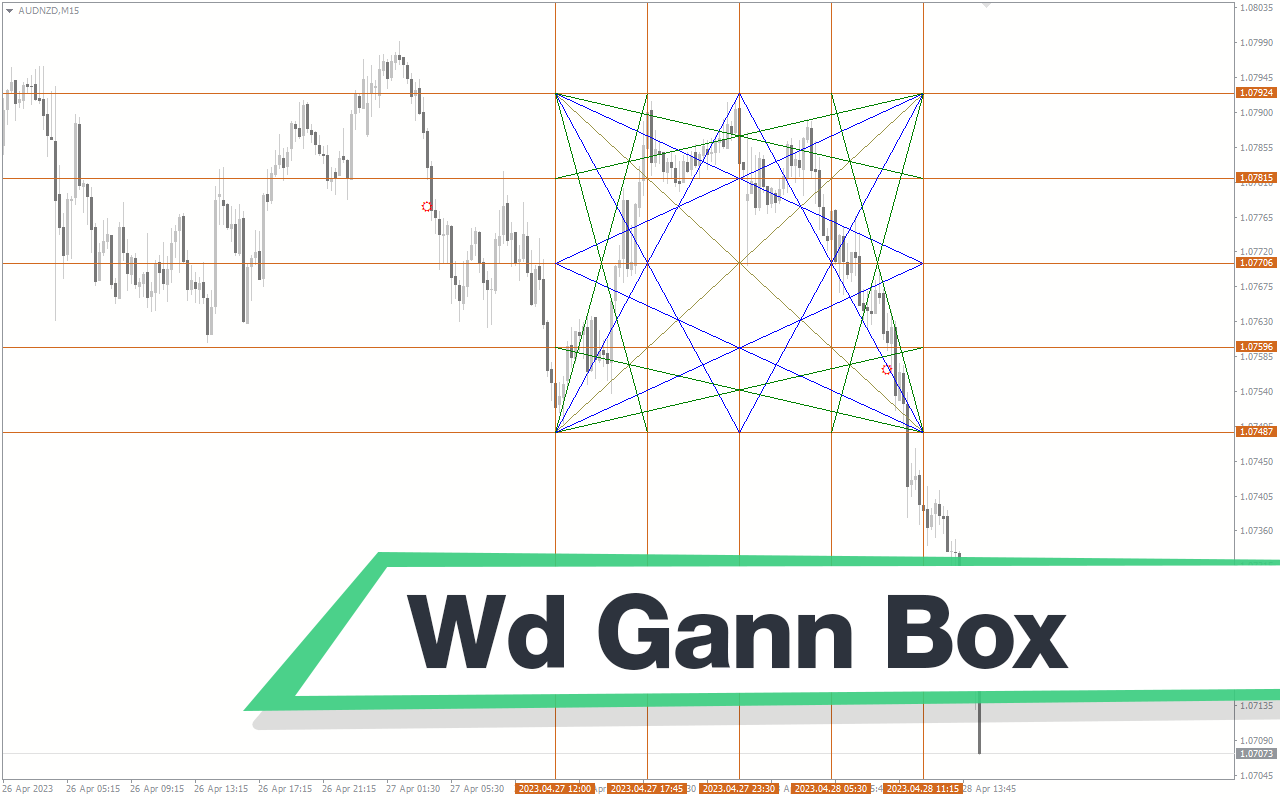

In the dynamic world of forex trading, a deep understanding of market patterns and their underlying principles can be the key to unlocking consistent profits. The WD Gann Box Indicator is a free and powerful tool that takes traders on a journey of discovery, revealing the hidden insights within the market’s price movements.

