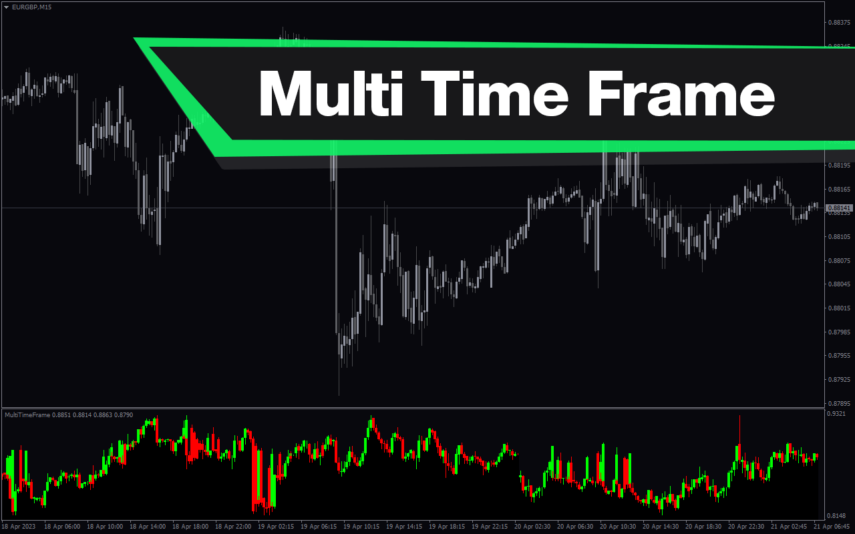

Due to its emphasis on volume, the indicator reacts more in high-volume trading sessions but relatively less reaction in other sessions. Additionally, intraday traders can use the indicator across various time frames for a more balanced price view. Furthermore, the effectiveness of the indicator extends to day traders, short-term traders, and long-term traders alike.