Features of the Indicator

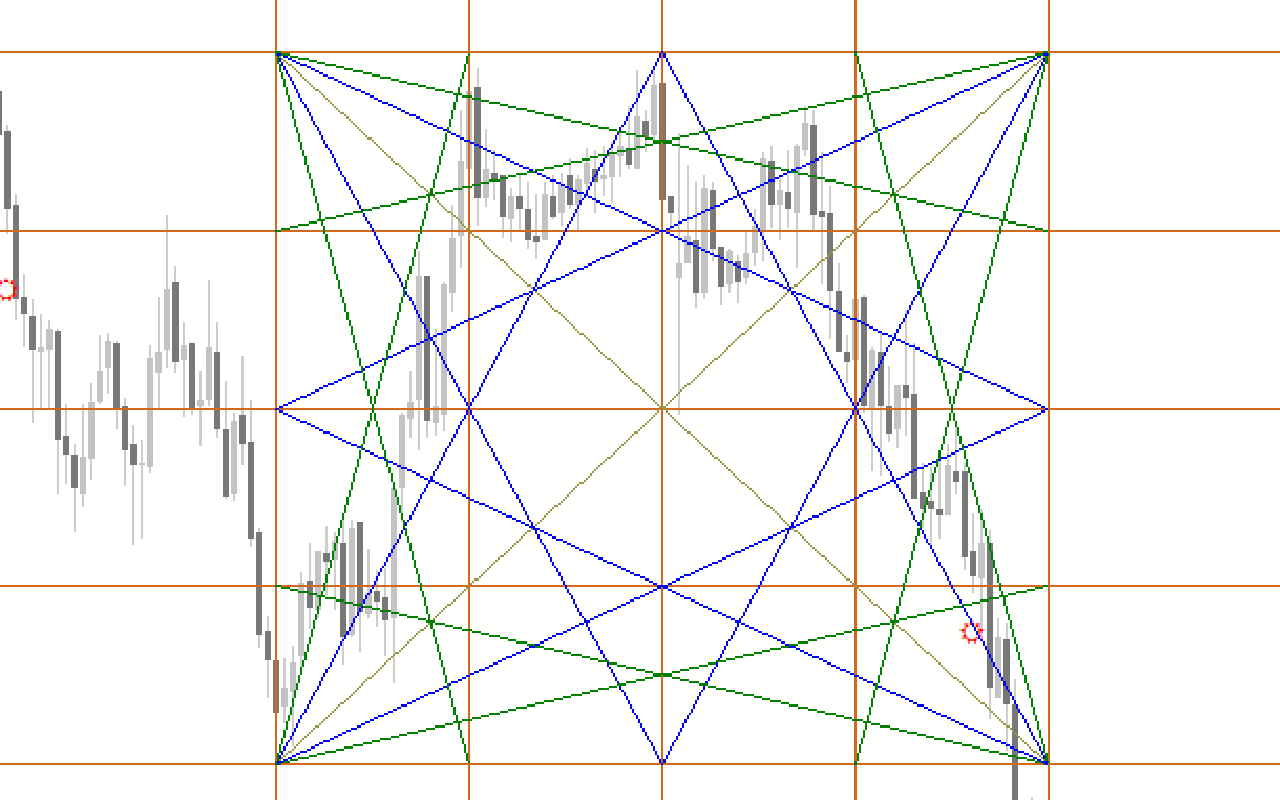

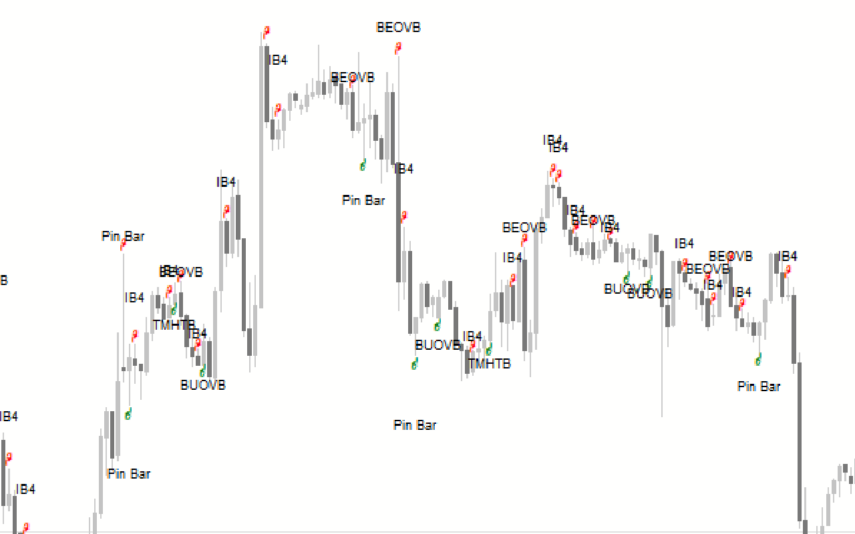

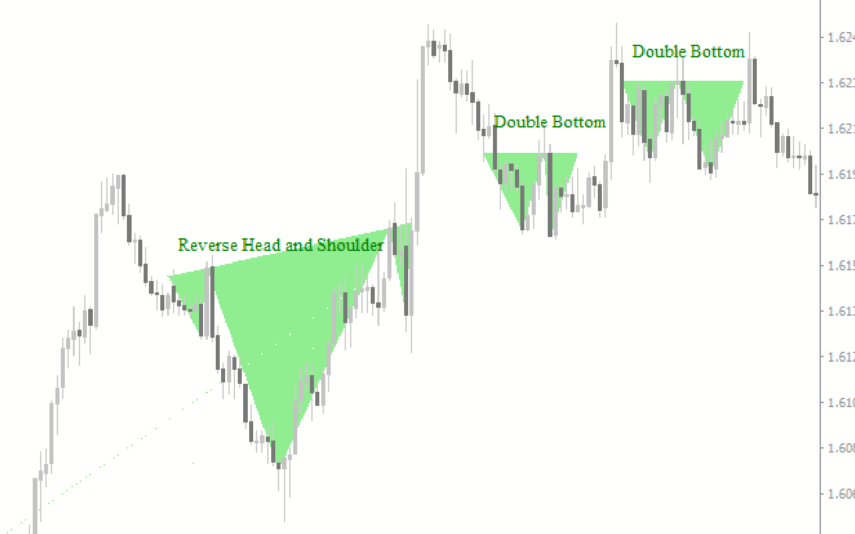

The WD Gann Box Indicator is rooted in the renowned Gann’s Square of Nine theory, a powerful analytical framework that has stood the test of time. This indicator plots a series of boxes on the chart, each representing a specific price range.

These boxes, meticulously constructed based on the principles of Gann’s theory, serve