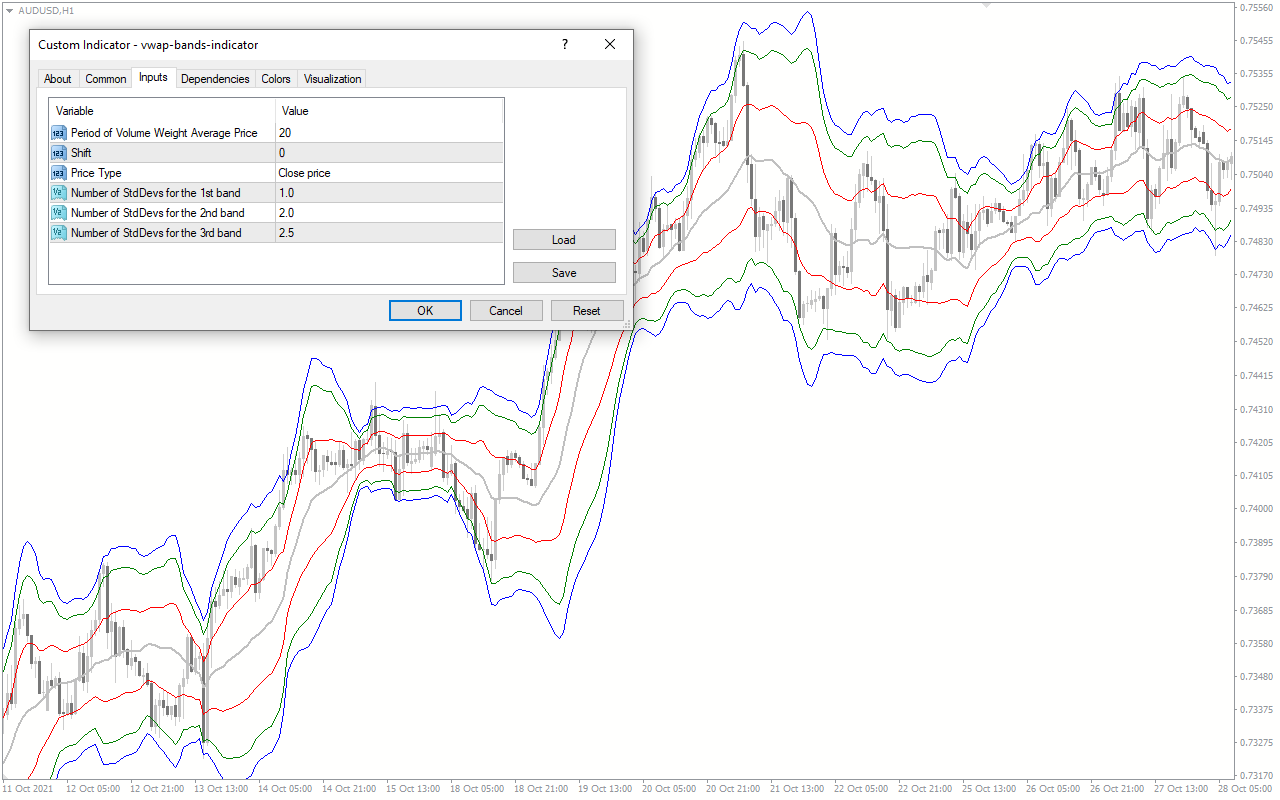

Indicator Setting Descriptions

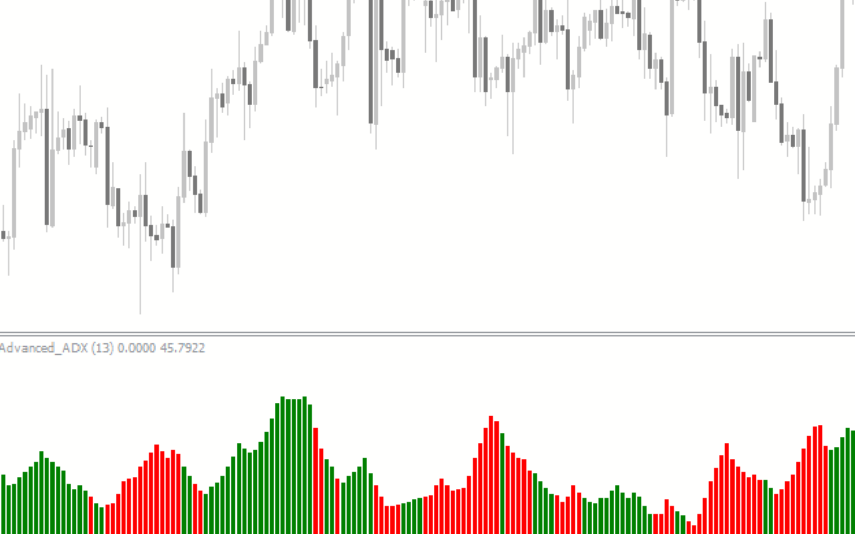

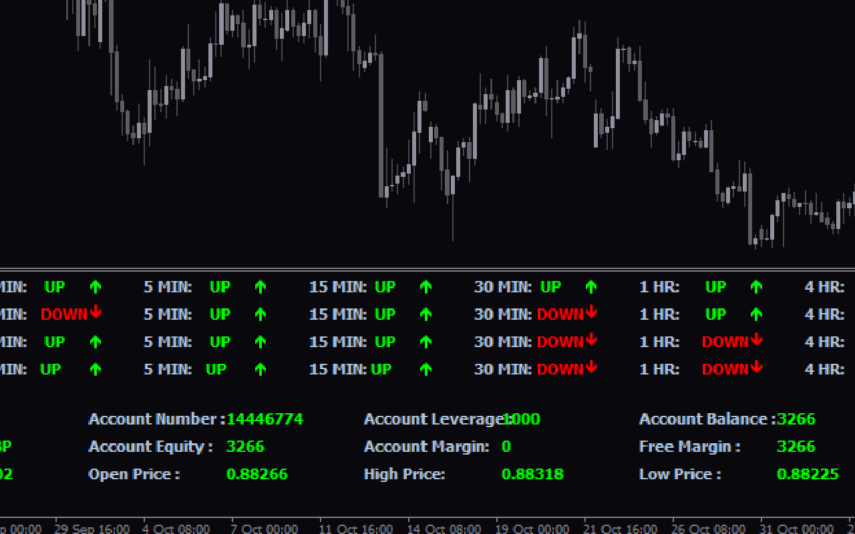

Period of volume weight average price: You can change the period of volume weight average price.

Shift: You can change the indicator shift.

Price Type: You choose the type of price to apply for the indicator calculation. This can be the close price, high or low price.

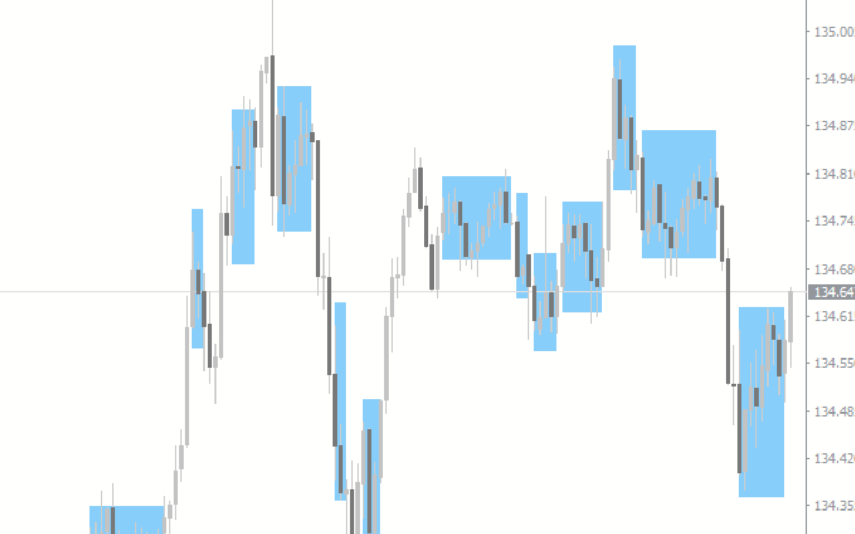

Number of StdDevs for the 1st band: You can change the standard deviation for the 1st band.

Number of StdDevs for the 2nd band: You can change the value to calculate the standard deviation for the 2nd band.

Number of StdDevs for the 3rd band: You can change the calculation of the standard deviation of the 3rd band.

Reviews

There are no reviews yet.