as a roadmap for traders, helping them identify critical support and resistance levels, as well as potential buy and sell signals.

How the Indicator Can Benefit You

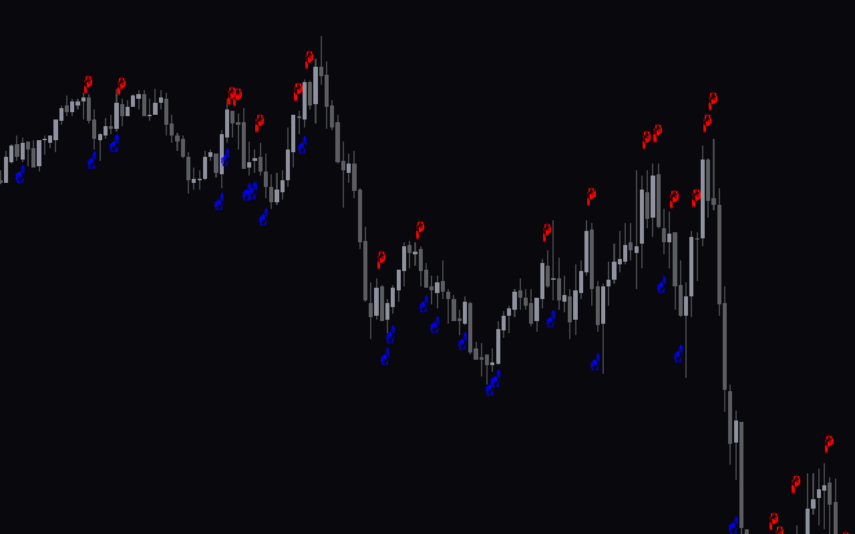

By integrating the WD Gann Box Indicator into your trading arsenal, you gain access to a wealth of valuable information. This tool empowers you to anticipate market movements with greater precision, allowing you to time your buy and sell orders more effectively.

Whether you’re a short-term scalper or a long-term swing trader, the insights provided by the WD Gann Box Indicator can be instrumental in improving your overall trading performance and profitability.

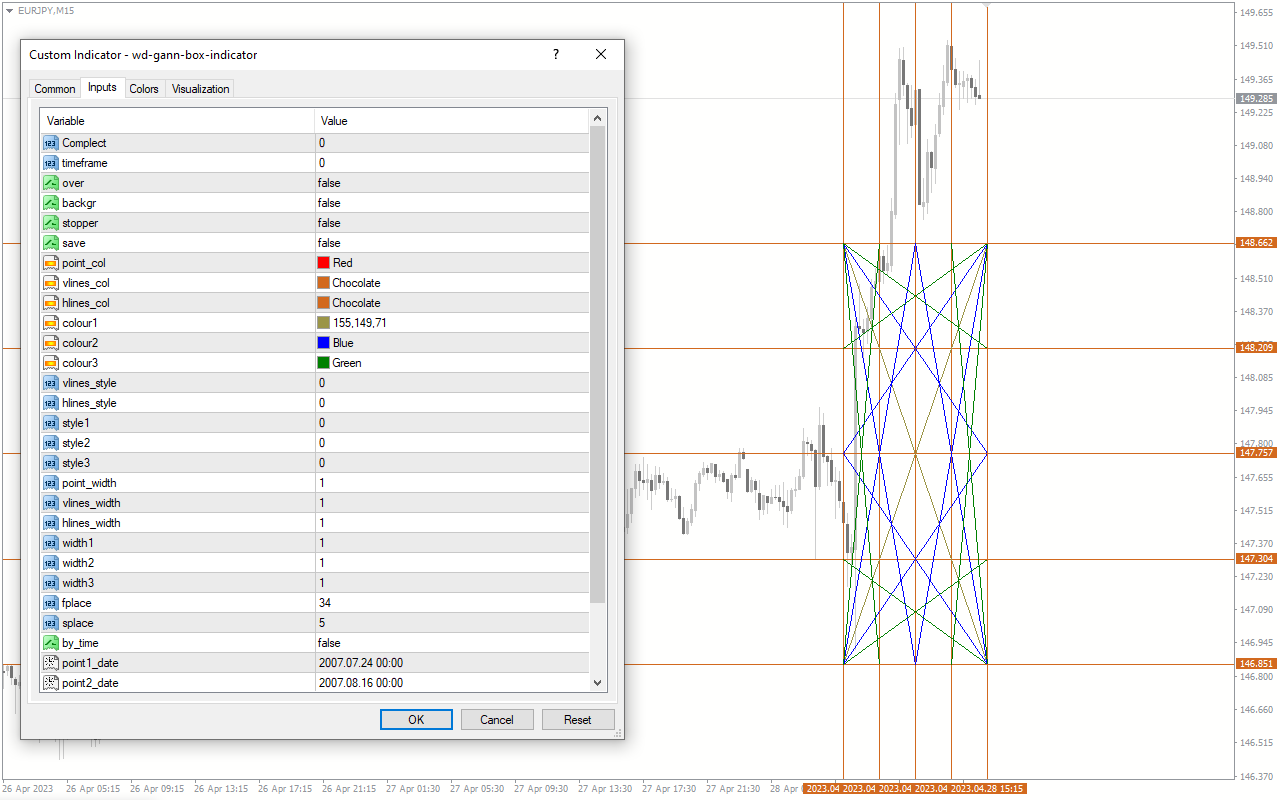

Indicator Settings

Complect: Number of intersections.

Timeframe: 0 = current timeframe. Other values represent corresponding timeframes.

Over: Toggle to enable chart overlay.

Backgr: Toggle to send the chart to the background.

Stopper: Application of stopper to charts.

Save: Saving of old patterns.

Conclusion

The WD Gann Box Indicator is a true gem in the world of forex trading tools. With its firm foundation in Gann’s groundbreaking work and its ability to uncover the hidden patterns in the market, this free indicator is a must-have for any trader seeking to gain an edge in the dynamic forex landscape. Download the WD Gann Box Indicator today and unlock the full potential of your trading strategy.

Reviews

There are no reviews yet.